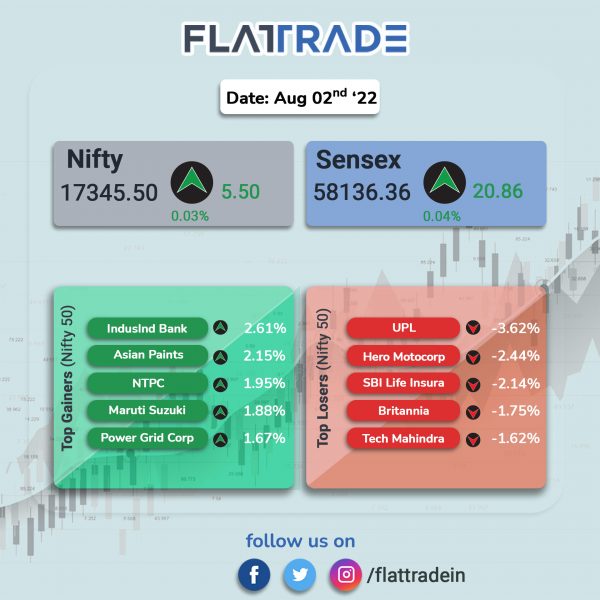

Benchmark indices ended with marginal gains after swinging between gains and losses during the day. The Sensex inched up 0.04% and the Nifty rose 0.03%.

Broader markets outperformed headline indices. The Nifty Midcap 100 increased 0.33% and BSE Smallcap gained 0.34%.

Top Nifty sectoral gainers were PSU Bank [2.68%], Energy [1.09%], FMCG [0.64%], Auto [0.54%] and Private Bank [0.39%]. Top losers were Realty [-1.69%], IT [-0.67%], Metal [-0.26%] and Financial Services [-0.26%].

The Indian rupee appreciated by 31 paise to 78.71 against the US dollar on Tuesday.

Stock in News Today

GAIL (India) Ltd: The country’s largest gas distributor has started gas rationing and has cut supplies to fertiliser and industrial clients after imports were hit under its deal with a former unit of Russian energy giant Gazprom, Reuters reported citing two sources familiar with the matter. Lower gas supplies will affect India’s urea production, and a sustained cut could lift imports of the soil nutrient, a fertiliser industry source aware of the matter said.

Adani Group: Adani Data Networks, the digital connectivity solutions arm of the group, has won 400MHz of spectrum in the 26GHz millimetre wave band for 20 years in the recently concluded 5G spectrum auction, which was conducted by telecommunications department. It is expected to accelerate Adani Group’s digitisation efforts of its core infrastructure, primary industry and B2C business portfolio.

Jubilant Pharmova: Shares of the company fell 4.86% in intraday trading after the company posted tepid earnings. Its consolidated net income tanked 71% to Rs 47.04 crore in Q1FY23 from Rs 160.56 crore in the year-ago period. Revenue was down 11% to Rs 1,451.72 crore in Q1FY23 as against Rs 1,634.65 crore in the same period last year.

Larsen & Toubro Infotech (LTI): The company said that it plans to train more than 12,000 employees on various Microsoft technologies by 2024. LTI will focus on developing high-value cloud solutions for enterprises.

Thyrocare Technologies: Shares of the company fell 4% after the company posted lower-than-expected results. Its consolidated net profit slumped 61% to Rs 21.73 crore in Q1FY23 from Rs 55.58 crore in Q1FY22. The company’s revenue fell 22% to Rs 127.79 crore in Q1FY23 from Rs 164.65 crore in the year-ago period. Its EBITDA stood at Rs 35.92 crore in the reported quarter compared with Rs 71.23 crore in the year-ago period.

Godrej Properties: The company posted a consolidated net profit of Rs 45.55 crore in Q1FY23 compared with Rs 17.03 crore in Q1FY22. Revenue rose to Rs 244.67 crore in the reported quarter as against Rs 86.16 crore in the year-ago period. The company’s EBITDA loss stood at Rs 14.2 crore in Q1FY23 as against a loss of Rs 63.67 crore in the same period last year.

The company said that Gaurav Pandey will take over from Mohit Malhotra as managing director and CEO of Godrej Properties, effective January 1, 2023. Pandey is currently the CEO of the North Zone of Godrej Properties.

Adani Ports: The company said that its cargo volumes stood at over 31 million metric tonnes in July 2022, up 13% year-on-year. The monthly volume growth across its key ports were 12% YoY in Mundra, 16% YoY in Krishnapatnam, 81% YoY in Tuna , 87% YoY in both Kattupalli & Ennore, and 69% YoY in Dahej.

Shriram Transport Finance Company Ltd (STFC): The company said that it has received approval from the Competition Commission of India (CCI) for the Composite Scheme of Arrangement and Amalgamation involving merger between Shrilekha Business Consultancy, Shriram Financial Ventures (Chennai), Shriram Capital, Shriram Transport Finance Company, Shriram City Union Finance and Shriram LI Holdings, Shriram GI Holdings and Shriram Investment Holdings. The scheme was cleared by RBI earlier.

Krsnaa Diagnostics: The company’s shares fell 4.23% after the company informed exchanges that income tax officials visited its premises in Pune. However, the company denied press reports stating that the company accepted Rs 100 crore of undisclosed income and called the allegations incorrect & baseless.

SpiceJet: The company has entered into a full and final settlement with the Airports Authority of India and cleared all outstanding dues. The company will no longer remain on ‘cash and carry’ at AAI run airports across the country. The company said its cash flow improved and led to clearing its pending dues, according to exchange filing. The AAI will also release SpiceJet’s Rs 50 crore bank guarantee as the company cleared principal dues.

Wheels India: The company reported a 6 per cent rise in net profit at Rs 10.7 crore in Q1FY23, compared to Rs 10.1 crore in the same period last fiscal. The company’s revenue increased to Rs 1057.1 crore in Q1FY23, compared to Rs. 675.1 crore in the same quarter last year. The company said that semiconductor shortages affected some segments, while demand for trucks, agricultural tractors and passenger vehicles in India remained healthy.

IDFC Ltd: The company has received CCI approval for divestment of IDFC AMC and the transaction subject to approval from RBI and SEBI.