Elin Electronics plans to raise Rs 475 crore through an initial public offering (IPO). The IPO subscription will be open from December 20 to December 22, 2022. The price band is fixed in the range Rs 234-247 per share.

The IPO comprises of fresh issue of shares worth Rs 175 crore and offer for sale of shares worth Rs 300 crore. The face value is fixed at Rs 5 per share.

Company Summary

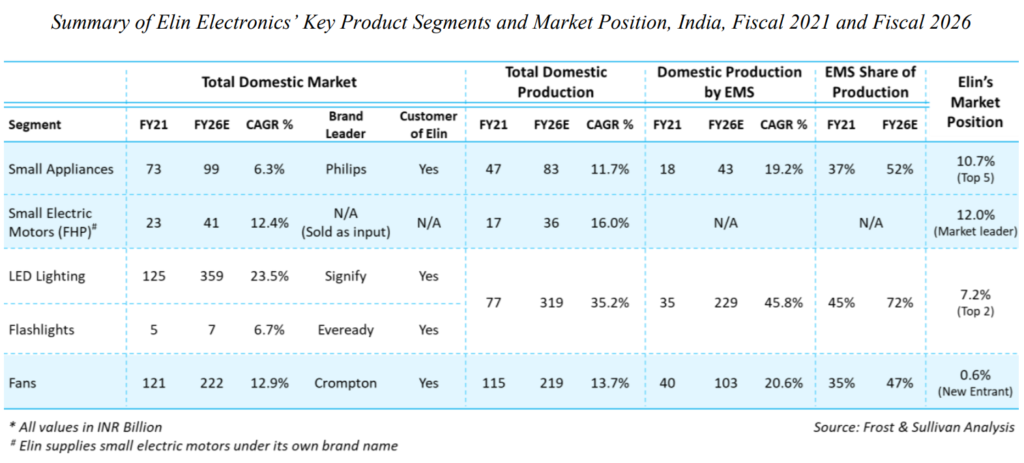

Elin Electronics Limited is a leading electronics manufacturing services (“EMS”) provider. The company is a manufacturer of end-to-end product solutions for major brands of lighting, fans, and small appliances and kitchen appliances in India, and it is one of the largest fractional horsepower motors manufacturers in India.

Elin Electronics Limited manufactures and assembles a wide array of products and provides end-to-end product solutions. The company serve under both original equipment manufacturer (“OEM”) and original design manufacturer (“ODM”) business models.

The company’s diversified product portfolio in EMS includes (i) LED lighting, fans and switches including lighting products, ceiling, fresh air and TPW fans, and modular switches and sockets; (ii) small appliances such as dry and steam irons, toasters, hand blenders, mixer grinders, hair dryer and hair straightener; (iii) fractional horsepower motors, which is used in mixer grinder, hand blender, wet grinder, chimney, air conditioner, heat convector, TPW fans etc.; and (iv) other miscellaneous products.

The company also has a centralized R&D centre in Ghaziabad (Uttar Pradesh), focusing on the research and development of all aspects of OEM and ODM models including concept sketching, design refinement, generating optional features and testing. The company has three manufacturing facilities which are strategically located in Ghaziabad in Uttar Pradesh, Baddi in Himachal Pradesh and Verna in Goa.

Company Strengths

- Established market position in key verticals including leadership in fractional horsepower motors.

- Diversified products resulting in a de-risked and robust business model.

- Well-established relationships with marquee customer base.

- High degree of backward integration resulting in higher efficiencies, enhanced quality of products and customer retention capability.

- Consistent and strong track record of financial performance.

Company Financials

Period | 6MFY23 | FY22 | FY21 | FY20 |

Total Assets (Rs in crore) | 589.24 | 532.61 | 508.29 | 387.61 |

Total Revenue (Rs in crore) | 604.74 | 1094.67 | 864.9 | 786.37 |

Profit After Tax (Rs in crore) | 20.67 | 39.15 | 34.86 | 27.49 |

Net worth (Rs in crore) | 320.15 | 303.07 | 262.25 | 227.75 |

EBITDA (Rs in crore) | 43.36 | 79.93 | 69 | 56.24 |

EBITDA (%) | 7.17 | 7.31 | 8 | 7.16 |

PAT margin (%) | 3.42 | 3.58 | 4.03 | 3.5 |

ROE (%) | 6.63 | 13.85 | 14.23 | 12.88 |

ROCE (%) | 8.09 | 15.82 | 14.9 | 15.44 |

Purpose of the IPO

- The company plans to utilise the net proceeds from fresh issue of shares for repayment/ prepayment, in full or part, of certain borrowings availed by the company aggregating to Rs 88 crore.

- Funding capital expenditure towards upgrading and expanding the company’s existing facilities at Ghaziabad in Uttar Pradesh, and Verna in Goa totalling Rs 37.59 crore.

- General corporate purposes.

- The selling shareholders will be entitled to their respective portion of the proceeds of the offer for sale (OFS) after deducting its relevant expenses and taxes thereon.

- In addition, the company expects to receive the benefits of listing of the equity shares on the stock exchanges and enhancement of the company’s visibility and brand image as well as creation of a public market for its equity shares in India.

Company Promoters

Mangi Lall Sethia, Kamal Sethia, Kishore Sethia, Gaurav Sethia, Sanjeev Sethia, Sumit Sethia, Suman Sethia, Vasudha Sethia and Vinay Kumar Sethia are the promoters of the company.

IPO Details

IPO Subscription Opening Date | December 20, 2022 |

IPO Subscription Closing Date | December 22, 2022 |

Face Value | Rs 5 per share |

Price Band | Rs 234 to Rs 247 per share |

Lot Size | 60 shares |

Issue Size | Rs 475 crore |

Fresh Issue | Rs 175 crore |

Offer for Sale | Rs 300 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 60 | Rs 14,820 |

Retail (Maximum) | 13 | 780 | Rs 1,92,660 |

Small HNI (Minimum) | 14 | 840 | Rs 2,07,480 |

Large HNI (Minimum) | 68 | 4,080 | Rs 10,07,760 |

Allotment Details

Event Schedule | Date |

Allotment of Shares | December 27, 2022 |

Initiation of Refunds | December 28, 2022 |

Credit of Shares to Demat Account | December 29, 2022 |

Listing Date | December 30, 2022 |