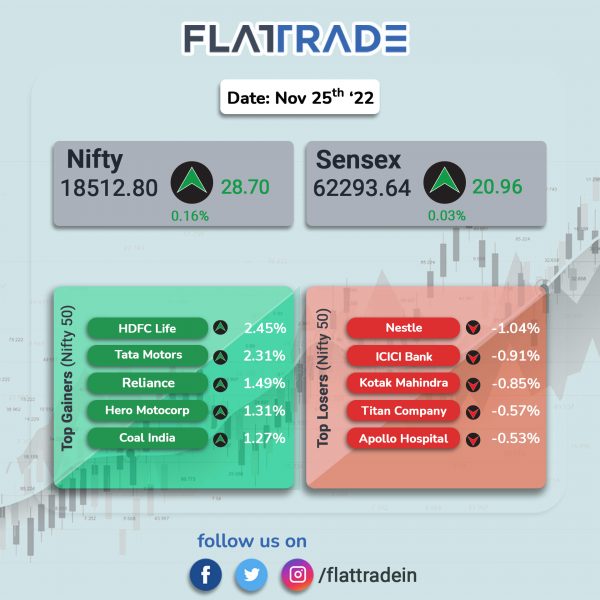

Benchmark indices closed with minor gains as auto and realty stocks advanced. The Sensex inched up 0.03% and the Nifty 50 index rose 0.15%.

In broader markets, Nifty Midcap 100 index jumped 0.95% and the BSE Smallcap gained 0.69%.

Top gainers among Nifty sectoral indices were Media [2.52%], Realty [1.17%], Auto [0.88%], Oil & Gas [0.83%] and Pharma [0.62%]. Top losers were FMCG [0.31%], Financial Services [-0.31%] and Bank [-0.21%].

Indian rupee fell 6 paise to 81.69 against the US dollar on Friday.

Stock in News Today

Adani Enterprises: The company plans to raise Rs 20,000 crore via a public offering of fresh equity shares. The company’s board has approved the proposal to raise the funds and will seek shareholder approval through postal ballot.

In other news, Gautam Adani is planning to invest more than $4 billion in a petrochemical complex in the state of Gujarat, he said in an interview with the Financial Times (FT) on Friday. Adani also said that he wanted to build a global news brand. In the interview with the FT, Adani said that India does not have a “single [outlet]” to compare with big international media houses.

Further, Adani plans to launch a “super app” in the next three to six months to connect Adani airport passengers with other Adani Group services.

Coal India, Hindustan Zinc and Rashtriya Chemicals and Fertilizers: The Indian government is planning to sell small stakes of 5-10% in the state-run firms, to ride a stock market boom and boost revenue in the final quarter of the current fiscal, Bloomberg reported citing people familiar with the matter. The sources said five firms could be chosen, including a listed entity under the railway ministry, the report added.

VA Tech Wabag: The company’s board has approved a proposal to raise up to Rs 200 crore from Asian Development Bank via issuance of non-convertible debentures. The board also appreciated the management’s efforts towards debt optimization and mentioned that the proposed NCD will further contribute to the same, according to its regulatory filing.

HDFC Bank: The private sector lender has appointed Bhavesh Zaveri as executive director and redesignated Kaizad Bharucha as deputy managing director for a period of three years.

Castrol India: The company signed a deal to acquire 7.09% stake in Ki Mobility Solutions for Rs 497.50 crore. The deal is said to be Castrol’s largest all-cash deal till date, according to its regulatory filing. The acquisition will take place in two tranches and will be completed by January 2023. With this deal, Castrol aims to expand its presence in the after sales service and maintenance segment. 4%.

Union Bank of India (UBI): The lender has revised the interest rates on fixed deposits under Rs 2 crore. The new rates are effective from today (November 25, 2022), according to the bank’s official website. The bank is now giving a maximum interest rate of 7.3% on deposits having maturities of 800 days and 3 years.

IDFC: Shares of the company rose over 4% in intraday trade after company announced scheme of amalgamation of IDFC Alternatives, IDFC Trustee Company and IDFC Projects into IDFC Ltd.

Engineers India: Shares of the company rose 3.4% after it bagged new order from Mangalore Refinery & Petrochemicals. The order pertains to preparation of basic design and engineering package, detailed feasibility reports and pre-project activities for Mangalore Refinery’s Bio-ATF plant.

Allcargo Logistics: The company’s owned subsidiary, Allcargo Belgium NV, has entered into a share purchase agreement with NBG Logistik Beteiligungs und Beratungsges mbH to acquire 75% stake in Fair Trade GmbH Schiffahrt, Handel und Logistik for €12 million (Rs 101.9 crore).

Tata Steel Long Products: The company has acquired additional 4.69 crore shares of subsidiary Neelachal Ispat Nigam at a premium of Rs 54 apiece totalling Rs 300 crore, according to its regulatory filing.

KIOCL: Shares of the company rose 8.3% in intraday trade from Thursday’s close after the company announced the resumption of operations at its pellet plant unit in Mangalore. The operations were stopped in August 2022 due to lack of demand in domestic market and unviability in international market in view of levy of duty on export of pellets by Indian government.

Man Infraconstruction: The realty company is launching a prestigious premium residential project, Aaradhya Parkwood, in Mumbai. The project is located near Dahisar check Naka, next to Singapore International School. The project is spread over 2.5 acres of land, having approximately 5.3 lakh square feet of carpet area for sale which has the potential to generate revenue to the tune of approximately Rs 850 crore.