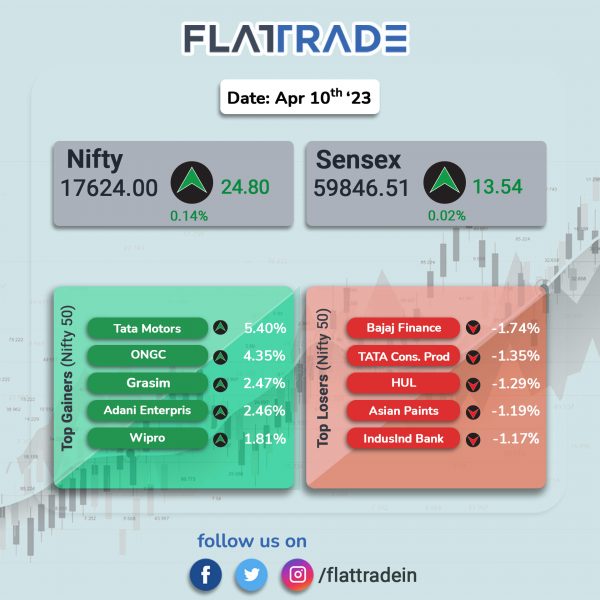

Benchmark indices pared gains in the fag end of the trading session, weighed by losses in financials and FMCG stocks. The Sensex inched up 0.02% and the Nifty rose 0.14%.

In broader markets, the Nifty Midcap 100 index rose 0.38% and the BSE Smallcap index edged up 0.16%.

Top gainers were Realty [4.29%], Auto [1.18%], Energy [1.07%], IT [0.96%], Oil & Gas [0.77%], and Metal [0.76%]. Top losers were PSU Bank [-0.63%], Private Bank [-0.51%], Bank [-05%], FMCG [-0.43%], and Financial Services [-0.39%].

Indian rupee fell 9 paise to 81.98 against the US dollar on Monday.

Stock in News Today

Larsen & Toubro (L&T): The company said that its hydrocarbon business, L&T Energy Hydrocarbon (LTEH), has secured a significant order under its AdVENT (Advanced Value Engineering and Technology) business vertical. As per L&T classification, the value of the significant project is Rs 1,000 crore to Rs 2,500 crore. The EPC company said that the order is for license plus engineering, procurement and construction (L-EPC) of a technical ammonium nitrate (TAN) plant along with weak nitric acid (WNA) plant at Gadepan, Kota, Rajasthan from Chambal Fertilisers and Chemicals.

Tata Power: The company said that Asian Development Bank (ADB) has entered into an agreement with its distribution arm Tata Power Delhi Distribution (TPDDL) for subscribing to non-convertible debentures for Rs 150 crore. With this agreement, the two parties plan to enhance Delhi’s power distribution through grid enhancements. ADB has also awarded TPDDL with a grant of $2 million to partially finance the purchase and integration of a pilot battery energy storage system (BESS).

Sona BLW Precision Forgings (Sona Comstar): The company announced that the board has approved an investment of Rs 52.9 crore for capacity expansion of new Pune plant to 20.1 million gears from 11.8 million gears by financial year 2025. The company stated that it has shifted its operations from its existing Pune plant, Bhosari industrial area, to a new bigger facility at Chakan Industrial Area, Wasuli, Pune, Maharashtra. The new plant is capable of manufacturing gears for EV and non-EV applications and serves customers globally.

GAIL India: The company’s city gas arm lashed prices with effect from 9 April 2023, following the Indian government’s recent change in the pricing formula of natural gas to put a check on soaring prices of cooking gas. GAIL Gas has reduced domestic PNG prices by Rs 7 per standard cubic meter (SCM) in Bengaluru and Dakshin Kannada and Rs 6 per SCM in all its other Geographical areas (GAs). Similarly, CNG prices are also reduced by Rs 7 per kg in Karnataka GAs and Sonipat and Rs 6 per kg in rest of the GAs. It operates in 16 geographical areas across the country.

