Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.35% lower at 18,395.50, signalling that Dalal Street was headed for a negative start on Friday.

Asian shares were trading lower on Friday, after a sharp decline on Wall Street due to poor US retail sales data and worries over a global recession due to interest rate hikes by global central banks. The Nikkei 225 index dropped 1.58% and Topix fell 0.75%. Hang Seng inched up 0.06% and the CSI 300 index was down by 0.25%.

Indian rupee slipped 30 paise to 82.76 against the US dollar on Thursday.

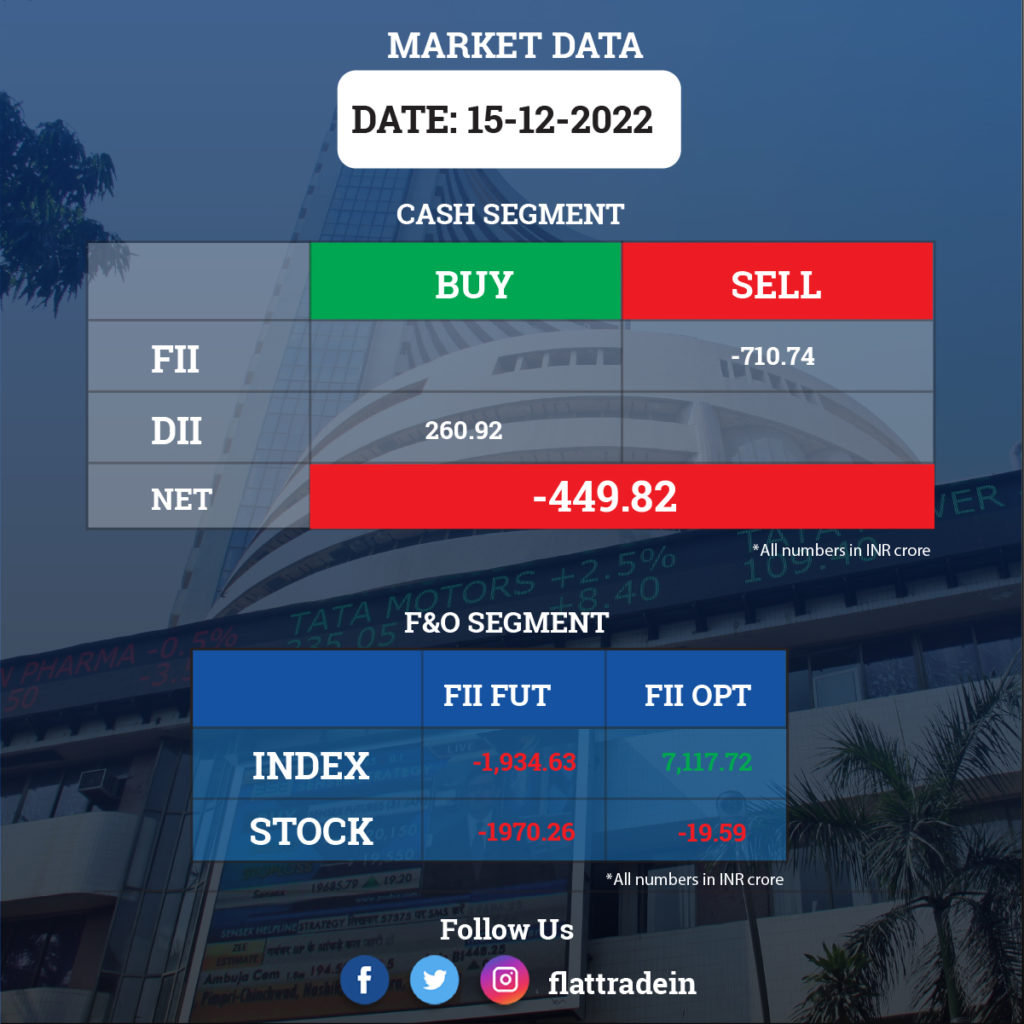

FII/DII Trading Data

Stocks in News Today

Reliance Retail: The company’s FMCG arm, Reliance Consumer Products, has launched its consumer packaged goods brand, Independence, in Gujarat. Its product portfolio, which includes staples, processed food, and other daily essentials, was introduced to consumers and kirana partners on the centenary celebration of Pramukh Swami Maharaj at Akshardham in Ahmedabad.

Wipro: The IT services company has announced a partnership with Finastra, a global provider of financial software applications and marketplaces, to drive digital transformation for corporate banks in the Middle East. This multi-year engagement, aligned with the region’s vision to rapidly digitize and bolster cross-border trade, will make Wipro the exclusive implementation and go-to-market partner to deploy Finastra’s trade finance solutions in the region.

