Market Opening - An Overview

SGX Nifty futures were trading 1.97% lower at 15,866.50, indicating that Dalal Street was headed for a gap-down start on Monday.

Asian shares were trading lower as investors were worried over persistent higher inflation and further aggressive monetary tightening by the US central bank. Japan’s Nikkei 225 and Topix tanked 2.64% and 2.01%, respectively. China’s Hang Seng slumped 2.48% and CSI 300 index dropped 1.05%.

The Indian rupee fell 6 paise to 77.83 against the US dollar on Friday.

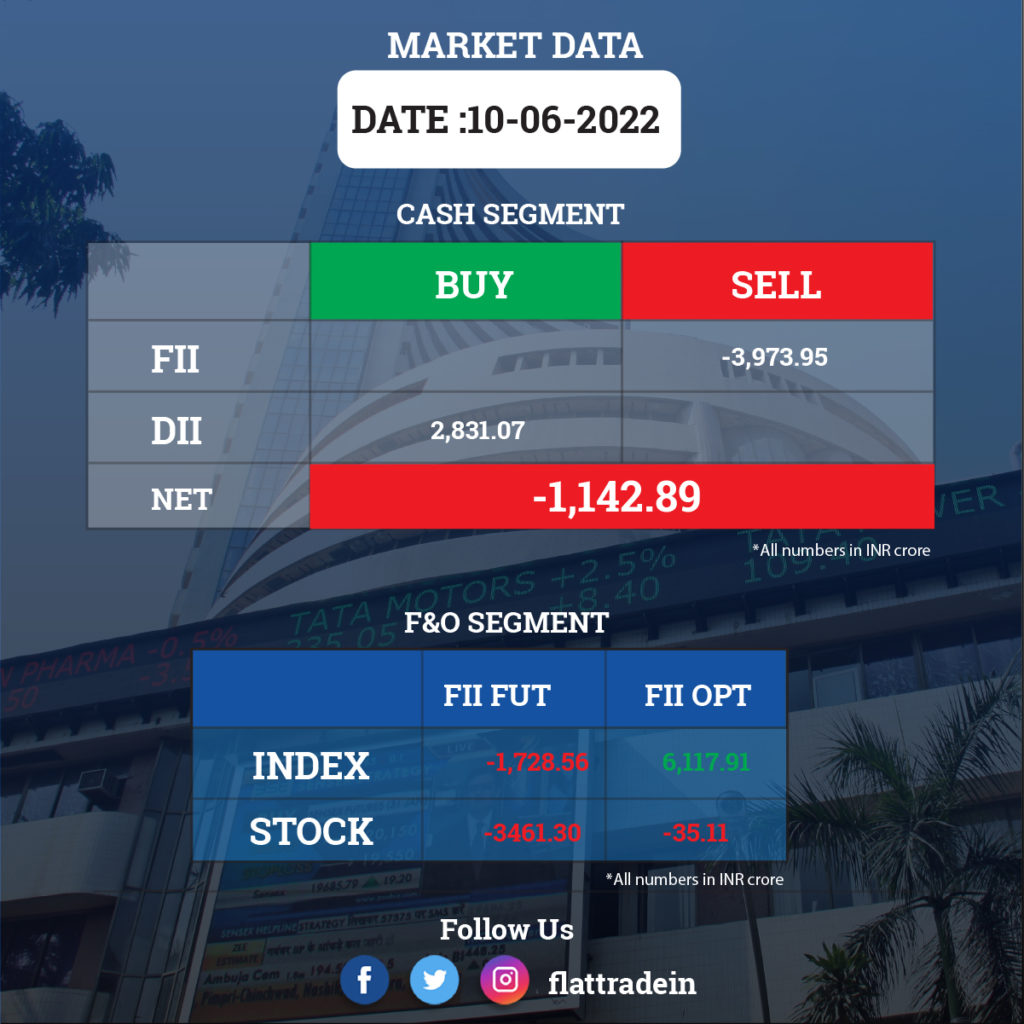

FII/DII Trading Data

Stocks in News Today

Maruti Suzuki India (MSI): The country’s largest carmaker has shipped 2.33 lakh units through Railways last fiscal, its highest ever dispatch in a financial year so far, since commencing the initiative eight years ago, as per a senior company official. The company’s dispatch in 2021-22 was 23% up from 1.89 lakh units it transported using Railways in the 2020-21 financial year.

