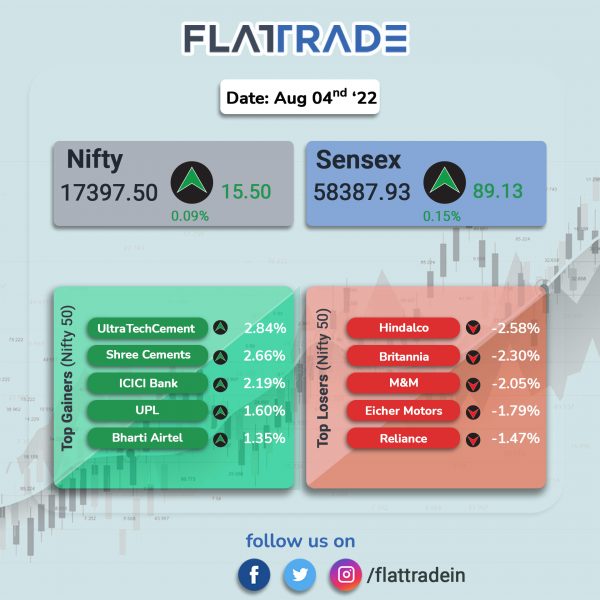

Benchmark equity indices ended slightly higher after the RBI’s monetary policy committee raised repo rate by 50 bps to 5.4% as expected. Meanwhile, higher inflation forecasts were maintained for FY23 that weighed on the markets. The Sensex rose 0.15% and the Nifty inched up 0.09%.

Broader markets outperformed headline indices. The Nifty Midcap 100 rose 0.22% and BSE Smallcap increased 0.23%.

Top Nifty sectoral gainers were IT [0.64%], Bank [0.44%], Private Bank [0.41%], Financial Services [0.36%] and Realty [0.31%]. Top losers were Energy [-1.44%], Auto [-1.09%], Media [-0.52%], Metal [-0.44%] and PSU Bank [-0.41%].

The Indian rupee rose 26 paise to 79.23 against the US dollar on Friday.

Stock in News Today

HDFC: The mortgage lender said that it has raised $1.1 billion from investors under the ‘Syndicated Social Loan Facility’ to cater to the affordable housing segment. The amount was raised through external commercial borrowings (ECBs). MUFG Bank Ltd (MUFG) is the lead social loan coordinator for this transaction along with being one of the Mandated Lead Arrangers and Borrowers (MLAB). State Bank of India, CTBC Bank, Mizuho Bank and Sumitomo Mitsui Banking Corporation were the other MLABs and joint social loan coordinators.

Titan: The company’s consolidated total income jumped more than two-fold to Rs 9487 crore in Q1FY23 from Rs 3519 crore in the year-ago period. The profit after tax surged to Rs 790 crore in Q1FY23 from Rs 18 crore in the year-ago period.

Mahindra & Mahindra (M&M): The company posted revenue from operations at Rs 19,612.64 crore in Q1FY23 as against Rs 11,764.82 crore in the year-ago period. Its profit after tax stood at Rs 1,430.16 crore in Q1FY23 from 856.67 crore in Q1FY22.

Steel Stocks: The steel ministry and finance ministry are mulling to roll back or reduce export duty, amid industry representation seeking a cut, Mint news reported citing sources. According to the news report, the export duty could be halved or even eliminated for some products and a decision is likely by the end of August.

Aurobindo Pharma: The company annouced that its oral manufacturing facility at Jedcherla, Hyderabad, received an Establishment Inspection Report (EIR) with a Voluntary Action Initiated (VAl) status from the US drug regulator concluding the inspection. The US FDA inspected the unit between May 2 and 10, and issued a ‘Form 483’ with six observations.

Alkem Labs: The company’ consolidated revenue was down 6% to Rs 2,576 crore in Q1FY23 from Rs 2,731 crore in Q1FY22. Its net profit plunged 73% to Rs 128 crore in Q1FY23 as against Rs 468 crore in the year-ago period. EBITDA tanked 66% to Rs 203 crore in Q1FY23 from Rs 593 crore in Q1FY22.

Eris Lifesciences: The company’s revenue was up up 14% to Rs 399 crore in Q1FY23 as against Rs 349 crore in Q1FY22. It posted a net profit of Rs 95 crore, down 11% YoY from Rs 107 crore in Q1FY22. EBITDA rose 2% to Rs 129 crore in the quarter under review from Rs 127 crore in the year-ago period. The company’s board declared an interim dividend of Rs 7.35 per share of face value Re 1 each.

Pricol: The automotive technology firm reported more than six-fold jump in standalone profit after tax at Rs 15.92 crore in the April-June quarter of FY23. The company had posted a standalone PAT of Rs 2.41 crore in the corresponding quarter of FY22. Revenue from operations in Q1FY23 was recorded at 414.57 crore, a 41.61 per cent rise from 292.75 crore in the same quarter last fiscal.

New Delhi Television: The media firm reported a 55.85 per cent rise in consolidated net profit to Rs 25.81 crore for the first quarter ended June 2022. The company had posted a net profit of Rs 16.56 crore during the April-June quarter a year ago. Its revenue from operations increased 26.72 per cent to Rs 107.74 crore during the quarter under review compared to Rs 85.02 crore in the year-ago period.

Welspun Corp: Shared of the company fell nearly 7% in intraday trading after the company posted a 96% drop in consolidated net profit to Rs 4 crore in Q1FY23 from a consolidated net profit stood of Rs 94 crore in the year-ago period. Its total revenue stood at Rs 1322 crore, down 12% from Rs 1510 crore in the corresponding quarter last fiscal.

Pfizer: The company reported lower-than-expectd results. Its consolidated revenue was down 21% YoY at Rs 593 crore during April-June quarter of FY23. The company’s net profit plunged 84% YoY to Rs 32.5 crore in the reported quarter. Shares of the company tanked more than 4% during the session but recouped some losses to end 1.5% lower.

Venky’s India: The poultry firm posted a net profit of Rs 49.2 crore in April-June quarter of FY23 versus Rs 55.1 crore in the same period a year ago. Its revenue grew 11% YoY to Rs 1,200 crore. Expense grew to Rs 1,140 crore in the reported quarter from Rs 1,020 crore in the same period last year due to high bird feed prices.

Aditya Birla Fashion: The company’s consolidated revenue was up 257% YoY at Rs 2,770 crore In Q1FY23 from Rs 774 crore in the year-ago period. Its net profit stood at Rs 124 crore as against a loss of Rs 510 crore. Total costs was up 112% to Rs 264 crore in the reported quarter from Rs 125 crore in the year-ago period.