Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.20 per cent higher at 17,360, signalling that Dalal Street was headed for a positive start on Wednesday.

Most Asian shares were up as investors gauged heightened US-China tensions. Japan’s Nikkei 225 index rose 0.53%, Topix index edged up 0.10%. China’s Hang Seng increased 0.13%, while CSI 300 index fell 0.35%.

The Indian rupee appreciated by 31 paise to 78.71 against the US dollar on Tuesday.

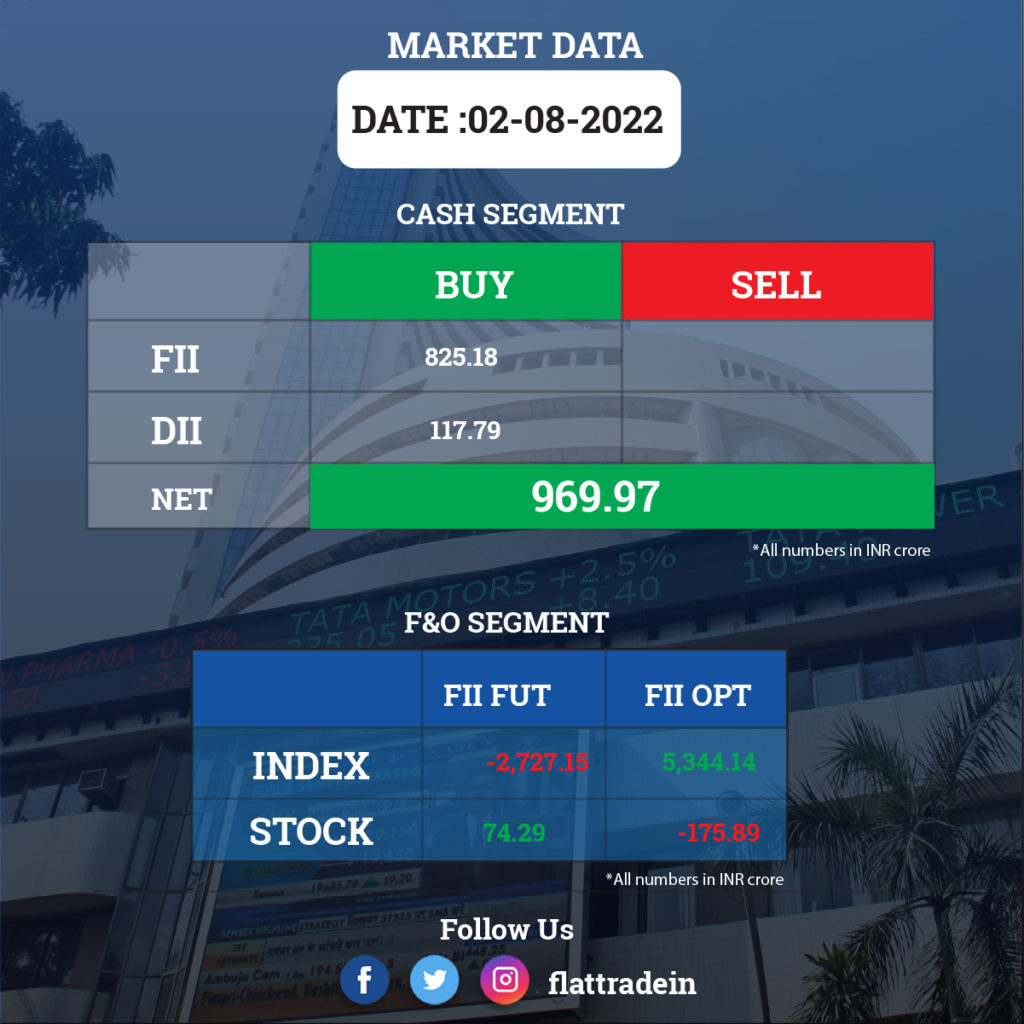

FII/DII Trading Data

Upcoming Results

Adani Power, Adani Transmission, Adani Wilmar, InterGlobe Aviation, Vodafone Idea, Godrej Consumer Products, Aditya Birla Capital, Lupin, BASF India, Birlasoft, Chambal Fertilisers, Devyani International, Firstsource Solutions, Gujarat Gas, Inox Leisure, KEC International, Paras Defence and Space Technologies, PI Industries, Sandhar Technologies, Satin Creditcare Network, Speciality Restaurants, Tata Coffee, and Zuari Agro Chemicals will post quarterly results today.

