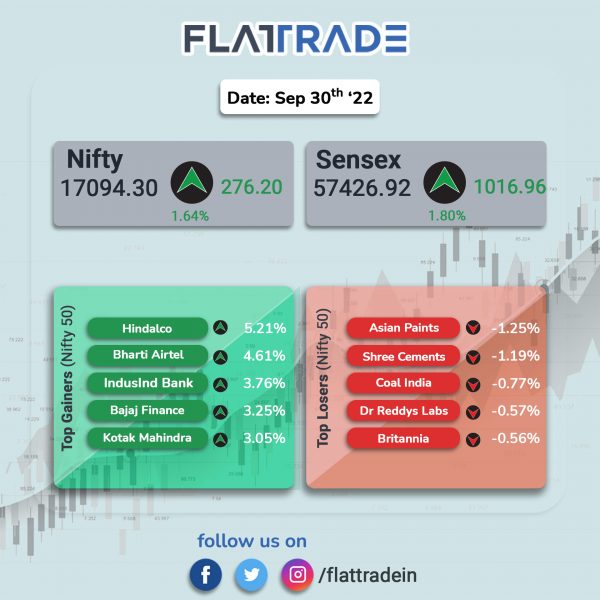

Dalal Street closed higher after the Reserve Bank of India (RBI) raised benchmark repo rate by 50 basis points on Friday, along expected lines. The Sensex rose 1.8% and the Nifty 50 index jumped 1.64%.

India’s central bank raised repo rate by 50 basis points to 5.9% to fight elevated inflation. The RBI has increased the benchmark policy rate by 190 bps in the current financial year. To read more about RBI’s growth outlook, click here

Broader markets rose, tracking benchmark stock indices. The Nifty Midcap 100 index advanced 1.6% and the BSE Smallcap gained 1.45%.

Top gainers in Nifty sectoral index were PSU Bank [3.01%], Private Bank [2.79%], Bank [2.61%], Financial Services [2.24%] and Metal [2.17%]. All the Nifty sectoral indices closed in the green.

Indian rupee closed 52 paise higher at 81.34 against the US dollar on Friday.

Stock in News Today

Vodafone Idea: In an exchange filing, the company informed that the company has been in discussion with Indus Tower for softer payment terms, which are continuing, but have not been concluded as yet. The company also said that it would keep the stock exchanges informed on any development with respect to the same. Shares of the Vodafone Idea rose 6.47% in intraday trade.

Tata Communications: The company has launched a dedicated private 5G Global Centre of Excellence (CoE) in Pune to accelerate Industry 4.0 applications and capabilities for enterprises. With trials in progress, Tata Communications will be able to demonstrate private 5G use cases such as automated quality inspection of equipment using video and image analytics, inventory management and asset tracking, warehouse theft detection, AR/VR-based remote worker collaboration, and video-powered retail purchase.

Paytm: Global brokerage firm JPMorgan reiterated ‘overweight’ recommendation on Paytm and maintained a target price of Rs 1,000 apiece. The brokerage firm said that the fintech firm is undergoing a model shift from chasing ‘growth at any loss’ to ‘profitability by September 2023. The brokerage firm said that moderation in indirect expenses from second quarter is expected to be a key driver for profitability.

Inox Leisure: The theatre operator has commenced the commercial operations of a three screen and 522 seats multiplex cinema theatre in Shivpora, Srinagar, taken on management contract basis. Inox is now present in 74 cities with 165 Multiplexes, 705 screens and a total seating capacity of 1,57,290 seats across India.

Vedanta: The company has won the Golden Peacock GLOBAL Award for Excellence in Corporate Governance – 2022 under the Metals and Metallurgy category. This is the third time the Company is being honoured with this prestigious award. Golden Peacock Awards are instituted by the Institute of Directors (IOD) and it is regarded as a benchmark of Corporate Excellence worldwide.

Heritage Foods: The dairy products manufacturer said that its board has approved to issue equity shares in ratio of 1:1 by way of rights issue. The company will issue 4,63,98,000 equity shares and the size of the rights issue is Rs 23.19 crore. Shares of the company rose 19.52% in intraday trade.

Dilip Buildcon: Shares of the company rose 7.32% in intraday trade after the company said it has emerged as the lowest bidder for the second phase of Ahmedabad Metro Rail project by Gujarat Metro Rail Corp. The project cost is Rs 723.45 crore and it includes construction of 7.5 km elevated viaduct and seven stations.

Schneider Electric: Shares of the company jumped over 8% in intraday trade after the company said it will invest Rs 300 crore in its smart factory in Telangana. The smart factory will be spread over 18 acres and it will be developed in two phases. The first phase of the construction of the factory with 2 lakh square feet area is expected to be completed in September 2023.

Hitachi Energy India: In an exchange filing, the company announced that Hitachi has signed a share transfer agreement for the remaining 19.9% shares from ABB, pursuant to the acquisition agreement signed in December 2018. The development is in line with the plan and ahead of schedule, and the transfer of shares is expected to be completed by end of December 2022, subject to regulatory approvals.

Motherson Sumi Wiring: The company’s board approved the increase in authorised share capital from Rs 333 crore to Rs 900 crore, according to its regulatory filing. It has recommended issue of bonus shares in the ratio of 2 bonus shares for five equity shares of Re 1 each held.

Railtel Corporation of India (RCIL): The company’s board has approved the scheme of amalgamation of RaiITel Enterprises (REL) with and into RCIL. The amalgamation is subject to regulatory approvals.