Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.28 per cent lower at 17,343.50, signalling that Dalal Street was headed for a negative start on Tuesday.

Asia stocks were trading lower as investors were worried about the risk of global recession and escalating US-China tension over Taiwan. Japan’s Nikkei 225 index dropped 1.59% and Topix fell 1.81%. China’s Hang Seng plunged 2.97% and CSI 300 index tanked 2.32%.

The Indian rupee appreciated by 23 paise to 79.02 against the US dollar on Monday.

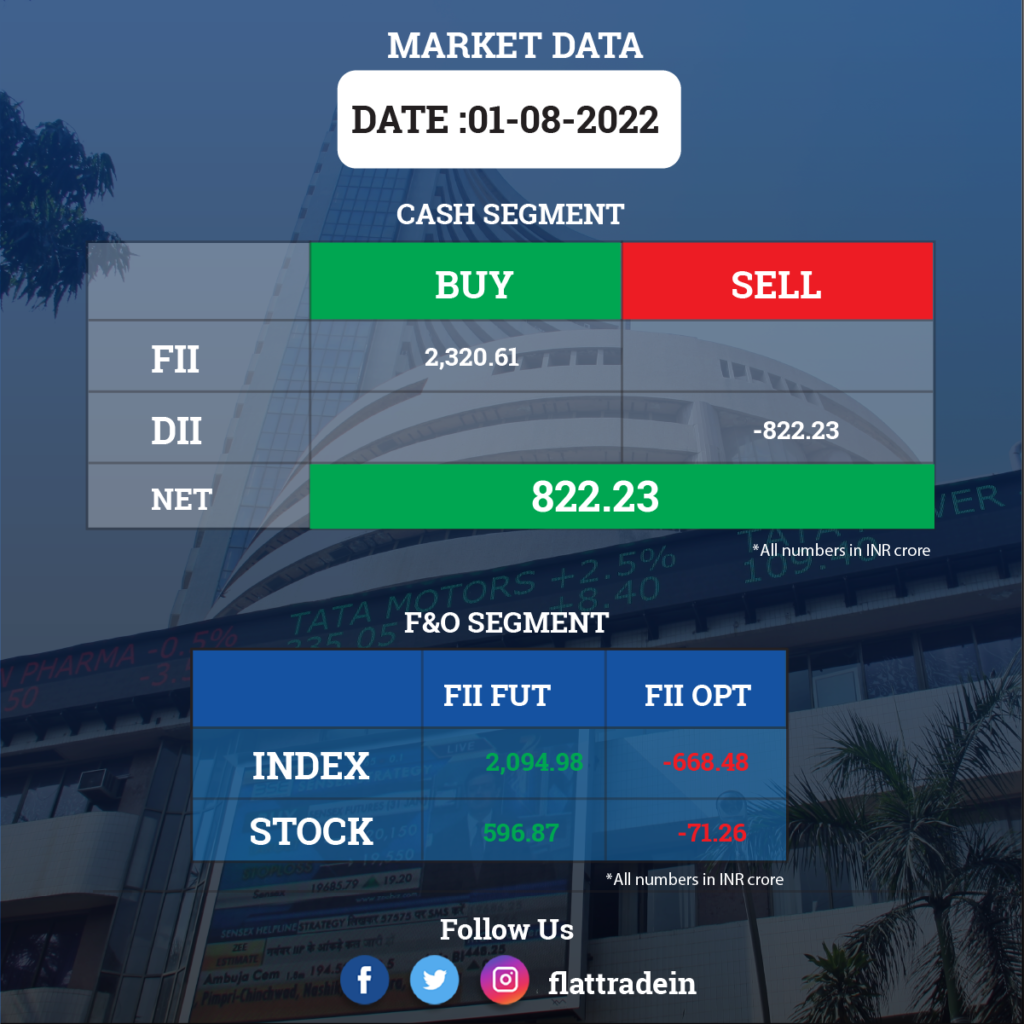

FII/DII Trading Data

Upcoming Results

Adani Green Energy, Indus Towers, Voltas, Bosch, Siemens, Bank of India, Brigade Enterprises, Deepak Nitrite, Dhanuka Agritech, Dodla Dairy, Gateway Distriparks, Gati, Godrej Properties, Gravita India, JM Financial, Jubilant Pharmova, Lemon Tree Hotels, MOIL, Paradeep Phosphates, RPG Life Sciences, Schneider Electric Infrastructure, Shyam Metalics and Energy, Thermax, Tube Investments of India, and Vaibhav Global will report their quarterly earnings on August 2.

Stocks in News Today

ITC: The cigarette maker recorded a 38.3% year-on-year growth in standalone profit at Rs 4,169.4 crore for the quarter ended June 2022, on strong topline and operating performance. Revenue grew by 41.4% YoY to Rs 18,320 crore in Q1FY23 quarter. Its EBITDA jumped 41.5% YoY to Rs 5,647.2 crore in Q1FY23.