Oil and Natural Gas Corporation (ONGC): The company’s board announced that its board has approved the acquisition of 23.04% stake in Mangalore SEZ (MSEZ) from IL&FS for cash consideration of Rs 40.32 crore. The acquisition will be completed within one year and the shareholding of ONGC shall increase to 49% from 26% in MSEZ, post the acquisition. Meanwhile, the firm’s board has appointed Sushma Rawat as director of the company with effect from 8 April 2023.

Bajaj Finserv: The financial services company said that Bajaj Allianz Life Insurance Company’s total premiums aggregated to Rs 1,676.15 crore for the month of March 2023, up 0.24% YoY. Total premiums in the same period last year were Rs 1,672.18 crore. For the period from April 2022 to March 2023, Bajaj Allianz’s total premiums were Rs 10,736.98 crore, up by 17.53% from Rs 9,135.82 recorded in the same period last year.

Adani Power: The power utility company announced that the Unit 1 of 800 megawatt (MW) capacity of the 2×800 MW ultra-supercritical power project of Adani Power (Jharkhand) (APJL), situated in Godda district in Jharkhand, has commenced commercial operations. The company said that its Unit 2 of 800 MW is in an advanced stage of completion and is expected to be commissioned soon.

Thomas Cook (India): The company and its wholly-owned SOTC Travel announced the signing of exclusive long-term agreement with Mandai Wildlife Group to target the high growth India market. Under the MoU, Mandai Wildlife Group and the two companies will partner to maximize on India’s rapid recovery-growth post pandemic and drive visitations to Mandai Wildlife Reserve, the integrated nature and wildlife destination in northern Singapore, home to the Night Safari, River Wonders and Singapore Zoo.

Force Motors: The company registered 1.5% rise in domestic sales to 2,428 units in March 2023 from 2,392 units sold in March 2022. As compared with February 2023, the domestic sales rose 8.59% last month. Export sales aggregated to 106 units in March 2023, down 64.43% YoY from 298 units and 52.4% MoM from 221 units. The company’s production in March 2023 was 2,421 units, up by 32.3% from 1,830 units produced in March 2022.

Anup Engineering: The company said that Nilesh Hirapara will replace Bhavesh Shah as the chief financial officer (CFO) of the company with effect from 10 April 2023. Bhavesh Shah has decided to step down as CFO to pursue another role within the Arvind Group.

Kalyani Steels: The company has commissioned coke making facility and partially commissioned waste heat recovery (WHR) based captive power plant, adjacent to its steel plant situated at Ginigera, Koppal, Karnataka. The company has commissioned the coke oven plant with all its auxiliaries and utility systems and started its commercial production from 31 March 2023.

Shakti Pumps (India): The company announced that it has received a patent for inventing ‘switching circuit to start single phase-induction motor’ from the Intellectual Property India, a Ministry of Commerce & Industry Organisation. With the help of this invention, one can avoid complications and save additional costs of conductors in the riser cable. This invention also eliminates the issues of voltage drop in riser cables and increases the precision in switching, as compared to the panel and capacitor. The patent will hold a validity of 20 years from the date of filing of the patent. The company has received 3 patents till date and have filled 26 more patents in India and abroad.

Thyrocare Tech: The healthcare service provider announced that its board has declared an interim dividend of Rs 18 per share for the financial year 2022-23. The board of directors of the company has fixed, Thursday, 20 April 2023 as the record date for the purpose of determining the entitlement of shareholders for the interim dividend.

Godrej Properties (GPL): The real estate developer’s sales volumes for the quarter grew by 19% QoQ in terms of area to 5.25 million square feet from 4.42 million square feet. The company’s sales volumes for the full financial year grew by 40% in area terms from 10.84 million sq. ft. to 15.21 million sq. ft. GPL’s cash collections for FY23 grew 41% to Rs 8,991 crore. Q4FY23 collections stood at Rs 3,822 crore representing QoQ growth of 127% and YoY growth of 52%. GPL reported highest ever quarterly and annual project deliveries. Its delivered projects aggregating over 10 million sq. ft. across 5 cities in FY23 including 7.6 million sq. ft. in Q4.

