Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.6% higher at 18,360, hinting at a positive start for Indian markets on Thursday.

Asian stocks rose, tracking gains in Wall Street after data showed strong US consumer confidence and robust earnings from Nike and FedEx. The Nikkei 225 index gained 0.40%, Topix advanced 0.55%. The Hang Seng climbed 2.78% and the CSI 300 index was up 0.83%.

Indian rupee fell 6 paise to 82.81 against the US dollar on Wednesday.

Wine maker Sula Vineyards will make its stock market debut on December 22. The issue price has been fixed at Rs 357 per share.

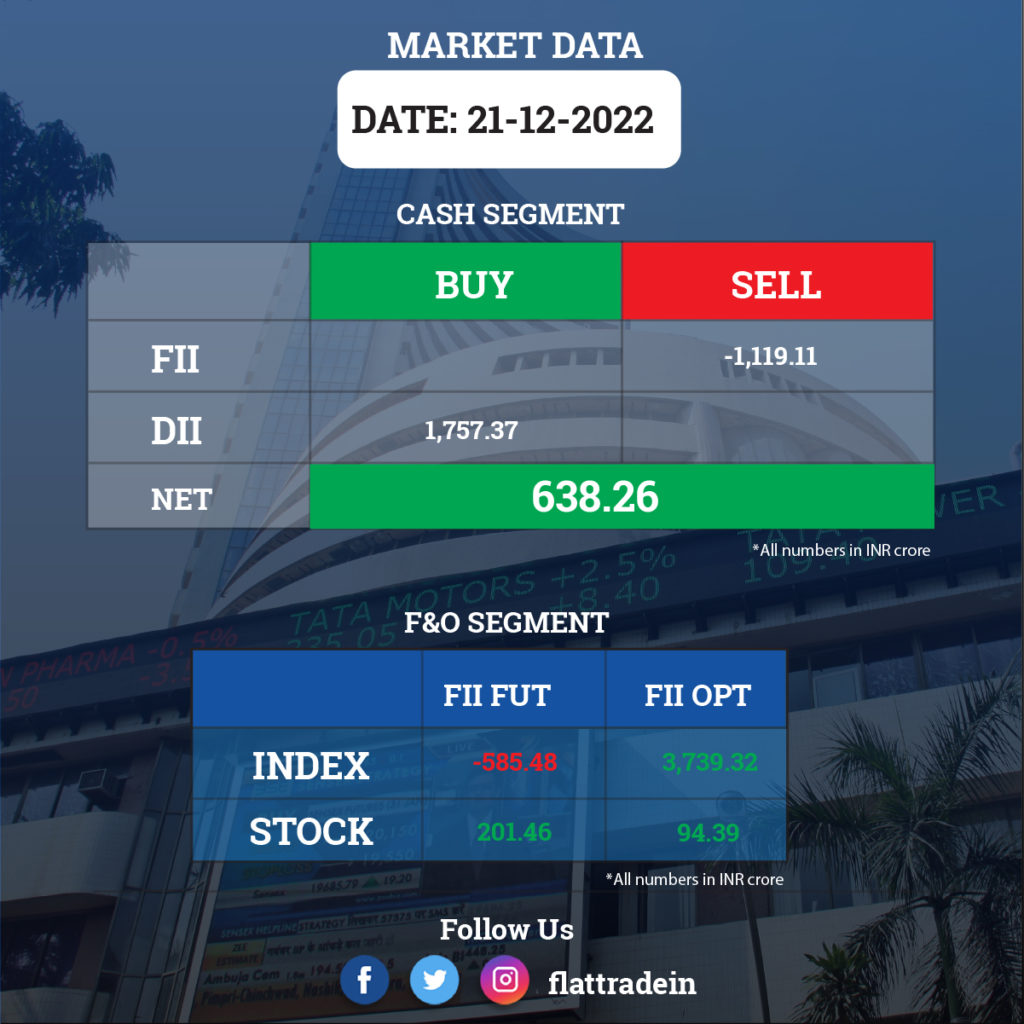

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The company’s retail arm, Reliance Retail, has inked a definitive agreement to acquire 100% stake in METRO Cash & Carry India for Rs 2,850 crore. This acquisition will add multi-category large format stores to Reliance Retail’s store footprint across India and further strengthen its new commerce business, the company said in a release.

Bandhan Bank: The private sector lender has received binding bid of Rs 801 crore from asset reconstruction company, on security receipt consideration basis, for its written-off portfolio with outstanding of Rs 8,897 crore. The bank said it would go for bidding as per Swiss challenge method. The bank had earlier received approval of the board members for transfer of group loan and SBAL written-off portfolio to asset reconstruction company.