Reliance Jio and Tata Communications: The Supreme Court directed Jio, the telecom arm of Reliance Industris Ltd, to pay Rs 70 crore to Tata Communications in two weeks while hearing Reliance Jio’s plea against Telecom Disputes Settlement and Appellate Tribunal (TDSAT) order.The order asked Reliance Jio to pay Rs 147 crore to Tata Telecom as cable landing station usage charges.

Meanwhile, Reliance Jio said that it is fully ready for 5G rollout in the shortest period of time, backed by nationwide fibre presence, an all-IP network with no legacy infrastructure, an indigenous 5G stack and strong global partnerships across the technology ecosystem.

Zomato: The online food delivery firm posted a consolidated loss of Rs 186 crore in Q1FY23, down from a loss of Rs 360.7 crore in Q1FY22 and loss of Rs 360 crore in Q4FY22. The narrow losses were backed by other income, which more than doubled to Rs 168.1 crore YoY from Rs 72.2 crore. Revenue grew by 67.4% YoY to Rs 1,413.9 crore in Q1FY23.

Zomato said that it is transitioning to a multiple chief executive structure for its businesses, which will be housed under a larger organisation called Eternal.

Arvind Ltd: The textile manufacturer reported a consolidated net profit of Rs 101.62 crore in Q1FY23, compared with a net loss of Rs 11.42 crore in the year-ago period. Its revenue from operations was at Rs 2,352.12 crore, up 63.93 per cent from Rs 1,434.79 crore in the corresponding period a year ago. The company said that profit margins continued to be under pressure as input costs remained high and increase in unit price realizations helped to offset only the cost increases.

Carborundum Universal (Cumi): The company has posted a 10 per cent rise in consolidated net profit of Rs 85.99 crore compared to Rs 78.01 crore in Q1FY23 in the year-ago period. Its consolidated revenue from operations increased 60 per cent to Rs 1,139.83 crore in Q1FY23 from Rs 711.59 crore in the year-ago period. The company said that the lower profit was due to cost impact, closure cost at China and integration cost.

Castrol India: The company reported a 47.3% year-on-year growth in profit at Rs 206.26 crore for the quarter ended June 2022 despite higher input cost, driven by strong top line and operating performance. Revenue grew by 40% YoY to Rs 1,241.71 crore during the same period.

NMDC: The mineral producer recorded monthly production of iron ore at 2.05 million tonnes in July 2022, declining from 3.06 million tonnes in July 2021 and sales dropped to 2.95 million tonnes from 3.29 million tonnes during the same period.

Eicher Motors: The company sold 5,982 units in the commercial vehicle segment in July 2022, up 40.1% compared to 4,271 units sold in same month last year, with domestic sales increasing 51% to 5,360 units but exports fell 22% to 501 units in the same period.

Eveready Industries: Anand Burman has been appointed non-executive chairman of in the first board meeting since the Burman family, promoters of Dabur India, took control of the battery makers.

TVS Motor: The two- and three-wheeler maker reported a 13 per cent increase in total sales at 3,14,639 units in July. It had posted a total sales of 2,78,855 units in the same month last year. Total two-wheelers sales were up 14 per cent at 2,99,658 units in July 2022, as against sales of 2,62,728 units in July 2021. Domestic two-wheeler sales stood at 2,01,942 units as compared to 1,75,169 units in the year-ago period, up 15 per cent.

Kansai Nerolac Paints: The company reported a 36.5% YoY growth in consolidated profit at Rs 152 crore in the quarter ended June 2022 despite sharp increase in input cost, supported by operating performance and top line. Revenue grew by 46% YoY to Rs 2,051.40 crore during the same period.

Apollo Tyres: The company expects electric vehicles’ adoption to pick up pace over the next few years and is gearing up to cater to demand both in passenger vehicle and two-wheeler segments. The company introduced two tyre brands for electric passenger vehicles and two-wheelers and said that it is bullish on opportunities across domestic and international markets.

Barbeque-Nation Hospitality: The restaurant chain reported a net profit of Rs 16.02 crore in Q1FY23 compared with a net loss Rs 43.85 crore in the year-ago period. Its revenue from operations surged three-fold to Rs 314.86 crore in Q1FY23, from Rs 101.97 crore in the same period last year.

Escorts Kubota: The tractor manufacturer said its consolidated revenue rose 8% to Rs 2,032.06 crore in Q1FY23 from Rs 1,886.64 crore in Q4FY22. Its net profit fell 26% to Rs 140.64 crore in the reported quarter as against Rs 190.92 crore in the last quarter of FY22. Thec company’s EBITDA fell 18% QoQ to Rs 203.61 crore in the reported quarter as against Rs 248.15 crore in the previous quarter.

Max Financial Services: The company’s consolidated revenue fell 64% QoQ to Rs 3,271.69 crore in Q1FY23 from Rs 8,959.65 crore in the prior quarter. Its net profit plunged 52% to Rs 56.36 crore in Q1FY23 from Rs 117.38 crore in the previous quarter. Its EBITDA tanked 46% QoQ to Rs 86.75 crore as against Rs 160.76 crore in Q4FY22.