Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.28% lower at 18,921.50, indicating a negative start for Dalal Street.

Asian stocks edged lower as traders awaited jobs report due later on Friday for clues on the Federal Reserve’s next monetary policy decision. Japan’s Nikkei 225 index fell 1.94% and the Topix tanked 2.04%. Hang Seng was down 0.31% and the CSI 300 index was 0.37% lower.

Indian rupee fell 21 paise to 81.22 against the US dollar on Thursday.

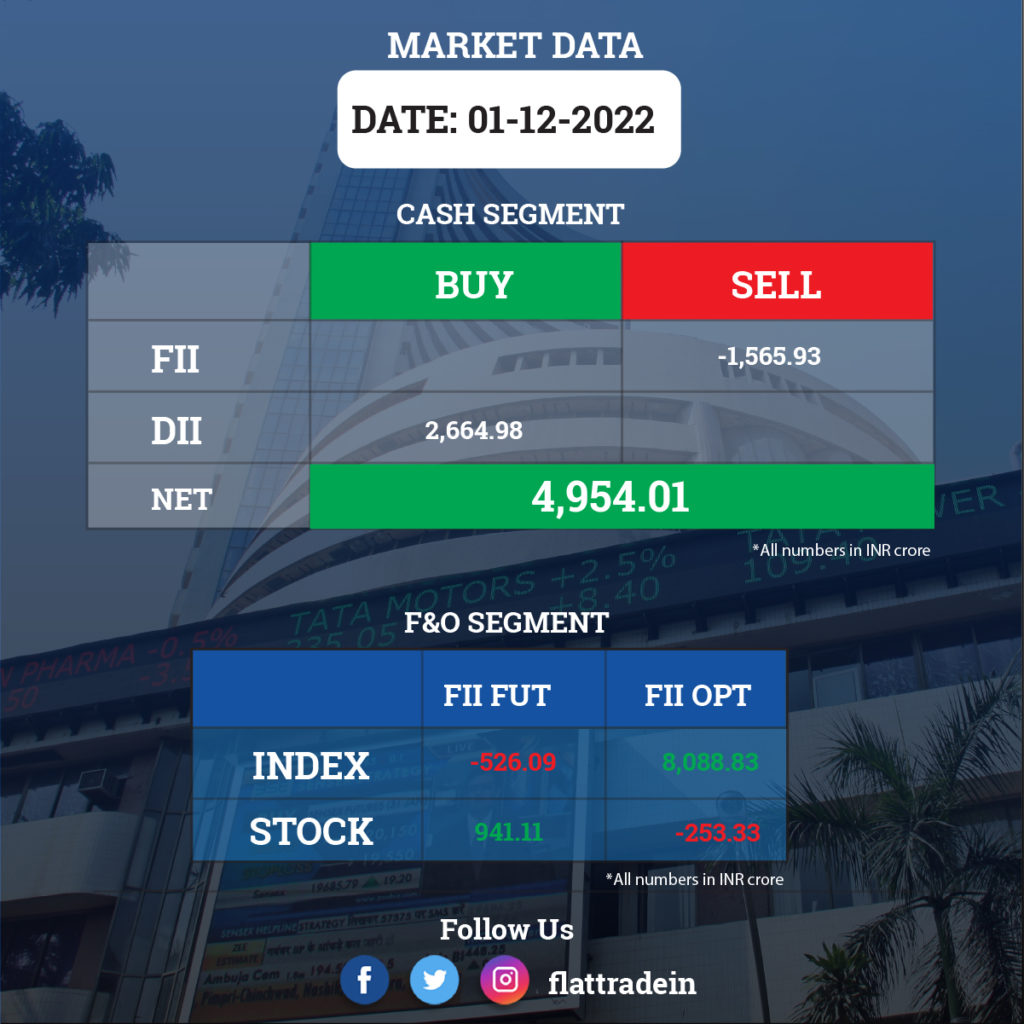

FII/DII Trading Data

Stocks in News Today

Hero MotoCorp: The two-wheeler manufacturer sold 3.9 lakh units in November 2022, a growth of 12% over the corresponding month of the previous year. The company had sold 3.49 lakh units in November 2021. The company said it expects the momentum to build-up in coming quarters on favourable economic indicators, including encouraging farm activity and positive consumer sentiments.

