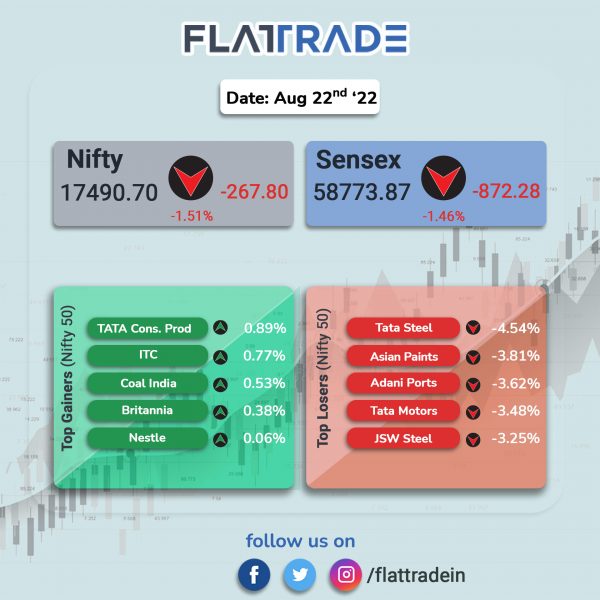

Benchmark indices fell more than 1% due to fresh worries over global economic downturn and tighter monetary policy by global central banks. The Sensex fell 1.46% and the Nifty dropped 1.51%

Broader markets mirrored headline indices. The Nifty Midcap 100 index slumped 2.02% and the BSE Smallcap was down 1.17%.

Top losers among Nifty sectoral indices were Metal [-2.98%], Realty [-2.51%], PSU Bank [-2.12%], Auto [-1.94%] and Financial Services [-1.94%].

Indian rupee fell 9 paise to 79.87 against the US dollar on Monday.

Stock in News Today

Larsen & Toubro (L&T): The construction and infrastructure company said that the hydrocarbon-onshore division of L&T Energy business has been awarded a large contract related to P-25 project from Indian Oil Corp (IOCL). As per L&T’s classification, the value of the large project is 2,500 crore to 5,000 crore. The scope of the project involves setting up a residue hydrocracker unit (RHCU) for this P-25 project.

Hindustan Petroleum Corp (HPCL): Shares of the company fell more than 6% in intraday trading on Monday. The company recommended a final dividend of Rs 14 per share on the face value of Rs 10 each on equity shares for FY22.

Hatsun Agro Products: The company’s board has approved proposal to raise funds not exceeding Rs 700 crore, through private placement of equity shares through QIP. Hatsun Agro Products also gave its nod to invest in buying paid up share capital (not exceeding 20%) of Huoban Energy 4 Pvt Ltd. The investment is done for the purpose of consuming solar energy captively for the company’s plant in Maharashtra.

Zomato: Investment bank Nomura has initiated coverage of Zomato with a ‘reduce’ recommendation with a target price of Rs 50. Nomura said that the online delivery company’s target to achieve double-digit contribution margin in food delivery is very difficult and it has to depend on higher commissions from restaurants and rise in customer delivery fees. Nomura also expected food delivery revenue growth to moderate by FY27.

JSW Steel: The Competition Commission of India has approved the merger of Creixent Special Steels and JSW Ispat Special Products with JSW Steel, under Section 31 (1) of the Competition Act, 2002.

Greenlam Industries: The company said that the manufacturing capacity in Gujarat has commenced commercial production from August 20. The facility has an installed capacity of 3.4 million laminate sheets per year and has a potential to generate Rs 150 crore per year on full capacity utilisation. With this new manufacturing facility, Greenlam Industries said that the total installed capacity of the company rose to 19.02 million laminate sheets per annum.

Shilpa Medicare: The company announced that its subsidiary Shilpa Biologicals completed the Phase 3 Human Clinical Studies of its first biosimilar, the 100 mg/ml High Concentration (HC) Adalimumab biosimilar. The drug will treat Rheumatoid Arthritis, Plaque Psoriasis, Psoriatic Arthritis, Ankylosing Spondylitis, Crohns disease among others.

LIC Housing Finance: The company has increased its prime lending rate by 50 basis points. Therefore, the new interest rates on home loans will now start from 8% as against 7.50% earlier. The new rates will be effective from Monday.

RBL Bank: The lender sold 17.78% stake in Kilburn Engineering between May and August 2022. The total consideration for the sale of 61 lakh equity shares or 17.78% equity stood at Rs 27.07 crore.

Dilip Buildcon: The infrastructure company has received a provisional completion certificate for the project ‘Rehabilitation and Up-gradation to Six-Laning of Chandikhole-Bhadrak Section of NH-5 in Odisha executed as Hybrid Annuity Project under NHDP Phase V by the company’s subsidiary, DBL Chandikhole Bhadrak Highways. The project cost is estimated Rs 1522 crore.

Brooks Laboratories: The company said that its subsidiary, Brooks Steriscience, has received an approval for Meropenem Injection 500mg per vial and 1gram per vial (the product) from the US health regulator, Food & Drug Administration (USFDA). The product is generic equivalent to the Merrem Injection of Pfizer. Shares of the company jumped 5% and hit an upper circuit.

Piramal Enterprises: The company announced that its board has approved the appointment of Upma Goel as the chief financial officer (CFO) and key managerial personnel of the company with effect from August 18. Meanwhile, Vivek Valsaraj ceased to be the chief financial officer of the company.

Subex: The company has announced that it has been selected by Ethio Telecom to deploy its Fraud Management solution, which is built on Subex’s AI orchestration platform, HyperSense. The new fraud management system will replace Ethio Telecom’s existing legacy fraud management system, thereby enabling them to move from a traditional rules-based approach to an AI-first approach. This will enable Ethio to detect new and unknown threats in real-time.