Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.30 per cent higher at 17,450, indicating that Dalal Street was headed for a positive start on Friday.

Asian shares were trading higher as technology stocks gained and upbeat corporate results. Japan’s Nikkei 225 index rose 0.71% and the Topix index gained 0.68%. China’s Hang Seng inched down 0.02% and CSI 300 index was up 0.23%.

The Indian rupee depreciated by 30 paise to 79.47 against the US dollar on Thursday.

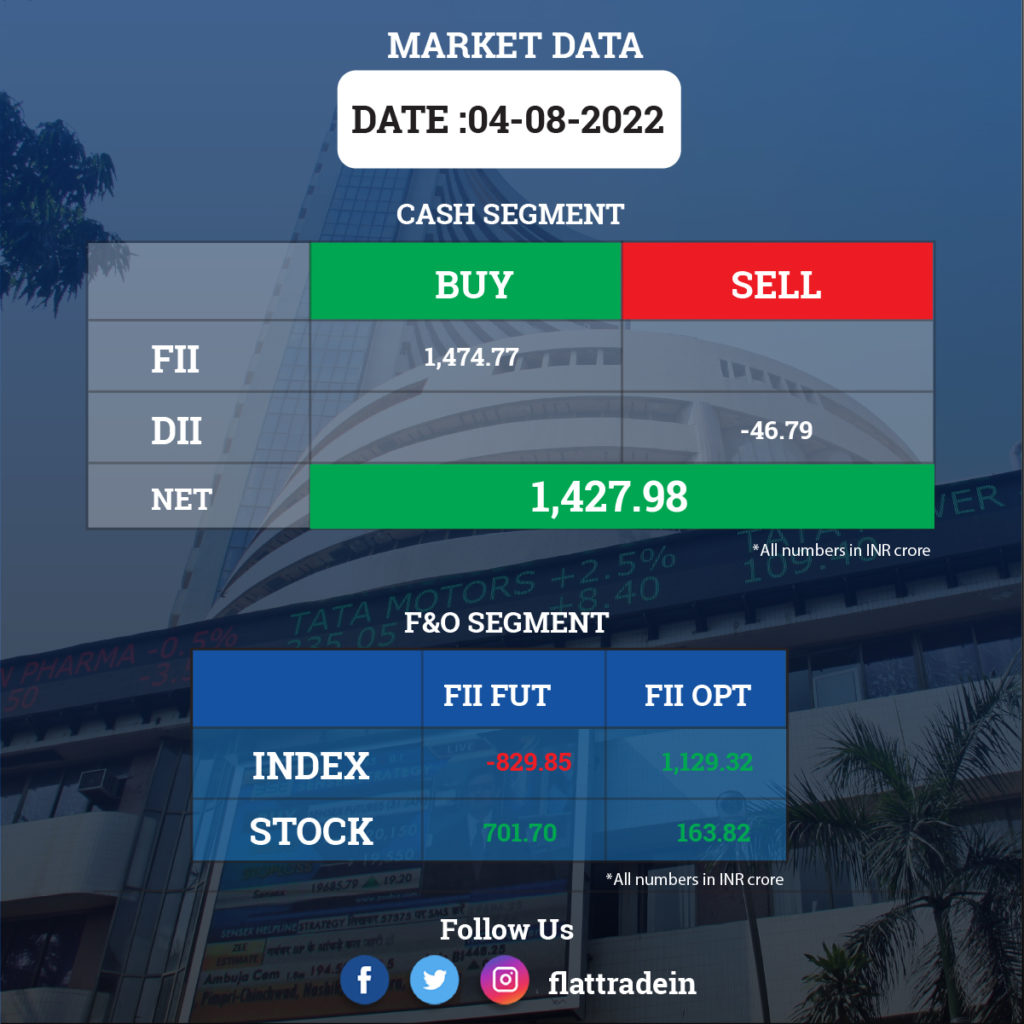

FII/DII Trading Data

Upcoming Results

Mahindra & Mahindra, Titan, FSN E-Commerce Ventures (Nykaa), IRB Infrastructure Developers, Engineers India, NMDC, One 97 Communications, Petronet LNG, Aditya Birla Fashion and Retail, Alkem Laboratories, Pfizer, Raymond, Computer Age Management Services, Eris Lifesciences, Fortis Healthcare, Greenply Industries, Minda Corporation, Indigo Paints, Motherson Sumi Wiring India, R Systems International, Shipping Corporation of India, Talbros Engineering, UCO Bank, and Zensar Technologies will report quarterly earnings on August 5.