Larsen & Toubro (L&T): The company said it has closed a $107 million sustainability-linked loan with Sumitomo Mitsui Banking Corporation (SMBC). The facility incorporates interest rate reductions linked to the achievement of two of L&T’s predetermined sustainability targets – reduction of greenhouse gas emission intensity and water consumption intensity against the target levels. L&T Group CFO and Whole Time Director R Shankar Raman said that L&T continues to focus on achieving water neutrality by 2035 and carbon neutrality by 2040.

Tata Steel: The company will continue to invest in the state which has 25% of India’s total steel making capacity, its MD & CEO T V Narendran said during the ‘Make in Odisha Conclave 2022’ event in Bhubaneswar. The company has already made an investments of over Rs 75,000 crore in Odisha. According to Narendran, Tata Steel is the largest steel manufacturer in Odisha producing about 9 million tonnes of steel annually. “We plan to double this over the next few years as we expand in all our locations in Odisha,” he said.

Britannia Industries: The company expects its cheese products business to grow around five-fold in the next five years to touch around Rs 1,250 crore. The company is foreseeing consumption growth in cheese segment coming from the domestic consumer. The company plans to invest Rs 160 crore in the next three years, said Britannia Industries Executive Vice-Chairman and Managing Director Varun Berry.

Bharat Heavy Electricals Ltd (BHEL): The state-run company has formed a consortium with Titagarh Wagons and is among five entities which have bid for the mega Rs 58,000 crore contract to manufacture 200 Vande Bharat trains and maintaining them for the next 35 years. Other players include French railway major Alstom; Medha-Stadler consortium between Swiss railway rolling stock manufacturer Stadler Rail and Hyderabad-based Media Servo Drives; Siemens along with BEML, and Russian rolling stock manufacturer Transmashholding (TMH) along with an Indian firm. Officials said Rs 26,000 crore is the upfront payment on the delivery of the trains and Rs 32,000 crore will be paid to the winning bidder over a period of 35 years for the maintenance of these trains.

Eicher Motors: The automaker has sold 70,766 motorcycles in November 2022, registering a 37% growth over 51,654 units sold in same month last year, but exports dropped 27% YoY to 5,006 motorcycles.

NLC India: The company and GRIDCO (Grid Corporation of Odisha) has signed MoU for setting up of ground mounted or floating solar power projects, pumped hydro storage projects, green hydrogen projects and any other renewable projects. This MoU will enable both the entities towards achieving national targets for renewable energy capacity and energy transition goal.

Kotak Mahindra Bank: The private sector lender has allotted 15,000 long term fully paid up non-convertible bonds with a face value of Rs 10 lakh each, on private placement basis. The coupon rate is 7.63% per annum and the tenor is 7 years from date of allotment.

SJVN: The public sector company said its subsidiary SJVN Green Energy has signed a Memorandum of Understanding with Grid Corporation of Odisha for developing 1,000 MW hydroelectric projects and 2,000 MW solar power projects in Odisha by incorporating a joint venture company. The development of these projects will attract an investment of Rs 20,000 crore and is expected to generate 4,207 million units (MUs) in first year and a cumulative generation of around 96,797 MUs over a period of 25 years.

Orchid Pharma: The drug maker said its board has approved qualified institutional placement (QIP) issue to raise Rs 500 crore. With this QIP placement, the Dhanuka group, which took over the company in 2018, is also meeting its mandatory obligation to dilute 15% stake in Orchid Pharma by March 2023.