Adani Green Energy: The Rajasthan government has allotted 2,397.54 hectares of government land in Bandha village of Jaisalmer district to Adani Renewable Energy Holding Four Limited, in order to set up 1,000 MW solar power project. With this, the state aims to increase electricity generation through the set up of solar energy based production units.

Indian banks: Six Indian banks namely Canara Bank, ICICI Bank, Bank of Baroda, Bank of India, Axis Bank and Indian Overseas Bank, have sued Singapore’s GVK Coal Developers for Rs 12,114 crore ($1.5 billion) plus interest in the London High Court, a report by The Times of India said. The banks have sued the GVK Group-owned GVK Coal Developers over dispute on a $1-billion loan and $35-million letter of credit facility that five banks lent to the company in 2011 and a $160-million loan lent in 2014, the report said.

Mahindra & Mahindra (M&M): The company will set up their first greenfield project in Mohali near Punjab. The expansion is a first after a decade by the world’s largest tractor maker, on the back of strong domestic demand.

Vedanta: Billionaire Anil Agarwal-owned Vedanta’s iron & steel division has ventured into iron ore mining operations in Liberia, West Africa through its subsidiary Western Cluster (WCL) with the ground-breaking ceremony that was held at the Bomi iron ore mine on June 8. WCL had signed a Mineral Development Agreement with the government of Liberia for three iron ore mining concessions in Bomi, Bea, and Mano in 2011. However, the operations could not be started due to the outbreak of the Ebola epidemic.

Coal India: The state-run company will get 6 million tonnes (MTS) more coal from abroad, issuing medium-term tenders for supplies after there was a shortfall in domestic supply chain for power generating companies.

Strides Pharma: The drug maker is recalling over six lakh bottles of blood pressure lowering drug Losartan Potassium tablets in the US market in multiple strengths due to deviation from standard manufacturing norms, according to a USFDA report.

CE Info Systems: The homegrown navigation firm MapmyIndia said it has collaborated with India’s space agency ISRO which will enhance the quality of its 3D maps. The company is developing new maps as part of its foray into the metaverse.

RBL Bank: The Reserve Bank of India (RBI) has approved R Subramaniakumar’s appointment as the MD & CEO of RBL Bank, the private lender told exchanges. Subramaniakumar is a banker with 40 years of experience. He was an Executive Director at Indian Bank and Indian Overseas Bank. He also held the position of Managing Director & CEO of Indian Overseas Bank.

IIFL Finance: British International Investment Plc (formerly known as CDC Group Plc) offloaded 1.6 crore equity shares in the company through open market transactions on June 10. With this, its shareholding in the company stands reduced to 3.557% from 7.772%. However, Max Life Insurance Company acquired 24.6 lakh equity shares in the company and Nomura India Investment Fund Mother Fund bought 44,74,548 shares at an average price of Rs 325.1 per share.

Lemon Tree Hotels: The company has signed a licence agreement for a 44 -room hotel in Gajuwaka, Visakhapatnam, Andhra Pradesh under its brand “Keys Lite by Lemon Tree Hotels”. The hotel is expected to be operational by March 2023. Carnation Hotels Private Limited, a subsidiary and the hotel management arm of the company, will operate this property.

IndInfravit Trust: The company proposes to acquire the entire equity share capital in five special purpose vehicles—three toll-road infrastructure assets (Simhapuri Expressway, Rayalseema Expressway, Mumbai Nasik Expressway) and two annuity infrastructure assets (Kosi Bridge Infrastructure Company, and Gorakhpur Infrastructure Company)—from BIF India Holdings Pte Ltd and Kinetic Holdings I Pte Ltd. Both entities (BIF and Kinetic) are owned by funds managed by Brookfield Asset Management Inc and its affiliates. The payment for the proposed transaction is based on a cumulative gross enterprise value of Rs 8,940.9 crore.