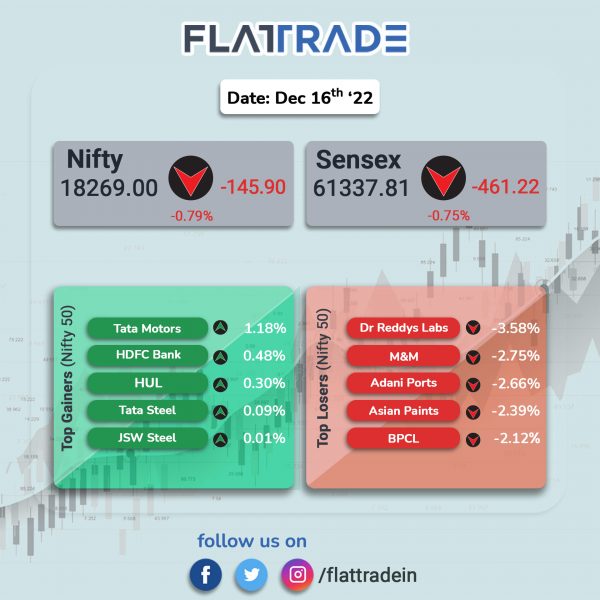

Major equity indices fell as investors were worried over recession, interest rate hike and persistent high inflation. The Sensex fell 0.75% and the Nifty dropped 0.79%.

In broader markets, Nifty Midcap 100 index plunged 1.6% and the BSE Smallcap was down 0.96%.

Top losers among nifty sectoral indices were PSU Bank [-2.92%], Realty [-1.51%], Pharma [-1.4%], IT [-1.33%], Media [-1.30%]. All indices ended in the red due heavy sellign pressure across sectors.

Indian rupee fell 11 paise to 82.87 against the US dollar on Friday.

Merchandise exports stood at $31.99 billion in November 2022, up 0.59% from $31.8 billion in November 2021, according to the data released by the government on Thursday. Merchandise exports had contracted 16.7% year-on-year to $29.8 billion in October. Imports rose 3.6% to $55.88 billion in November. Trade deficit stood at $23.89 billion during November, down from $26.91 billion in October. During April-November 2022, exports stood at $295.26 billion against $265.77 billion in the same period last year.

Stock in News Today

Reliance Industries (RIL): The company’s subsidiary, Reliance Digital Health, has signed definitive agreements with Synchron Inc. to acquire 2.25% stake in Synchron Inc. as part of its Series C financing round. Synchron is a clinical-stage endovascular brain computer interface (BCI) company. Since 2012, the company has been developing a BCI platform that avoids the need for open brain surgery by using a minimally-invasive procedure. The Synchron Switch BCI received FDA Breakthrough Device Designation in 2020, and is currently in human clinical trials in the US and Australia. Synchron is based in Brooklyn, New York, and R&D facilities in Melbourne, Australia.

Larsen & Toubro (L&T): Shares of the company hit a 52-week high of Rs 2,211.6 per share. The shares opened at Rs 2161 and continued its upward trend, but pared gains to close at Rs 2175. On the daily technical chart, it formed a shooting star pattern after bearish engulfing pattern on Thursday, indicating selling pressure. The share price is likely decline in the coming days.

Oil & Gas companies: Indian government slashed windfall tax on crude from Rs 4,900 per tonne to Rs 1,700 per tonne. Levy on diesel exports were cut from Rs 8 per litre to Rs 5 per litre. Also, the windfall tax on aviation turbine fuel was slashed from Rs 5 per litre to Rs 1.5 per litre.

Wipro: The IT major announced that it has signed five year multi million agreement with Mazda Motor Logistics Europe to deliver managed services for its entire application landscape. The five year strategic relationship with Wipro will help industrialize Mazda IT, digitize processes, and further enable agile software developer and operations (DevOps) ways of working while infusing state-of-the-art tools to drive automation.

GMM Pfaudler: Shares of the company fell over 18% in intraday trade amid heavy volumes. On the NSE, over 110.15 lakh shares of the company changed hands at the counter as against an average trading volume of 1.10 lakh shares in the past three months. According to media reports, Pfaudler Inc, one of the promoters of GMM Pfaudler Ltd, was to sell a majority of its stake in the company in a block deal that will fetch the shareholder Rs2,278 crore.

Dilip Buildcon: The construction company has received order worth Rs 976 crore from NHAI. The project involves four laning of Mehgama-Hansdiha in Jharkhand on hybrid annuity mode.

Dr Reddy’s Laboratories: The company will stop the clinical development of INDUS-3, a drug used for treating psoriasis. The development comes after Aurigene reported the results of a study, concluding that the magnitude of efficacy improvement was “not what we hoped for” in the study.

Patel Engineering: The company will allot equity shares having a face value of Rs 1 per share aggregating up to Rs 350 crore on rights basis to the eligible equity shareholders of the company.

Engineers India: The company has secured a deal from Mundra Solar Technology, a group company of Adani Enterprises for Polysilicon production. The order involves production of 30,000 MTPA Polysilicon and 500 MTPA Monosilane. Polysilicon is the primary component for manufacturing Photovoltaic panels.

AIA Engineering: The company has executed share purchase agreement with Clean Max Enviro Energy Solutions to acquire 26% stake in Clean Max Meridius (CMPL) for setting up a captive Hybrid (solar & wind) power project in Gujarat. The company will also sign and execute energy supply agreement with CMPL for supplying contracted hybrid (solar & wind) energy to the company as a captive user. CMPL was incorporated in August 2022 as a special purpose vehicle to setup hybrid power generation facilities in Gujarat.

Gyscoal Alloys: The company announced its plans to ramp up production capacity and resume export of its steel products following the removal of 15% export duty on steel exports. In the third week of November 2022, the Government of India has cut export duty on steel products and iron ore to nil.