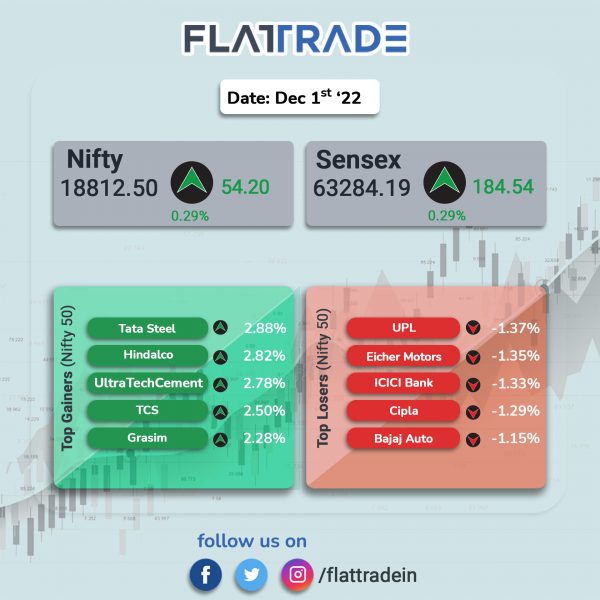

Benchmark indices closed positively as IT, state-owned banks and realty stocks gained. The Sensex and the Nifty 50 indices closed 0.29% higher, each. The session was volatile due weekly Nifty options expiry.

Broader market outperformed headline indices. The Nifty Midcap 100 index rose 0.77% and the BSE Smallcap gained 0.63%.

Top gainers among Nifty sectoral indices were IT [2.4%], PSU Bank [2.11%], Media [2.08%], Realty [1.98%] and Metal [1.53%].

Indian rupee fell 21 paise to 81.22 against the US dollar on Thursday.

In economic news, Manufacturing PMI stood at 55.7 in November 2022 compared to 55.3 in October 2022.

Stock in News Today

Coal India Ltd (CIL): The state-owned company said it had produced 412.6 million tonnes (MT) of coal in the April-November period of the current fiscal and expressed confidence that it will surpass the the output target set for the current financial year. The PSU had produced 353.4 MT in the April-November period of last fiscal (FY22). Coal India, which accounts for over 80% of domestic coal output, is eyeing a production of 700 million tonnes (MT) in the current financial year.

Adani Green Energy: The company through its subsidiary, Adani Solar Energy AP Six Private Ltd, has raised JPY denominated facility to refinance its existing debt. The facility comprises JPY 27,954 million ($200 million approx.) amortising project loan facility, assessing the 16 years debt structure with door-to-door tenor of 10 years and average tenor of more than 8 years. The project loan facility is supported by MUFG Bank and Sumitomo Mitsui Banking Corp with equal participation.

Maruti Suzuki India: The automaker sold a total of 159,044 units in November 2022 compared to 139,184 units in November 2021, recording a 14.27% growth. Domestic sales stood at 1,35,055 units, sales to other OEM was 4,251 units and exports were 19,738 units. Shortage of electronic components had a minor impact on the production of vehicles, mainly in domestic models.

Tata Motors: The automaker said its sales in the domestic & international market for November 2022 stood at 75,478 units compared to 62,192 units during November 2021, up 21%. Total sales included commercial vehicle sales of 29,053 units, a YoY decline of 10%. Passenger vehicle sales rose 55% YoY to 46,425 units. Total domestic sales stood at 73,467 units in November 2022, 27% higher compared to 58,073 units sold in November 2021.

Mahindra & Mahindra (M&M): The company said that its overall auto sales for the month of November 2022 stood at 58,303 vehicles, registering a growth of 45.39% as against 40,102 vehicles sold in November 2021. The company sold 19,591 units of commercial vehicles (LCV+MHCV) in November 2022 as against 14,979 units sold in November 2021, a growth of 30.79%. Exports for the month stood at 3,122 vehicles.

Easy Trip Planners: The company has entered into a deal to acquire the 75% stake in Nutana Aviation. Nutana Aviation leases charter aircraft enabling operators to run efficiently along with providing charter booking services to its clients, within and outside India. Under this transaction, EaseMyTrip will hold a majority stake in the Nutana aviation. Post investment by EaseMyTrip, Nutana Aviation will continue to run and operate as an independent entity. With this acquisition, EaseMyTrip will add a new segment that will ‘fast-track’ its growth.

Trident: The company has been granted patent for Fabric and Method of Manufacturing Fabric’ by Patent Office India. The present invention comprises a method of producing a fabric by subjecting the fabric to a special treatment, thereby obtaining increased air space in the resultant fabric. This will help the company to deliver its special soft towels without usage of any chemical-based fibers enabling it to save environment and at the same time to deliver its soft luxury towels in Indian Market.

Piramal Enterprises: The company’s board approved raising up to Rs 250 crore via the issuance of non-convertible debentures. Shares of the company closed 4.67% higher.

Shilpa Medicare: The company recieved Health Canada GMP approval for the inspection conducted from Sept. 12-16, 2022, at is Jadcherla facility in Telangana. The GMP approval will allow the company for the commercial distribution of products in Canada and enable new application submissions to Health Canada.

Timken India: Shares of the company rose 11.6% after brokerage firm JM Financial maintained a ‘buy’ call on the stock and raised the target price to Rs 3,700 from Rs 3,200. JM Financial said that Timken India is poised to benefit from macro tailwinds in the bearings industry. The brokerage firm expects the company to gain from a cyclical recovery over FY23-35 in its existing domestic segments i.e. commercial vehicles and railways.

Orient Beverages: Shares of the Bisleri bottler hit upper circuit for the fifth trading session on Thursday, soaring to Rs 179.05 apiece after news reports emerged that Tata Consumer Products Ltd (TCPL) will buy Bisleri for an estimated Rs 6,000-7,000 crore, according to reports. Orient’s shares have been in an upward trajectory in the past few sessions and has rallied more than 81% in the last one month.

Cosmo First: The company announced a share buyback of Rs 108 crore at a price of Rs 1,070 per share through tender route from the existing shareholders on voluntary and proportionate basis. The buyback price is fixed at Rs 1,070 per share, representing a premium of 33.37% to Wednesday’s closing price of Rs 802.30 on the BSE. The company’s board fixed December 14 as record date for the purpose of ascertaining the eligibility of the shareholders for the buyback.

NCC: The company has received two new orders for Rs. 376 crore in November 2022. Out of these two orders, one order valuing Rs. 321 crore pertains to Electrical Division and the second order valuing Rs. 55 crore pertains Roads Division.

Polycab India: The company announced that it has entered into strategic partnership with Redignton as its national distributor for passive networking solutions. With this partnership, Polycab’s telecom division, Polycab Telecom, looks forward to strengthen its passive networking portfolio, comprising end-to-end copper and fibre system, all across India, capitalizing on Redington’s extensive distribution-network and efficient operational expertise.