Stocks in News Today

Reliance industries Ltd (RIL): The Competition Commission of India (CCI) granted its approval for the acquisition of a 50.1 per cent stake of Sanmina-SCI India (SCIPL) by Reliance Strategic Business Ventures (RSBVL), a a subsidiary of RIL. Sanmina Corporation and RSBVL had inked an agreement in March to create a joint venture through investment in Sanmina SCI India. The investment would be about Rs 1,670 crore and RIL would hold the majority stake in the JV.

Voltas Ltd: Air conditioning manufacturer reported a decline of 10.47 per cent in consolidated net profit at Rs 109.62 crore in Q1FY23. It had posted a consolidated net profit of Rs 122.44 crore in the year-ago period. Its revenue from operations increased 55.05 per cent to Rs 2,768 crore during the period under review as against Rs 1,785.20 crore in the corresponding period of the previous fiscal.

Adani Green Energy Limited (AGEL): The company posted a fall of over 2 per cent in consolidated net profit at Rs 214 crore in Q1FY23 as against Rs 219 crore in the year-ago period. The company’s total income rose to Rs 1,701 crore in Q1FY23 from Rs 1,079 crore in the same period last year. Th company noted that solar and wind segment continued to show performance improvement.

Maruti Suzuki: The company could not produce 51,000 units in the April-June quarter owing to the ongoing chip shortage situation, according to a senior company official. The country’s largest carmaker noted that the semiconductor shortage is a challenge in planning its production activities. It had sold a total of 4,67,931 vehicles during the April-June quarter.

Kotak Mahindra Bank: The lender’s arm is targeting to raise up to Rs 1,500 crore to invest in private equity and venture capital funds. Kotak Investment Advisors (KIAL) said it is launching the Kotak India Alternate Allocation Fund (KIAAF), a ‘fund of funds’, which is targeting to raise Rs 750 crore with a greenshoe option of another Rs 750 crore.

Axis Bank: The lender said it will acquire over 5 per cent stake in fintech platform CredAble for Rs 55 crore and the deal is expected to be completed by September 2022. The bank will acquire 8,921 equity shares, equivalent to 5.09 per cent, of face value of Rs 10 each for Rs 55 crore in CredAble.

Bank of India: The public sector lender’s net profit declined 22.08 per cent year-on-year (YoY) to Rs 561 crore in the first quarter of FY23 due to fall in non-interest income and rise in provisions for bad loans. It had posted a net profit of Rs 720 crore during the year-ago period. Its net interest income (NII) was up 29.4 per cent at Rs 4,072 YoY, and net interest margin (NIM) improved to 2.55 per cent in the reported quarter from 2.16 per cent in the same period a year ago. Gross NPA stood at 9.3 per cent till June 2022 compared with 13.5 per cent in the year-ago quarter. Net NPAs dipped to 2.21 per cent in June 2022 from 3.35 per cent a year ago.

GMR Group: European plane manufacturer Airbus and GMR have signed a contract to provide aircraft maintenance training to young engineers. The GMR Group will provide fully integrated aircraft maintenance engineer (AME) licensing programme at the GMR School of Aviation in Hyderabad.

Paradeep Phosphates: The company reported a 4.7 per cent YoY increase in consolidated profit at Rs 62.77 crore for the quarter ended June 2022, impacted by higher finance cost and input cost. Revenue from operations grew by 85 per cent YoY to Rs 2,434.66 crore during the reported quarter.

Indus Towers: The telecom tower company reported a 66% on-year decline in net profit, on account of receivables due to the company from one of its major customers. It reported a net profit of Rs 477 crore compared with Rs 1,415 crore in the same period a year ago. The consolidated revenue for the quarter also increased marginally by 1% on-year to Rs 6989.8 crore.

Bosch: Auto components major reported a 28 per cent increase in consolidated net profit at Rs 334 crore in Q1FY23 amid overall recovery in the automotive segment. It had posted a net profit of Rs 260 crore in the same quarter of last fiscal. Revenue from operations rose to Rs 3,544 crore in the April-June period of FY23 as against Rs 2,443 crore in the year-ago period.