Stocks in News Today

Britannia: The biscuit manufacturer said its consolidated net profit fell 13.24 per cent to Rs 335.74 crore in the April-June quarter of FY23 due to higher cost of raw materials such as wheat and industrial fuel. The company had posted a net profit of Rs 387.01 crore in the April-June quarter a year ago. Its total revenue from operations increased 8.74 per cent to Rs 3,700.96 crore during the quarter under review as against Rs 3,403.46 crore in the year-ago period.

Adani Enterprises: The company reported 73% jump in consolidated net profit at Rs 469 crore for the quarter ending June 2022 compared to a consolidated net profit of Rs 271 crore in the year-ago period. The company’s consolidated revenue from operations surged 225% to Rs 40,844 crore in Q1FY23 from Rs 12,579 crore in Q1FY22.

In other news, the company said that its unit will acquire Macquarie Asia Infrastructure Fund’s India toll roads in Andhra Pradesh and Gujarat for Rs 3,110 crore ($391.89 million). The acquired portfolio has more than 5,000 lane km of highway projects under construction / operation.

DLF: The real estate developer is evaluating a bid for a prominent New Delhi shopping mall which has a starting auction price of $366 million, Reuters reported citing two sources and a public notice. The 1.2 million square feet “Ambience Mall” in the southern district of India’s capital has been put up for auction as its current owner, the Ambience Group, has not paid debt of $149 million to Indiabulls Housing Finance and other creditors.

Larsen and Toubro (L&T): The infrastructure behemoth is targeting Rs 2.7 lakh crore revenue by financial year 2025-26, its Chairman A M Naik said. “The group recorded revenues of Rs 1,56,521 crore during FY 2021-22, registering a growth of 15 per cent,” he added at the company’s 77th AGM. The company’s order book stood at Rs 3,57,595 crore. Currently, the Middle East constitutes 76 per cent of the international order book of Rs 95,227 crore.

Reliance Industries Ltd (RIL): Reliance Brands, a subsidiary of RIL, said it has signed a strategic deal with the global luxury brand Balenciaga “to bring the best of global couture to the Indian market”. With this long-term franchise agreement, RBL will be Balenciaga’s sole India partner to launch the brand in the country and this partnership will be RBL’s second with the parent group Kering, which houses Balenciaga.

Adani Ports and SEZ: The company and AD Ports Group have signed a Memorandum of Understanding for strategic joint investments in end-to-end logistics infrastructure and solutions, which include rail, maritime services, port operations, digital services, an industrial zone and the establishment of maritime academies in Tanzania.

LIC Housing Finance: The company’s net profit surged 503 per cent year-on-year to Rs 925.48 crore on back of uptick in net interest income, as against Rs 153.44 crore in the same quarter last year. The net interest income rose by 26 per cent to Rs 1,610.19 crore, as compared to Rs 1,275.31 crore for the same period last fiscal. Net interest margin for the quarter stood at 2.54 per cent, as against 2.20 per cent the previous year. Total revenue grew 9 per cent to Rs 5,285.46 crore in the recently reported quarter.

Bharat Heavy Electricals Limited (BHEL): The company’s consolidated net loss narrowed to Rs 187.99 crore for the quarter ended June 2022 compared to a net loss of Rs 448.20 crore in the year-ago period. Its total income from operations was at Rs 4,742.28 crore in the first quarter of the current fiscal, compared to Rs 2,966.77 crore in Q1 FY22.

SpiceJet: India will allow to reinstate flights in a “graded manner” once the airline shows it has sufficient engineering strength and the financial ability to stock up on spares, according Reuters news report. The country’s air safety watchdog DGCA said that at this point of time we feel SpiceJet can only operate 50% of their capacity without compromising safety. Meanhile, the DGCA deregistered three SpiceJet aircraft on Thursday, five days after their lessor Dubai Aerospace Enterprise (DAE) requested the aviation regulator for it.

