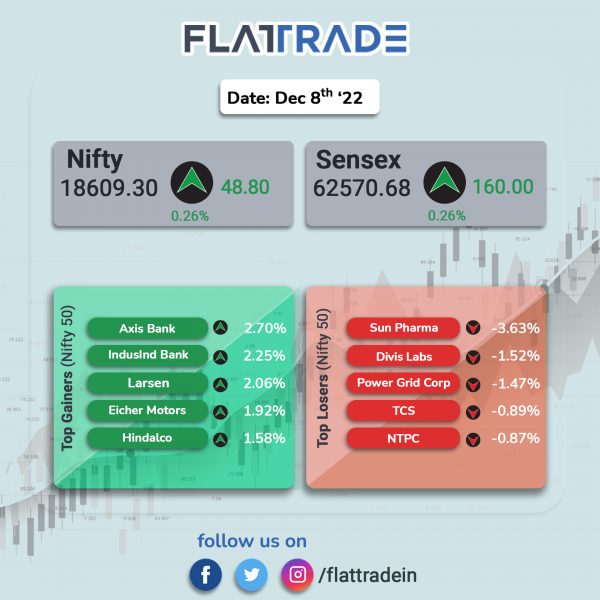

Dalal Street closed higher aided by gains in bank and metal stocks amid weak global sentiments. The Sensex and the Nifty 50 indices closed 0.26% higher, each.

In broader markets, the Nifty Midcap 100 index rose 0.61% and the BSE Smallcap index advanced 0.32%.

Top gainers among Nifty sectoral indices were PSU Bank [3.81%], Private Bank [1.17%], Bank [1.16%], Media [0.75%] and Metal [0.71%]. Top losers were Pharma [-1.10%], Realty [-0.78%], Energy [-0.27%] and IT [-0.24%].

Indian rupee slipped 5 paise to 82.42 against the US dollar on Thursday.

Stock in News Today

Axis Bank: Shares of the private lender rose over 3% after the bank announced that it will raise Rs 12,000 crore via unsecured, rated, listed, subordinated, taxable, non-convertible, Basel III compliant Tier II bonds with a green shoe option of Rs 11,000 crore, according to its exchange filing.

Adani Ports: The company said that it has submitted a resolution plan in the insolvency process of Karaikal Port in Tamil Nadu. Adani Ports clarified that the said process is underway and no conclusion has been reached yet. After the successful bidder is announced, the plan will be subject to approval from the National Company Law Tribunal.

Sun Pharmaceutical: The drug maker has received a communication from the USFDA stating that its Halol facility in Gujarat has been listed under import alert. The import alert implies that all future shipments of products manufactured at this facility are subject to refusal of admission to the US market until the facility becomes compliant with cGMP standards.

Oil and Natural Gas Corporation Limited (ONGC): The PSU has signed an MoU with global petroleum giant Shell for co-operation in carbon capture, utilization and storage (CCUS) studies. The collaboration shall focus on joint CO2 storage study and enhanced oil recovery (EOR) screening assessment for key basins in India including depleted oil and gas fields, saline aquifers.

JSW Steel: The company said its standalone crude steel production in November 2022 stood at 16.90 lakh tonnes, compared to 14.60 lakh tonnes in November 2021. The production of flat rolled products jumped 19% YoY to 11.86 lakh tonnes in November 2022. The production of long rolled products rose 5% to 3.47 lakh tonnes in November 2022 from 3.32 lakh tonnes in same period last year.

TVS Motor Company: The company’s subsidiary, TVSM Singapore, has acquired 100% stake in BBT 35/22 Vermogensverwaltungs GmbH for 25,000 euro. The acquired company’s name is likely to be changed to Celerity Motor GmbH. With this buyout, the company plans to undertake activities related to two-wheeler & three-wheeler vehicles, including research, development, engineering, sales and service.

Ashok Leyland: The automaker has appointed Shenu Agarwal as MD And CEO of the company for five years. Agarwal joins Ashok Leyland from Escorts Kubota, where he was President.

Kalyan Jewellers: The jewellery retailer has laid out expansion plans for 2023. The company plans to open 52 showrooms in 2023 and expand its retail footprint by over 30%. Expansion will mainly focus on the non-South region, which contributes 35% to India business. It also plans to open stores in Tier-2 and Tier-3 markets present in the North, East and Western India.

Bank of India: Investment bank Credit Suisse has upgraded Bank of India to “outperform” on improving profitability and strong capital position. The target price for the lender was increased from Rs 42 to Rs 105.

Hinduja Global Solutions (HGS): The company has announced two M&A developments to support its transformation journey as HGS 2.0. It has entered into a definitive agreement to acquire a 100% stake in TekLink International for a consideration of $58.8 million and the transaction is expected to close in the next two months. Further, HGS has signed a non-binding Letter of Intent (LoI) to acquire uKnowva, a digital Human Resources Management System (HRMS) product business, from Convergence IT Services.

Lumax Industries: The company’s board has approved setting up greenfield project at Chakan, Pune, with capital expenditure up to Rs 175 crore for Phase 1. This project will cater to the new orders received from OEM customers for advance lighting solutions. The company said that capex will be funded by mix of debt and internal accruals. The project is expected to be commissioned by Q2FY24.

VA Tech Wabag: The company said that its board has approved the appointment of Pankaj Malhan as deputy managing director and Group chief executive officer of the company, with immediate effect from December 7, 2022.

EaseMyTrip: The company said that it is the official travel partner for the inaugural season of the World Tennis League, which will be taking place between December 19 and December 24 at the Coca Cola Arena in Dubai. Under the partnership, EaseMyTrip customers will have an opportunity to witness the groundbreaking event along with specially curated packages to Dubai.

Moschip Technologies: The company said it has inaugurated a VLSI & embedded systems training facility in Hyderabad. The company has partnered with Cadence Design Systems to expand and enhance the program.

Dredging Corporation of India (DCI): The company announced that it has secured a contract worth about Rs 60 crore from Numaligarh Refinery (NRL). According to its regulatory filing, NRL awarded the reclamation dredging contract for NRL Crude Oil Import TerminaI (COIT) Plot to DCI for transportation & pumping of dredge material from Paradip Port Authority Sand Trap to NRL (COIT) Plot for the year 2022-23.

Talbros Automotive Components: The company said that it has received an order worth Rs 60 crore in the heat shield business from a passenger vehicle OEM in India. The order is to be executed over a period of next five years and help the company to increase its domestic market share. With this order, the company’s total orders stood at Rs 880 crore during the current financial year across its business divisions, product segments and joint ventures.

Shakti Pumps India: The company said it has incorporated a unit for electric vehicle business. The new company, Shakti Green Industries, will be engaged in manufacturing, trade, buy and sale of electric vehicle motors, charging stations, electric control panels, variable frequency drives, IoT based electric control panel and controllers.

Trent: The company has signed a definitive agreement with Tata Industries, Tata Unistore and Tata Digital to sell some stake. Trent will offload about 3.22% stake held in Tata Unistore to Tata Digital. The shares will be sold for Rs 24.14 crore.

Gujarat Ambuja Exports: The company inaugurated its maize processing greenfield project in West Bengal. The project has a capacity of 1,200 tonnes per day. The greenfield project is fully equipped with a captive power plant, effluent treatment plant and a maize storage capacity of 1,20,000 tonnes. The trial production has commenced and the commercial production with full capacity utilisation will be achieved in the coming quarter.