Market Opening - An Overview

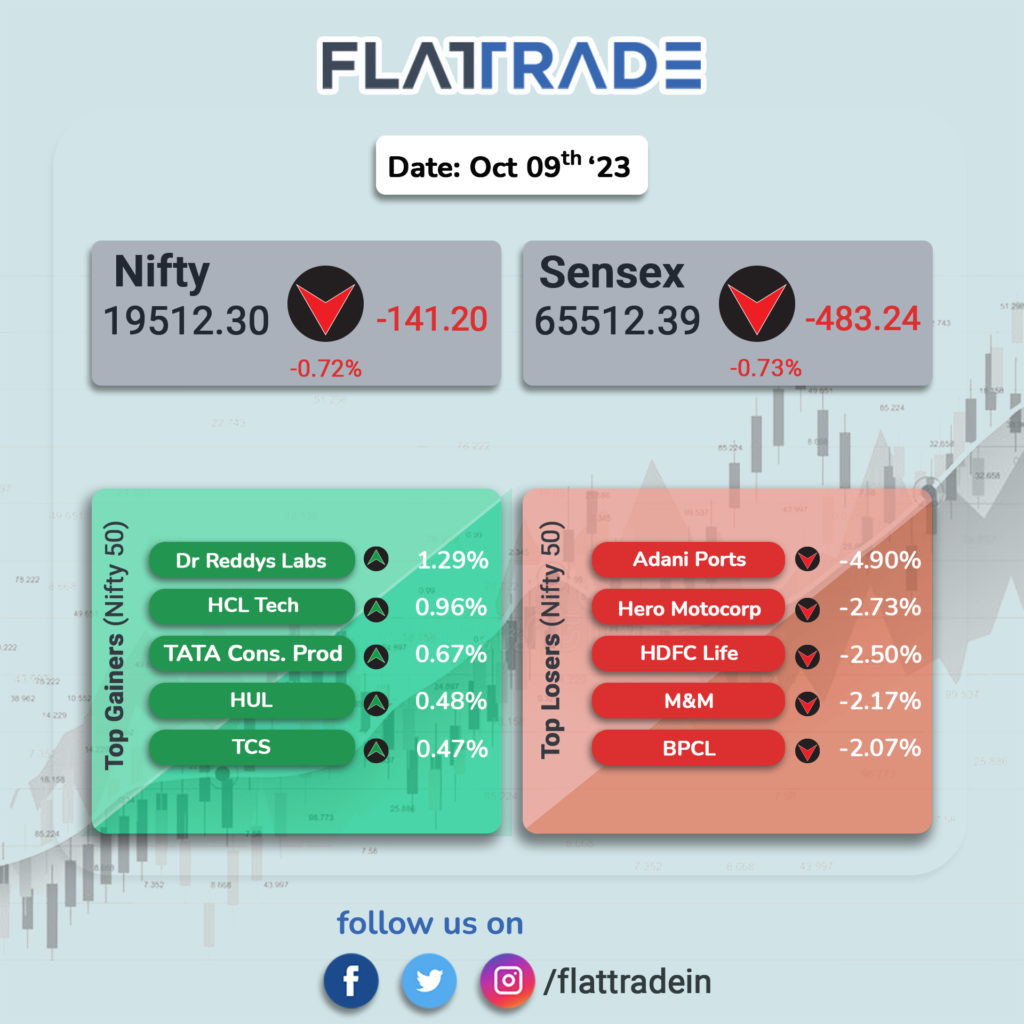

Dalal Street ended in the red as investors were worried over the geopolitical tensions between Israel and Hamas that led to soaring oil prices. The Sensex fell 0.73% and the Nifty 50 index dropped 0.72%.

Broader markets performed poorly compared with headline indices. The BSE Smallcap tanked 1.71% and the Nifty Midcap 100 slumped 1.34%.

Top losers were PSU Bank [-3.09%], Media [-2.18%], Metal [-1.44%], Financial Services [-1.13%], and Bank [-1.07%]. All sectoral indices closed negatively.

The Indian rupee weakened 2 paise to close at 83.27 against the US dollar on Monday.

FII/DII Trading Data

Stocks in News Today

ICICI Prudential: The company said in an exchange filing that New Business Premium rose 4.4% to Rs 4,359 crore in Q2FY24, from Rs 3051 crore in the preceding quarter. Retail Weighted Received Premium increased 4.1% QoQ to Rs 1574 crore in the quarter ended September 2023. Its Annualized Premium Equivalent stood at Rs 2,062 crore, up 3.2% QoQ from Rs 1461 crore in Q1FY24.

Adani Ports and SEZ: Shares of the company tanked 5% as investors sold the company shares due to the Israel and Hamas conflict. However, the company said the overall contribution of Haifa port in APSEZ’s numbers is relatively small at 3% of the total cargo volume. It further added that it is closely monitoring the action on ground which is concentrated in South Israel, whereas Haifa port is situated in the North.

Prestige Estates Projects: The company said that in Q2FY24, it has has registered sales of Rs 7092.6 crore, up by 102% YoY and quarterly collections of Rs 2639.8 crore, up by 1% YoY. The sales during this period is attributed to 6.84 mn sft, up by 50% YoY volume with an average realization of Rs 10,369 per sft, up by 29% YoY for apartments / villas and average realization of Rs 6,753 per sft, up by 62% YoY for plot sales.

