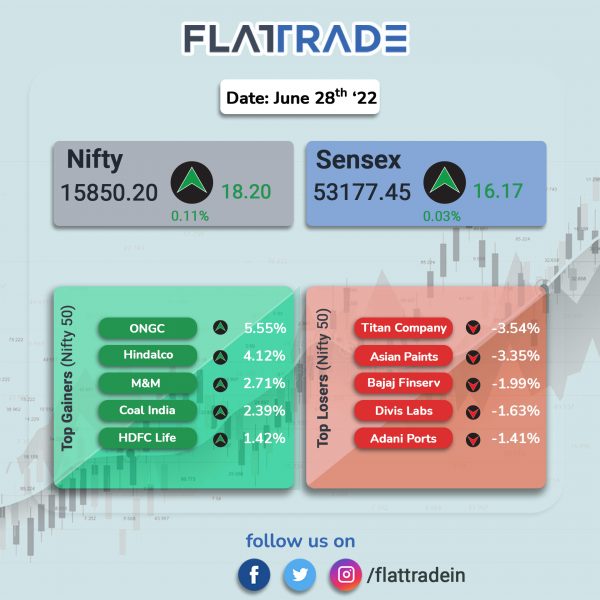

Benchmark stock indices erased intraday losses and rebounded, helped by gains in energy, metal and auto stocks amid rise in crude oil prices. The Nifty 50 index rose 0.11% and the Sensex inched up 0.03%.

The broader markets outperformed benchmark indices. The Nifty Midcap 100 index rose 0.29% and and the BSE Smallcap advanced 0.24%.

Top Nifty sectoral gainers were Metal [1.67%], Auto [1.31%], Energy [0.99%], Realty [0.67%] and IT [0.58%]. Top losers were Private Bank [-0.73%], Financial Services [-0.59%] and Nifty Bank [-0.5%].

Indian rupee lost 43 paise to 78.77 against the US dollar on Tuesday.

Stock in News Today

Tata Motors: The auto major has announced that it will hike prices of its commercial vehicle range. The increase in price shall range between 1.5% and 2.5% and it will come into effect from July 1 across the range, depending upon individual model and variant. The company said the steep rise in overall input costs makes it imperative to pass on a residual proportion via a minimised price hike.

Infosys: The IT services company announced it has been selected by Australian express logistics business, Global Express, to separate the technology landscape post divestment from Toll Holdings. Infosys will leverage the blueprints and tools from Infosys Cobalt, a set of services, solutions and platforms for enterprises to accelerate their cloud journey.

JSW Steel: Moody’s Investors Service has upgraded the Company’s Corporate Family Rating (CFR) to Ba1 (Stable) from Ba2 (Positive). The rating agency has upgraded the company’s senior unsecured notes rating and guaranteed backed senior unsecured notes/ revenue bonds to Ba1 (Stable) from Ba2 (Positive). Shares of the company closed 1.2% higher.

Glenmark Pharmaceuticals: The Mumbai-based company in an exchange filing said that it has acquired the generic versions of a few over-the-counter drugs from Wockhardt Ltd in the US for an undisclosed sum. The move is expected to strengthen Glenmark’s OTC product portfolio and offerings in the US.

Indiabulls Real Estate: Shares of the company 2.06% after the National Anti-profiteering Authority (NAA) found Indiabulls Real Estate guilty of not passing over Rs 6.46 crore input tax credit benefits to homebuyers by reducing prices post rollout of GST. The amount should be refunded by Indiabulls Real Estate along with interest of 18% within three months, according to NAA order.

Hindustan Aeronautics: The state-owned company has recommended a final dividend of Rs 10 per equity share for FY22. The dividend payment is subject to approval of members of company at the upcoming AGM. The dividend will be paid to the shareholders within 30 days of declaration.

Paint Companies: Shares of paint companies like Asian Paints, Indigo, Berger Paints fell over 2% as crude oil prices rose. Brent Crude was hovering around $117.31 per barrel and WTI Crude was at $111.34 a barrel.

Medplus: Shares of the company rose over 7% in intraday trading after brokerage firm Edelweiss Capital initiated coverage of the stock with ‘buy’ ratinf and a target price of Rs 905 apiece.

Ruchi Soya Industries Limited: The name of the company stands changed to Patanjali Foods Limited with effect from June 24. The firm has also received the certificate of incorporation from the Ministry of Corporate Affairs, it said in an exchange filing.