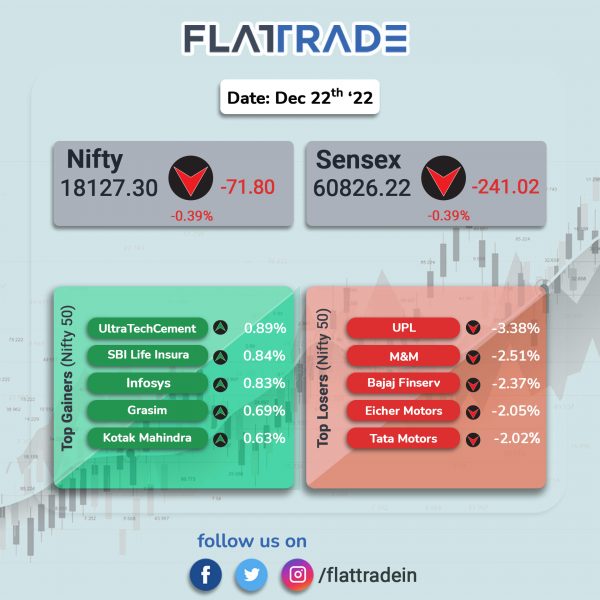

Major stock indices continued its downward trajectory and ended in the red as realty, public sector banks, metal, and auto stocks slumped. The Sensex and the Nifty 50 indices fell 0.39% each.

In broader markets, Nifty Midcap 100 dropped 0.875 and the BSE Smallcap tanked 1.83%.

Top losers among Nifty sectoral indices were Realty [-1.42%], PSU Bank [-1.23%], Metal [-1.13%], Auto [-1.11%] and Energy [-0.94%]. Nifty IT ended flat and all other indices closed in the red.

Indian rupee appreciated by 6 paise to 82.76 against the US dollar on Thursday.

Stock in News Today

Reliance Jio: Indian Oil Corporation has selected Reliance Jio’s managed network services to connect about 20% of its petrol pump network. Jio will connect 7,200 IOC retail outlets with SD-WAN managed service solution, zero-touch provisioning and 24×7 real-time monitoring for a period of 5 years.

In other news, Reliance Projects and Property Management Services, a subsidiary of Jio, has deposited Rs 3,720 crore in an SBI escrow account to acquire mobile tower and fibre assets of Reliance Infratel. The National Company Law Tribunal (NCLT) gave approval to Jio for the acquisition of Reliance Infratel (RITL) in November.

Maruti Suzuki India (MSI): The country’s largest car maker has signed an agreement with Kamarajar Port, Ennore, to export about 20,000 cars annually to global markets. Kamarajar Port will be used for exports to Africa, Middle East, Latin America, ASEAN, Oceania and SAARC regions by Maruti Suzuki. The agreement is for five years, starting December 2022. Other ports used by Maruti Suzuki for export are Mumbai, Mundra and Pipavav.

Tata Communications: The company will acquire a 100% stake in US-based Switch Enterprises for $58.8 million (approx. Rs 486.3 crore). Switch provides services for live production and video transmission. The deal is expected to be to be completed in the next 4-6 months. The acquisition will provide direct upsell opportunity for Tata Communications’ offerings, which will drive incremental expansion of Tata Communications’ video connect business as well as expand their leading presence in the media ecosystems in Europe and North America.

LTIMindtree: The IT services company will modernise operations across Yorkshire Water’s clean water, wastewater, and asset management businesses, as their strategic transformation partner. The company will help migrate core business systems to SAP S/4HANA platform covering a wide range of areas such as work and asset management, complex scheduling, materials management, inventory management, health, and safety. The IT company said that this will enable Yorkshire Water to boost operational efficiencies, augment capabilities, and enhance user experience.

Zydus Lifesciences: The company has received the final approval and 180 days shared exclusivity from the USFDA for Selexipag tablets. The tablets had an annual sales of $577 million (approx. Rs 4,772 crore) in the US, according to the latest IQVIA data. Selexipag tablet is indicated in adults for the treatment of pulmonary arterial hypertension. The drug will be manufactured in the group’s formulation manufacturing facility at Ahmedabad SEZ.

Union Bank of India: The sate-owned lender has considered issuing Basel III Compliant AT-1 Bonds of Rs 200 crore and green shoe option to retain over subscription up to Rs 580 crore with aggregating to Rs 780 crore on private placement basis.Debentures are issued with coupon rate of 8.40% per annum, payment of Interest will be annually and face value is Rs 1 crore per bond. Debt securities will be listed on National Stock Exchange and date of allotment will be 23 December 2022.

JK Cements: The company will acquire Acro Paints for Rs 152 crore via its subsidiary JK Paints. JK Paints will acquire 60% equity shares of Acro Paints and remaining 40% shall be acquired over a period of 12 months, as per the agreement. The deal provides JK Cements an entry into the growing vertical of construction chemicals.

Jindal Drilling and Industries: The company received order from Oil and Natural Gas Corporation for deployment of Jack-up Rig “Virtue-I” on charter hire contract for a period of three years at EDR of $77,963.78 (approx. Rs 64 lakh).

Strides Pharma Science: The company’ subsidiary, Strides Pharma Global, has received AUD 94 million (approx. Rs 524.74 crore) as the deferred consideration for the sale of Australian operations in 2019. The proceeds will be utilized for deleveraging the balance sheet, the company said in an exchange filing.

INOX Leisure: The theatre operator has commenced the commercial operations of two multiplex cinema theatres taken on lease basis with effect from December 21. The company will open INOX Leisure at Rajouri Garden Metro Station, New Delhi, having 5 screens and 216 seats and Laila Mall, M. G. Road, Vijayawada, having 3 screens and 959 seats. With this, INOX Leisure is now present in 74 cities with 169 Multiplexes, 720 screens and a total seating capacity of 1,59,747 seats across India.

Talbros Automotive Components: The company through its joint venture Talbros Marugo Rubber has received a new multi-year order worth Rs 150 crore for Rubber Hoses. These rubber hoses will be directly used to facilitate the E20 fuel mechanism from multiple passenger vehicle (PV) OEMs in India. This order is to be executed over a period of next 5 years. With this order, the company has added orders worth over Rs 1,000 crore during the current financial year across its business divisions, product segments and JVs.

Sula Vineyards: The wine maker made a tepid stock market debut. On the NSE, the stock got listed at Rs 361 against an issue price of Rs 357. The shares touched a low of Rs 328.3 and a high of Rs 363.30. The shares closed at 331.20 per share.