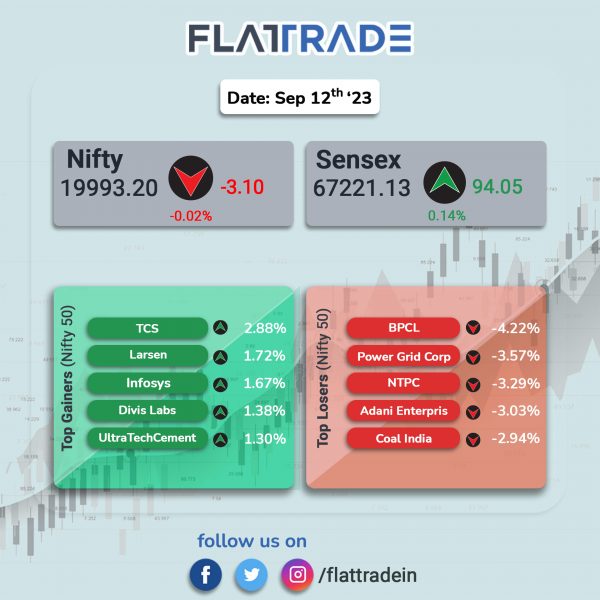

Sensex rose marginally higher, while Nifty 50 ended nearly flat as investors were concerned over high valuation and also awaited key economic indicators due today. The Sensex rose 0.14% and the Nifty 50 index slipped 0.02%.

In broader markets, the Nifty Midcap 100 tumbled 3.07% and the BSE Smallcap tanked 4.02%.

Top losers were Realty [-3.24%], Oil & Gas [-2.82%], Metal [-2.67%], PSU Bank [-2.38%], and Auto [-1.86%]. Top gainers were IT [1.03%] and Pharma [0.12%].

The Indian rupee slumped 11 paise to close at 82.92 against the US dollar.

Stock in News Today

Hindalco Industries: The aluminium manufacturer announced that the company has signed a technology partnership with Italy-based Metra SpA which is known for its expertise in producing structured and value-added aluminium extrusions. The partnership aims to enable the production of large-size aluminium extrusion and fabrication technology for building high-speed aluminium rail coaches in India.

Meanwhile, its subsidiary, Novelis Inc, has entered into a long-term agreement to supply aluminum beverage can sheet to Ball Corporation in North America. With this contract, Novelis has secured all of the beverage can capacity from its new plant in Bay Minette, Ala., underscoring the strong demand for the company’s high-recycled-content beverage can sheet.

Coal India: The state-run coal major announced that it has planned a capital investment of around Rs 24,750 crore in the next few years on 61 First Mile Connectivity (FMC) projects. The FMC projects will come up in three phases and the projects will have a capacity of 763.5 million tonnes per annum (MTPA) when completed, said the company.

Life Insurance Corporation of India (LIC): The insurer said it has decreased its stake in Dr Reddy’s Laboratories from 9.681% to 7.628%. The company sold 34,24,110 shares, or 2.053% equity, at an average cost of Rs 5,705.43 via open market sale during the period from March 10, 2023, to September 11, 2023.

TVS Holdings: The company announced that it has appointed Sudarshan Venu as managing director (MD) of the company effective from 11 September 2023 for a period of five years. Venu is the MD of TVS Motor Company and chairman of TVS Credit Services, the non-banking finance arm of the group.

Borosil Renewables: The glass manufacturer said that it has received an Income Tax demand notice along with an assessment order for the assessment year 2016-17 from the Income Tax Department for a demand of Rs 19.52 crore. Borosil Renewables said, “After examining the order and based on the advice from tax / legal experts, the company has filed Writ Petition before the High Court of Judicature at Bombay, seeking to quash, cancel and set aside the said Income Tax notice and Assessment Order issued against the company and to grant stay of any further proceeding consequent to the said notice and order.”

CEAT: The company said that India Ratings and Research (Ind-Ra) has affirmed the company’s long-term issuer rating at ‘IND AA’ with a ‘stable’ outlook. The rating agency said the ratings were attributed to substantial expansion in the scale of operations, along with a leadership position in two or more segments, leading to a significant improvement in the operating margins and a large positive FCF, on a sustained basis.

Ajmera Realty: The company said that it will undertake the redevelopment project at Yogi Nagar, Borivali West, Mumbai. Four societies of this township are set to undergo redevelopment. The project is estimated to generate sales of Rs 330 crore and will primarily consist of residential apartments of 2 & 3 BHK flats, with an estimated carpet area of 1,07,000 Sq.ft. This project is scheduled for launch in the first half of the calendar year 2024, with an estimated completion duration of three and a half years.

PCBL: The company announced the commencement of commercial production for final phase 84,000 MTPA MT of 147,000 MT Greenfield carbon black manufacturing facility in Tamil Nadu has been successfully commissioned on September 12.

Shalimar Paints: The paints maker announced that Davinder Dogra has tendered his resignation from the post of chief financial officer (CFO) and key managerial personnel of the company, due to personal reasons. “He will be relieved from his duties effective close of business hours of September 30, 2023,” the company said in a regulatory filing.

Uno Minda: The company said that its board has approved the acquisition of remaining 3.81% stake in Uno Minda Europe. The company plans to acquire remaining stake at a consideration of 1.3 million euro. Uno Minda Europe is a step-down subsidiary of the company.

SpiceJet: The company paid Kal Airways and its promoter Kalanithi Maran Rs 100 crore out of an order of Rs 380 crore for an arbitral award, the airline said in a statement on Tuesday. Earlier, the Delhi High Court on Monday instructed the low-cost airline to complete the payment.