Hinduja Group: The Maharashtra Government said that the group will be investing Rs 35,000 crore in the state. An official said the group has identified 11 sectors for investment including infrastructure, biotech, Electric Vehicles, manufacturing and health. The Chief Minister’s Office tweeted that an MoU was signed between the state government and Hinduja group in the presence of Chief Minister Eknath Shinde. G P Hinduja and Ashok Hinduja of the Hinduja group were present on the occasion.

Hindustan Petroleum Corporation Ltd (HPCL): The company will raise Rs 10,000 crore in debt from domestic or overseas market to fund its oil refining and fuel marketing operations, the company said. The company’s board approved a proposal for borrowing through further issuance of secured/unsecured redeemable non-convertible debentures/bonds/notes etc. up to Rs 10,000 crore on private placement basis in the domestic market and/or in the overseas market from the date of such approval.

IDBI Bank: The lender has moved the National Company Law Tribunal (NCLT) against Zee Entertainment Enterprises Ltd (ZEEL) seeking an insolvency proceeding against the media firm to recover dues of Rs 149.60 crore.”The bank’s purported claim arises under a Debt Service Reserve Agreement entered into by the bank and the company for the financial facility availed by Siti Networks Ltd,” it said. ZEEL is “vehemently disputing the bank’s claim in other proceedings filed by the bank against the company for recovery of its alleged dues,” it added further.

Biocon: The biotechnology major said it has initiated a clinical study in collaboration with Equillium Inc to evaluate efficacy of Itolizumab in patients with Ulcerative Colitis. Having obtained approval from the Drugs Controller General of India (DCGI), the study will cover several tertiary hospitals specialised in handling UC cases, it added.

Macrotech Developers (Lodha): The realty firm will invest Rs 330 crore to develop a premium warehousing project in Mumbai as part of its expansion plan and to tap rising demand from e-commerce and third-party logistic companies. Lodha Green Digital Infrastructure (LGDI) platform has acquired around 8 acres of land in Kurla, Mumbai. The land will be used for the development of about 4 lakhs square feet of Grade-A in-city fulfilment centre to provide the last mile warehousing infrastructure to 3PL, e-commerce and quick-commerce companies. The development is expected to be completed in the next 12-18 months in phases, it added.

Deepak Fertilisers: The company has announced the demerger of its mining chemicals & fertiliser businesses. The board members of Smartchem Technologies (STL), a subsidiary of Deepak Fertilisers, approved a corporate restructuring plan with the objective of unlocking growth potential of each of the businesses. They approved demerger of the TAN Business (mining chemicals) from STL to Deepak Mining Services (DMSPL) and amalgamation of Mahadhan Farm Technologies (MFTPL), with STL.

Kajaria Ceramics: The company has executed a joint venture agreement between subsidiary Kajaria International DMCC, UAE, and AL Rathath Marble Factory LLC, UAE. The joint venture will run the business of glazed vitrified tiles, sanitaryware/bathware products, marbles, granites, natural stones and allied products in UAE through a company namely Kajaria RMF Trading LLC, UAE, by way of 50:50 ratio.

Himatsingka Seide: The company said its board members have approved issuance of securities in one or more tranches, worth up to $13 million or Rs 108 crore, and issuance of non-convertible debentures up to Rs 500 crore, to identified investors.

HDFC Asset Management Company: Life Insurance Corporation of India has increased its stake in the asset management company by buying additional 2.03% stake via open market transactions. With this, LIC has increased its stake in HDFC AMC to 9.053% from 7.024%.

SJVN: The company’s subsidiary, SJVN Green Energy, has accomplished a major millstone of financial closure of its 1,000 MW solar power project under execution at Bikaner, Rajasthan. EPC contract of this project has been awarded to Tata Power Solar Systems, and total cost of the project is Rs 5,723.59 crore. The project is being financed at a debt equity ratio of 80:20.

Gammon India: The civil construction firm’s board has approved the extension of the tenure of the company’s Chief Executive Officer (CEO) Ajit Balubhai Desai till March 31, 2023. Earlier, Desai’s term as CEO was supposed to end on December 16.

Kesoram Industries: The company said it has raised Rs 90 crore by allotting ninety lakh non-convertible preference shares to a promoter shareholder. The fund will help ease the liquidity condition of the cement maker.

Petronet LNG: The company will set up a floating LNG receipt facility at Gopalpur port in Odisha at Rs 2,306 crore. The company has signed an agreement with Gopalpur Ports for the facility that will have a capacity of about 4 million tonnes per annum.

Max Healthcare Institute: The company’s board has approved providing funding of up to Rs 300 crore to its wholly-owned arm Max Hospitals and Allied Services to partly finance the cost of Phase-I expansion of bed capacity at Dr Balabhai Nanavati Hospital in Mumbai.

FSN E-Commerce Ventures (Nykaa): Kravis Investment Partners II offloaded 3.67 crore shares of e-commerce beauty company Nykaa in five tranches at a price of Rs 171 apiece for a Rs 629.06 crore through open market transactions, according to data on the BSE.