Rail Vikas Nigam (RVNL): The company said that it has received two letters of acceptance (LOAs) from Maharashtra Metro Rail Corporation (MMRCL) for design and construction of elevated metro viaduct aggregating to Rs 651.08 crore. Both the projects is expected to be be executed within 30 months.

Godrej Properties: The realty company announced the opening of Taj The Trees at their flagship project and one of India’s most sustainably planned mixed-use developments – The Trees in Vikhroli, Mumbai. The hotel is entirely owned by Godrej Properties and will be managed by the Indian Hotel Companies (IHCL) as a luxury Taj hotel. The hotel will be spread across 0.35 million sq. ft., Taj The Trees offers 151 spacious rooms; restaurants – Shamiana and Nonya; a rooftop bar – The Mangrove Bar; an infinity pool across the length of the building; generous conference facilities; and a signature spa.

One97 Communications: The company announced that its wholly-owned subsidiary, Paytm Payments Services, has become the first in the industry to enable merchants with Alternate ID (ALT ID) based Guest Checkout solution across networks. This allows customers to checkout as a guest without saving sensitive card details on an e-commerce or merchant website for a transaction.

Inox Green Energy Services: The company has signed a term sheet for divestment of 100% stake in Nani Virani Wind Energy SPV, which is a 50 MW operational wind farm located in Gujarat. The divestment is part of the strategic decision taken by the company to become net debt-free, further enabling the company to become an asset-light annuity Operations and Maintenance (O&M) business.

Vascon Engineers: The company announced that it has received letter of intent (LoI) worth Rs 262.19 crore from Bridge and Roof Company India, a Government of India enterprise. The contract is for planning, designing, construction, IT (networking) and maintenance of Government Medical College at District Kanker, Chhattisgarh, under Chhattisgarh Medical Services Corporation, Government of Chhattisgarh. The work has to be completed within 24 months from the date of commencement.

IRB InvIT: The company’s monthly toll collection grew by 28% from Rs 328 crore in September 2022 to Rs 421 crore in September 2023. During July-September period, the aggregate toll revenue grew 22% to Rs 1,203 crore in Q2FY24 over Rs 984 crore in Q2FY23.

Indiabulls Housing Finance: The company has issued an offer to all NCD holder(s) for pre-mature redemption of its NCDs maturing till 31 March 2024. The Asset Liability Management Committee of the company has decided to make the offer to NCD holders to acquire NCDs maturing till 31 March 2024, and hold them as treasury stock until maturity.

Restaurant Brands Asia: The company’s board has approved availing of secured term loan facility including fund based loan and non-fund based loans totalling Rs 150 crore from Axis Bank.

KPI Green Energy: The company has received new orders aggregating to 4.20 MW for executing solar power projects under ‘Captive Power Producer (CPP)’ segment of the company. With this order, the cumulative orders of solar power projects, till date have crossed 100+ MW under CPP segment of the company.

Rishabh Instruments: The company’s material subsidiary, Lumel SA, in Poland has won a project for co-financing under Support for Entrepreneurs, SMART Path, European Funds for the Modern Economy 2021-2027. The execution of this project will be for the next two years. This co-financed project will involve investment in Additional Surface Mount Technology (SMT) Line, Online Automated Optical Inspection (AOI), X-Ray Devices to ensure reliability, quality and miniaturization of SMT Processes involving components like BGA to deliver next generation of Digital Metering Devices.

Solar Industries India: The company has received orders worth Rs 1,853 crore from Coal India to supply explosives. The company will supply bulk explosive to coal India. The said project will be executed in 24 months and will be delivered over a period of two years.

Sigachi Industries: The company’s board has approved allotment of 1,60,51,900 equity shares of one rupee to non-promoters on conversion of 16,05,190 warrants at an issue price of Rs 261 per share.

Multi Commodity Exchange (MCX): The company has announced that SEBI has withdrawn its directions to MCX and MCXCCL to keep the proposed Go-Live of Commodity Derivative Platform (CDP) in abeyance.

JSW Holdings Limited: The company clarified in an exchange filing that it is not in any talks with Shanghai-based SAIC Motor Corp. or MG Motor as mentioned in some media reports.

IFL Enterprises: The company has signed an Memorandum of Understanding (MoU) with Charter Paper Pty Ltd, an Australian family-owned company specializing in paper products. The company has secured an order valued at Rs. 72.98 crore from the international client. The company has also secured commitments for orders worth approximately A$115 million (Rs 609.62 crore) over the next 18 months. These orders encompass a diverse range of products and are expected to contribute significantly to our revenue growth and profitability in the long run, the company said in a regulatory filing.

Alphalogic Industries: The company announced that it has bagged an order from Scootsy Logistics (popularly known as ‘Swiggy’) worth Rs 71.10 lakh.The contract is for design, manufacture, supply and installation of storage racking system. The project has to be executed within this month. Separately, the company informed that Trinity Engineers has awarded the company a contract for design, manufacture, supply and installation of MS pallet and storage rack solutions for their units based in Pune in Maharashtra. The project has to be executed within this quarter. The value of the said contract is Rs 30.69 lakh.