Macrotech Developers: Ivanhoe Op India Inc, the real estate arm of Canadian Pension Fund CDPQ, offloaded 70.29 lakh shares of the realty major Ltd for Rs 736 crore through open market transactions.

Zomato: The food delivery company said that investment firm Tiger Global has reduced its stake in the company by almost half to 2.77 per cent by selling over 18.45 crore shares in the open market.

Kalyan Jewellers: The jewellery retailer reported a consolidated profit after tax (PAT) of Rs 107.77 crore for the quarter ended June 2022 helped by higher footfalls and revenue across markets. It had posted a loss of Rs 51.30 crore during the corresponding quarter of the previous financial year. Revenue from operations jumped 103.61 per cent during the quarter under review to Rs 3,332.63 crore compared to Rs 1,636.77 crore in the year-ago period.

Blue Star: Air conditioning and commercial refrigeration maker said its consolidated net profit jumped to Rs 74.35 crore in Q1FY23 higher demand for its products. It had posted a consolidated net profit of Rs 12.71 crore in the April-June quarter a year ago. Its revenue from operations was up 87.28 per cent YoY at Rs 1,970.32 crore.

Spandana Sphoorty Financial: The rural focussed micro-lender reported a net loss of Rs 220 crore for the quarter ended June 2022, mainly on account of a one-time write-off. It had posted a net profit of Rs 55 crore in the corresponding period of the preceding fiscal. Its total income during April-June 2022 declined to Rs 259 crore from Rs 435 crore in the same period of 2021-22 due to a fall in interest income. The company’s core interest income declined to Rs 244 crore during the quarter against Rs 397 crore in the year-ago period.

BEML: The state-owned company has posted a consolidated loss of Rs 82.36 crore for the quarter ended June 2022, against a loss of Rs 94 crore in same period last year. Revenue grew by 43% YoY to Rs 669.2 crore in Q1FY23. The company has an orderbook of Rs 9,100 crore as of June 2022 including order booking of Rs 571 crore during the quarter ended June 2022.

REC: The company clocked a 8.2% year-on-year increase in consolidated profit at Rs 2,454.2 crore for the quarter ended June 2022, partly due to decline in impairment on financial instruments. Revenue declined 0.55 percent YoY to Rs 9,497.5 crore for the June FY23 quarter.

Alembic Pharmaceuticals: The pharma company posted a consolidated loss of Rs 65.88 crore for the quarter ended June 2022, against a profit of Rs 164.52 crore in same period last year, impacted by lower sales. Revenue fell nearly 5% to Rs 1,262.14 crore compared to year-ago period.

Balkrishna Industries: The company recorded a 7.1% year-on-year decline in consolidated profit at Rs 307 crore for the quarter ended June 2022, impacted by higher input cost and freight & forwarding expenses. Revenue surged 45.3% YoY to Rs 2,619.43 crore for the June FY23 quarter.

Dalmia Bharat: The cement maker reported a 26.78 per cent decline in consolidated net profit to Rs 205 crore in Q!FY23 compared to a net profit of Rs 280 crore in Q1FY22. Its revenue from operations increased 27.44 per cent to Rs 3,302 crore during the quarter under review as against Rs 2,591 crore in the corresponding period of the previous fiscal. Its sales volume increased 26.53 per cent in the April-June quarter to 6.2 million tonne (MT) in Q1FY23 compared to 4.9 MT of Q1FY22.

Kalpataru Power Transmission Ltd (KPTL): The company’s consolidated net profit rose 13 per cent to Rs 88 crore for the quarter ended June 2022, mainly driven by higher sales. Its consolidated net profit stood at Rs 78 crore in the year-ago period. The company’s total income stood at Rs 3,691 crore in the first quarter of the current fiscal compared to Rs 3,218 crore in the same period last year.

Berger Paints India: The company reported an increase of 80.60 per cent in consolidated net profit to Rs 253.71 crore for the first quarter ended June 2022. The company had posted a net profit of Rs 140.48 crore in the April-June period a year ago. Its revenue from operations rose 53.44 per cent to Rs 2,759.70 crore during the quarter under review as against Rs 1,798.49 crore in the year-ago period.