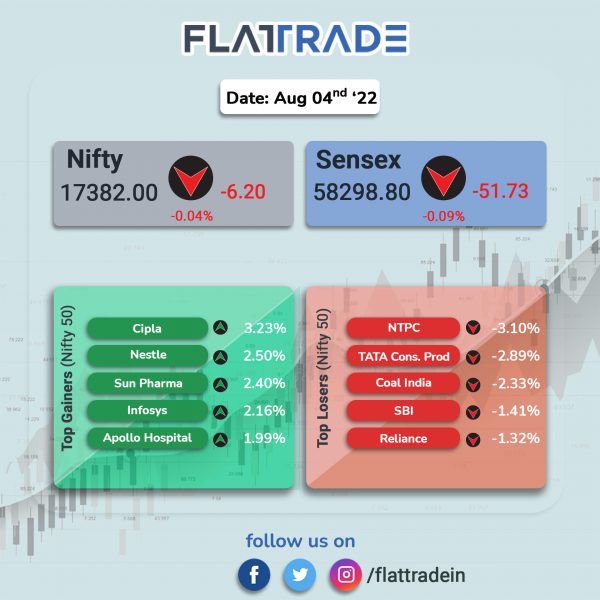

Benchmark equity indices struggled for direction and finally ended nearly flat ahead of RBI’s monetary policy decision on Friday. The Sensex slipped 0.09% and the Nifty inched down 0.04%.

Broader markets outperformed headline indices. The Nifty Midcap 100 rose 0.58% and BSE Smallcap increased 0.25%.

Top Nifty sectoral gainers were Pharma [2.37%], IT [1.24%], Metal [1.21%] and FMCG [0.48%]. Top losers were PSU Bank [-1.75%], Realty [-1.14%], Energy [-0.92%] and Private Bank [-0.68%].

The Indian rupee fell 30 paise to 79.47 against the US dollar on Thursday.

Stock in News Today

GAIL India: The nation’s largest gas utility reported a 51 per cent jump at Rs 3250.95 crore in Q1FY23 helped by higher margins from natural gas marketing. It had posted a consolidated net profit of Rs 2,157.15 crore in Q1FY22. Its revenue more than doubled to Rs 38,033.30 crore in Q1FY23 from Rs 17,702.43 crore in the same period last fiscal.

Adani Total Gas: The company psoted a net profit of Rs 138.37 crore in Q1FY23 from Rs 142.58 crore in the same period last fiscal. The company’s revenue doubled to Rs 1,110.21 crore in Q1FY23 from Rs 522.27 crore in Q1FY22. The company’s EBITDA stood nearly flat at Rs 218.55 crore in Q1FY23 compared with Rs 207.11 crore in Q1FY22.

HDFC Bank: The private sector lender clarified on news reports claiming that it will need to raise funds to immediately pay off liabilities arising out of merger with HDFC Ltd. The bank said that the claims in the news reports are incorrect and speculative. The bank added that it has not approved any plan to raise capital to fund its statutory liquidity ratio and other liabilities. The liabilities of HDFC will be transferred to the bank and will be serviced and repaid by the bank as per the contracted maturity.

Dabur India: The FMCG major reported a marginal increase in consolidated net profit at Rs 441.06 crore for the first quarter ended June 2022. It had posted a net profit of Rs 438.30 crore in the year-ago period. Its revenue from operations was up 8.07 per cent to Rs 2,822.43 crore during the quarter under review as against Rs 2,611.54 crore in the corresponding quarter of the previous fiscal.

Glass manufacturers: Shares of glass makers rose after the government extended anti-dumping duty on the imports of opal glassware, originating from China and UAE, for a period of five years. Directoreate General of Trade Remedies, which is a part of Commerce Ministry, recommended continuation of existing quantum of anti-dumping duty, as it found significant dumping of opal glassware from China, UAE despite duties. It also found that the volume of dumped imports have increased significantly and has made domestic industry vulnerable to injury from dumped imports. Shares of glass products makers like Borosil, La Opala, Hindusthan National Glass & Industries rose between 4.5%-5% in the day.

Balrampur Chini: The company’s consolidated net profit plunged to Rs 12.38 crore in Q1FY23 from Rs 76.93 crore in the year-ago period. Revenue stood at Rs 1,080.08 crore in Q1FY23 from Rs 1,140.44 crore in the same period last year. Its EBITDA at tanked to Rs 44.42 crore in the reported quarter from Rs 134.03 crore in the same period last fiscal.

Gujarat Gas: The company’s revenue jumped 72.5% YoY at Rs 5,303.23 crore in Q1FY23 from Rs 3,074.15 crore in Q1FY22. Net profit fell 19.6% YoY to Rs 381.9 crore in Q1FY23 from Rs 475 crore in Q1FY22. The company’s EBITDA fell 16% YoY to Rs 606.61 crore in Q1FY23 from Rs 722.39 crore in Q1FY22.

Adani Enterprises: The company has signed an MoU with Israel Innovation Authority to create an innovation platform that will allow Adani businesses to access tech solutions provided by Israeli startups and selected innovation projects will be supported by the partnership. The collaboration between the two entities will involve climate change, cyber, Al, loT, 5G and agriculture.

Redington India: The company has posted a net profit of Rs 315.78 crore in Q1FY23, up 33.43% from Rs 236.67 crore in Q1FY22. The company’s revenue rose 24.89% to Rs 16,803.14 crore in the reported quarter from Rs 13,454.05 crore in the year-ago period. Its EBITDA was up 34.14% to Rs 461.82 crore in the quarter under review from Rs 344.28 crore in the year-ago period.

Lupin: The drugmaker reported a net loss of Rs 89 crore in Q1FY23 compared to a net profit of Rs 542 crore in the year-ago period. Revenue fell 12% YoY to Rs 3,744 crore in the reported quarter. Shares of the company closed 5.15% higher.

PI Industries: The company’s consolidated revenue rose 29% to Rs 1543.2 crore in Q1FY23 from Rs 1193.8 crore in the year-ago period. The EBITDA increased 39% to Rs 345.60 crore in the quarter under review from Rs 248.9 crore in the same period last year. Its net profit jumped 40% to Rs 262.4 crore in Q1FY23 from Rs 187 crore in Q1FY22. Shares of the company rose 3.7%.