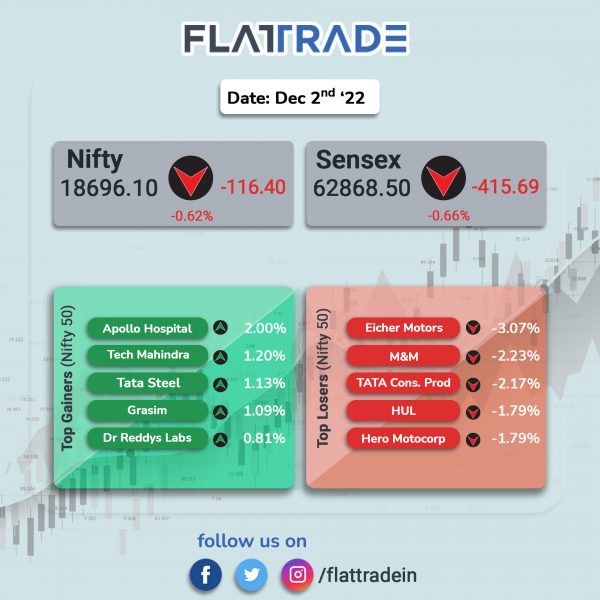

Benchmark stock indices snapped eight-day rally to close lower as investors booked profits. Auto and Financial Services indices dragged Sensex and Nifty down. The Sensex fell 0.66% and the Nifty 50 index dropped 0.62%.

However, broader markets performed better than headline indices. The Nifty Midcap 100 index was up 0.88% and the BSE Smallcap index ended 0.7% higher.

Top losers among Nifty Sectoral indices were Auto [-1.1%], Financial Services [-0.62%], Energy [-0.57%], FMCG [-0.48%] and Bank [-0.36%]. Top gainers were Media [1.22%], Realty [0.94%], Metal [0.44%] and PSU Bank [0.42%].

Indian rupee fell 10 paise to 81.32 against the US dollar on Friday.

Stock in News Today

Reliance Industries Ltd (RIL): The company is buying Russian refined fuels, including rare purchases of naphtha, after some Western buyers stopped Russian imports, Reuters reported. India imported about 410,000 tonnes of naphtha, used for making petrochemicals in September-October 2022. Out of this, Reliance received about 150,000 tonnes from the Russian ports of Ust-Luga, Tuapse and Novorossiysk during the two months, Reuters report said.

Maruti Suzuki India: The company said it is planning to raise prices across models in January 2023 due to increased cost pressure driven by overall inflation and recent regulatory requirements. Shares of the company fell 1.68%.

Separately, the company released its production volume numbers. The total passenger vehicles produced stood at 151,326 units in November 2022 as against 142,025 unit in November 2021. It produced 1,460 units of light commercial vehicles as against 3,535 units.

Tata Power: The company plans to invest Rs 6000 crore in Odisha, the company’s CEO and MD Praveer Sinha said during a “Make in Odisha Conclave”. The four power discoms of Odisha, where Tata Power has a majority stake, are committed to Rs 6,000 crore capex investment in the next five years. Sinha said the company will also set up 1,000 electric vehicle (EV) charging points, 1,00,000 solar pumps, microgrids, rooftop and floating solar plants in the next five years.

PB Fintech (Policybazaar): Shares of the company surged 6% to Rs 489 in intraday trade on the NSE after 5% equity of the company changing hands via block deal. About 22.84 million shares representing 5% of total equity of PB Fintech worth Rs 1,042.53 crore changed hands on the NSE in the pre-open deals at Rs 456.30, the exchange data showed.

ACC and Ambuja Cements: The Adani group is in talks with several foreign banks to refinance $3.5 billion of bridge loans taken for the acquisition of Ambuja Cement and ACC this year. The tenure of the refinanced loans may be extended to five years.

ONGC, Oil India, RIL: The government slashed to less than half the windfall profit tax on domestically produced crude oil and also reduced the levy on diesel. The tax on crude oil produced by firms such as state-owned ONGC has been reduced to Rs 4,900 per tonne from the existing Rs 10,200 per tonne. In the fortnightly revision of windfall profit tax, the government cut the rate on export of diesel to Rs 8 per litre from Rs 10.5 per litre.

Separately, petrol and diesel sales in India saw a double-digit year-on-year growth in November on increased demand from the agriculture sector.

Macrotech Developers: Shares of the company rose 4.83% in intraday trade after Jefferies updated their India long-only portfolio and raised the weightage of the scrip to 6%.

Godrej Properties: The realty firm said it has bought 18.6 acre land at Kandivali in Mumbai to develop a premium housing project. The company said that the project would have a developable potential of about 3.72 million square feet with an estimated revenue potential of about Rs 7,000 crore.

Amara Raja: The company and Telangana govt has signed a pact for 16 GWh lithium cell gigafactory and 5 GWh battery pack assembly unit in Mahbubnagar. The company plans to invest Rs 9500 crores in the facility over a period of the next 10 years.

Bank of India: The PSU bank raised capital worth Rs 1,500 crore through additional tier I bonds (AT1 bonds) to meet regulatory norms and support business growth. Following a strong response, the coupon was fixed at a finer rate of 8.57 per cent against an indicative range of 8.75-9.0 at the start of bidding.

NMDC: The finance ministry on Thursday invited initial bids for NMDC’s Steel Plant (NSL) at Nagarnar and offered to sell a 50.79% stake in the company. After the divestments, shares of NSL will be listed on the exchanges. The last date for submitting queries is December 29, 2022, and that for submission of bids is January 27, 2023.

Yes Bank: The Reserve Bank of India has issued conditional approval to PE investors Carlyle and Advent International for planned acquisition of 9.99% share capital of Yes Bank. The fund-raising would be conducted through a combination of $640 million (Rs 5,100 crore) in equity shares and $475 million (Rs 3,800 crore) through equity share warrants.