Adani Enterprises: Adani Solar, the photovoltaic manufacturing and research arm of the Adani Group, has launched large sized monocrystalline silicon ingot, at its Mundra facility. The monocrystalline ingots will drive indigenization to produce renewable electricity from silicon based PV modules with efficiencies ranging from 21% to 24%.

Bharat Forge: The company has commenced supply of forgings utilizing green steel, manufactured and supplied by Saarloha Advanced Materials, a part of the Kalyani Group. This is in line with company’s commitment to reduce the carbon footprint.

Adani Power: The Adani Group’s utility firm said it has received a B score for climate change transparency from CDP (Carbon Disclosure Project) for 2022. This is higher than the global and Asia regional average of C, and same as the thermal power generation average of B.

Max Financial Services: Max Ventures Investment Holdings has sold 58.85 lakh shares (1.7% stake) in the company via open market transactions at an average price of Rs 679.2 per share. The stake sale was worth Rs 400 crore.

Apex Frozen Foods: The company has received board approval for appointment of Karuturi Neelima Devi as Whole Time Director, and Karuturi Subrahmanya Chowdary, Managing Director, as Chief Financial Officer with immediate effect. Karuturi Neelima Devi is designated as Director (Admin) with effect from January 1, 2023.

Axiscades Technologies: The company has received board approval for allotment of 450 non-convertible debentures (NCDs) of face value of Rs 10 lakh each on private placement basis. The company will receive Rs 45 crore after allotment of these NCDs.

Starlog Enterprises: The company’s subsidiary, Starport Logistics, has completed sale of 29.6% stake in its subsidiary India Ports & Logistics, for Rs 16.5 crore. Bollore Logistics India is the buyer for the said stake. With this, the shareholding of Starport Logistics in India Ports & Logistics is nil and India Ports & Logistics has ceased to be an associate of Starport Logistics.

Reliance Capital: Torrent Group emerged as the highest bidder for debt-ridden Reliance Capital in the auction conducted as part of its resolution process, which submitted a bid of Rs 8,640 crore for acquiring the NBFC firm set up by the Anil Ambani Group. Hinduja Group was the second highest bidder.

Schneider Electric Infrastructure: The company has signed an agreement with Nettur Technical Training Foundation (NTTF). The MoU with NTTF is to maximise the impact of training and skilling initiative among the youth of the country.

Uno Minda: The auto components maker said it has entered into a technical license agreement with South Korea’s Asentec Co for design, development, manufacturing and marketing of wheel speed sensors in India. The agreement with Asentec will strengthen the company’s advanced automotive sensors product portfolio.

GR Infraprojects: Infrastructure investment trust India Grid Trust and GR Infraprojects have joined hands to bid for identified power transmission projects worth Rs 5,000 crore. India Grid Trust (IndiGrid) and GR Infra have announced a strategic partnership in the Indian power transmission sector.

JMC Projects (India): The National Company Law Tribunal has sanctioned the Scheme of Amalgamation of the company with Kalpataru Power Transmission.

Speciality Restaurants: The company has received board approval for issue of 60 lakh warrants convertible into equity shares on preferential basis, at a price of Rs 212.05 per warrant. An amount equivalent to 25% of the warrant issue price (i.e. Rs 53.02 per warrant) will be payable at the time of subscription and allotment of each warrant, and the balance 75% of the warrant issue price (Rs 159.03 per warrant) will be payable on the exercise of warrants on or before April 30, 2023.

JB Chemicals & Pharmaceuticals: The company has completed acquisition of Razel franchise from Glenmark Pharmaceuticals for Rs 313.7 crore. Razel is Glenmark’s cardiac brand.

Supriya Lifescience: The company has signed an agreement with Pune-based Enrich Energy to develop 4.68 MWp DC solar photovoltaic power project at Nanded in Maharashtra. This project will generate & supply green energy to fulfill about 50 percent present consumption of the company & reduce carbon emission equivalent to 6,830 tons per annum.

Lyka Labs: The company has signed an agreement to acquire animal healthcare business from Agilis Healthcare. In November, it had proposed acquisition of animal healthcare business.

Kwality Pharmaceuticals: The company has received approval from Brazil’s National Health Surveillance Agency ANVISA (Agencia Nacional de Vigilancia Sanitaria) for its injectable formulations manufacturing unit at Amritsar and oncology injectable unit at Himachal Pradesh. The approval allows company to market its products in Brazilian pharmaceutical market.