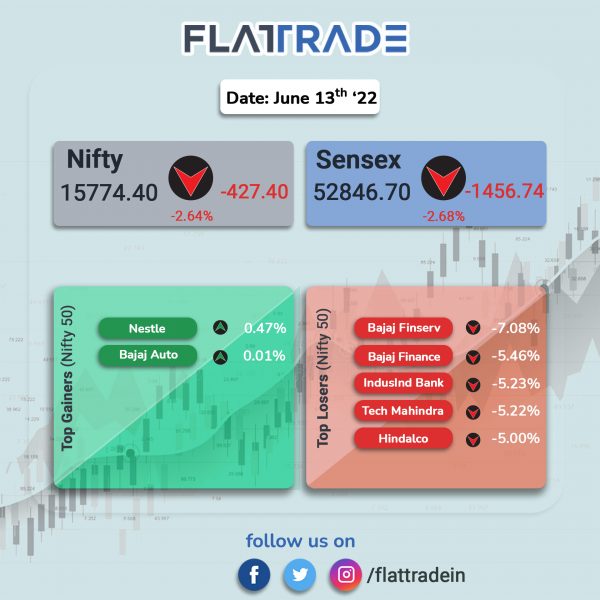

Dalal Street tanked as investors stayed away from risky assets due to fears of a recession in the US and Europe. The Sensex tanked 2.68% and the Nifty 50 plunged 2.64%.

In broader markets, Nifty Midcap 100 was fell 2.89% and BSE Smallcap slumped 3.15%.

Top Nifty sectoral losers were IT [-4.12%], Media [-4.03%], Metal [-3.85%], PSU Bank [-3.58%] and Private Bank [-3.57%]. All other sectoral indices closed in the red.

India rupee depreciated 20 paise to 78.04 against the US dollar on Monday.

Stock in News Today

Tata Steel: The company has unveiled a 7-million pound investment plan for its Hartlepool Tube Mill in north-east England that is expected to cut carbon emissions, improve capacity and reduce costs to strengthen its UK business. The investment will go into a new slitter which will allow the Hartlepool site to process coils of steel delivered from Tata’s Port Talbot steelmaking site in South Wales.

Information Technology (IT) companies: Shares of companies such as TCS, Infosys, etc. were under pressure on Monday with the Nifty IT index falling over 4% due to concerns over moderation in growth and lower global growth outlook.

Rajesh Exports: Shares of the company rose 4.9% after its subsidiary, Elest, announced that it will set up India’s first ever display fabrication facility in Telangana with investment worth Rs 24,000 crore. Under the MoU, Elest will manufacture displays for smartphones, tablet computers and laptops.

G R Infraprojects: Shares of the company tanked nearly 10% after the company confirmed that the CBI conducted a search at the residence of the company’s chairman Vinod Kumar Agarwal and also the corporate office of the company at Gurugram. The search at the chairman’s residence has been completed, while the process is still underway at the company’s office. The company also confirmed that few of its employees have been arrested at project site.

Reliance Infrastructure Limited (Reliance Infra): The company is set to receive a sum of Rs 595 crore from Damodar Valley Corporation (DVC) by July 31. DVC has furnished an undertaking on June 6, 2022, stating that DVC will comply with the direction to deposit a sum of Rs 595 crore in cash and Rs 303 crore by way of Bank Guarantee within July 31.

Hindustan Zinc: Shares of the company fell after the DIPAM secretary said that the government plans to sell residual stake in tranches. Last month, the cabinet had approved the sale of government’s residual stake of 29.5% in Hindustan Zinc to raise about Rs 38,000 crore.

Crompton Greaves Consumer Electricals: The company board approved proposal to modify its debt profile and approved buyback of commercial paper aggregating to Rs 600 crore. The company also approved raising Rs 925 crore via bonds, according to its regulatory filing.

Cement companies: Shares of cement manufacturers fell after brokerage firm gave a negative outlook for the sector due to several headwinds that could weigh on their earnings. The brokerage firm noted aggressive capacity expansion plans, deteriorating demand, persistent cost inflation environment and lack of pricing power due to tough competitions as key concerns for the sector.