Engineers India: The company said that ADNOC Offshore, Abu Dhabi, UAE, has awarded the company a contract for minor engineering works for offshore facilities. The value of the said contract is Rs 31.50 crore and the time period for the cntract is 10 months.

Sobha: The company said that its total sales value in Q4FY23 was Rs 1,463.4 crore, up 26% as compared with Rs 1,164.2 crore recorded in the corresponding quarter last fiscal. The real estate developer said that the sales volume in Q4FY23 stood at 1.48 million square feet up by 10% from 1.34 million square feet recorded in Q4FY22. Average price realization increased by 14% to Rs 9,898 per square feet in Q4 FY23 from Rs 8,709 per square feet in Q4 FY22.

Anant Raj: The company said that its wholly owned subsidiary, Anant Raj Cloud, has formed an alliance with Telecommunication Consultants India (TCIL) for data centres. The company has plans to develop data centres of 300 MW of IT load at Manesar, Rai and Panchkula.

IIFL Finance: The company said that it has received $100 million long term funding, jointly from Export Development Canada (EDC) and Deutsche Bank. The NBFC secured $50 million from EDC and $50 million from Deutsche Bank, respectively. The deal was structured under the aegis of Deutsche Bank as mandated lead arranger, book runner and co-financier.

PNC Infratech: The company announced that it has received letter of acceptance (LoA) from Haryana Rail lnfrastructure Development Corporation for engineering, procurement and construction (EPC) contract worth Rs 771.46 crore. The order comprises designing and construction of civil works and its connectivity to lndian Railways network from New Patli to Patli Station & New Patli to Sultanpur Station including modifications/ civil works at Sultanpur Station in connection with laying of new BG double railway line of HORC project, in Haryana. The project is expected to be executed in 30 months.

Alkem Laboratories: The company said that the USFDA had conducted a good manufacturing practices (GMP) and pre-approval inspection at the company’s API manufacturing facility located at Ankleshwar, Gujarat. At the end of the inspection, no ‘Form 483’ was issued.

Coffee Day Enterprises (CDEL): The company said that the total financial indebtedness of listed entity including short term and long term aggregated to Rs 461.06 crore. Of this, the company is in default of Rs 436.06 crore in the quarter ended 31 March 2023. According to the company’s exchange filing, loans or revolving facilities like cash credit from banks or financial institutions amounted to Rs 220.65 crore.

Metro Brands: Care Edge Ratings said that the ratings assigned to the bank facilities of Metro Brands (MBL) continue to derive strength from the vast experience of its promoters and the long track record of the company in the footwear business. In addition, the established market position of the company with a wide distribution network across India, has led to stable operational performance on a sustained basis, as well as comfortable financial risk profile characterised by strong liquidity position and low overall gearing. The rating agency also factored in the improvement in the operating performance of the company in FY22 & 9MFY23 on the back of improved demand from all segments, after recovering from adverse market conditions in the last two fiscals on account of covid.

Ashoka Buildcon: The company announced that it has received letters of award (LoA) from Maharashtra State Electricity Distribution Company (MSEDCL) for development of distribution infrastructure at the seven circles in Maharashtra. The contract value of all the seven circles is Rs 2,285.02 crore.

Ethos: The luxury watch retailer said its gross revenue grew by 30.8% to Rs 242 crore in Q4FY23 as against Rs 185 crore in Q4FY22. Ethos said its gross revenue grew by 36.6% YoY to Rs 918 crore in FY23 as against Rs 672 crore in FY22. The company said it ventured into two new cities in Q4FY23 i.e., Bhopal and Siliguri. With this the number of cities now increased to 20. The company has opened 4 stores during the quarter and total number of stores are now 54. The company continues to show highest ever growth in FY23 on the back of robust demand and focused marketing initiatives. The firm reported strong revenue growth across offline and online channels.