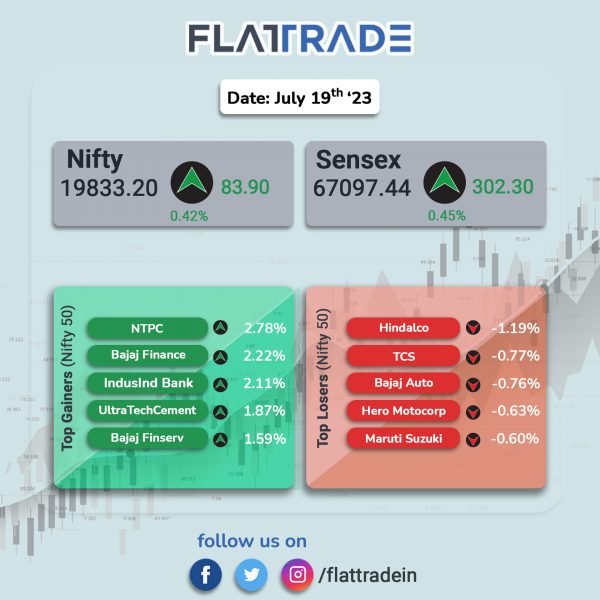

Dalal Street ended higher on Wednesday on rising risk appetite among investors and robust macroeconomic outlook. The Sensex jumped 0.45% and the Nifty 50 index rose 0.42%.

In broader markets, the Nifty Midcap 100 index gained 0.68% and the Nifty Smallcap 250 index advanced 0.73%.

Top gainers among Nifty sectoral indices were PSU Bank [1.95%], Media [1.13%], Consumer Durables [0.97%], Energy [0.81%], and Oil & Gas [0.66%]. Nifty IT fell 0.06% and the Auto index ended flat.

Indian rupee depreciated by 6 paise to close at Rs 82.10 against the U.S dollar on Wednesday.

Stock in News Today

Tata Motors: Shares of the company rose 1.4% after Tata Sons said that it will build a 40GW battery cell gigafactory in the United Kingdom. The investment of over £4 billion (Rs 42,480.9 crore) will be utilised to deliver electric mobility and renewable energy storage solutions for customers in the UK and Europe. JLR and Tata Motors will be the primary customers, with supplies commencing from 2026, as per the company’s press release.

Tata Consultancy Services (TCS): The IT services behemoth has expanded its long-standing relationship with GE HealthCare Technologies to help transform the latter’s IT operating model. The partnership will focus on digitally transforming GE HealthCare’s global IT function by launching a new operating model for managing its application estate and driving innovation. TCS will manage the development, maintenance, rationalization, and standardization of its enterprise IT applications.

GAIL: The state-owned company has entered into a partnership with US-based LanzaTech Global to explore setting up a pilot project for CO2 capture and conversion into useful materials. The partnership will explore innovative technology solutions that advance GAIL’s Net Zero 2040 goals and have the potential to support wider decarbonisation applications globally, the company said.

Newgen Software Technologies: The company’s consolidated net profit surged 57.19% YoY to Rs 30.15 crore on 33.95% YoY rise in revenue from operations to Rs 251.67 crore in Q1FY24. The company’s revenue from EMEA market (Europe, Middle East and Africa) stood at Rs 82.48 crore in Q1FY24, contributing 33% to the total revenue. Revenue from India market stood at Rs 77.35 crore in Q1FY24, contributing 31% to the total revenue. Revenue from the US market stood at Rs 62.41 crore in Q1 FY24, contributing 25% to the total revenue. Separately, the company announced that it has received a purchase order for the implementation of end-to-end trade finance including customer web portal & supply chain finance solution. The aggregate value of the aforesaid purchase order is Rs 34.64 crore and the order is valid for five years.

Tata Coffee: The company reported a consolidated total income of Rs 708 crore for the quarter ended June 2023, a 6% increase compared to the corresponding quarter of the previous year. The higher growth was driven by higher realisations in both the Plantation Coffee and Instant Coffee businesses in India and Vietnam. The group’s consolidated profit fell to Rs 62 crore in Q1FY24 from Rs 65 crore in the corresponding quarter of the previous financial year.

Bikaji Foods International: The company has acquired a stake of 49% in equity shares and 396 Compulsorily Convertible Debentures (CCDs) in Bhujialalji Private Limited. With this acquisition, Bhujialalji Private Limited has become an associate of the company.

CRISIL: The company’s consolidated income from operations rose 15.3% to Rs 771 crore in Q2 of 2023, compared with Rs 668.5 crore in the corresponding quarter of the previous year. Profit after tax increased 10.0% to Rs 150.6 crore in Q2 of 2023, compared with Rs 136.9 crore in the year-ago period. Its board declared an interim dividend of Rs 8 per share of Rs 1 face value in the current quarter for the financial year ending December 31, 2023. The performance of CRISIL Ratings was supported by higher bond issuances and increased demand for bank loan ratings during the second quarter

Bank of Maharashtra: The state-owned lender’s net profit jumped 95.19% to Rs 882.08 crore in Q1FY24 as compared with Rs 451.90 crore posted corresponding quarter last year. Total income increased 43.53% to Rs 5417.45 crore in quarter ended 30 June 2023 as compared with Rs 3774.32 crore posted in same quarter last year. Net Interest Income (NII) jumped 38.80% to Rs 2,340 crore in Q1FY24 as against Rs 1,686 crore posted in Q1FY23. Net interest margin (NIM) improved to 3.86% as on 30 June 2023 as compared with 3.28% reported in the corresponding quarter previous year. Net NPA improved to 0.24 % as on 30 June 2023 as against 0.88 % as on 30 June 2022.

Torrent Power: The company’s wholly-owned subsidiary, Torrent Solargen, has commissioned 115 MW wind power project in Devbhumi, Dwarka district, Gujarat. The integrated power utility company signed a power purchase agreement (PPA) for a period of 25 years with SECI which has a back-to-back power sale agreement (PSA) with the state of Haryana. With the addition of 115 MW wind power, Torrent Power’s installed renewable capacity has reached 1.18 GW and total generation to 4.2 GW.

PNB Gilts: The company announced that its board will meet on Friday (July 21) to consider the proposal for declaration of interim dividend for FY24.The record date for the same is 31 July 2023, the company said in a regulatory filing.

Lemon Tree Hotels: The company announced that it has signed a license agreement for a 72 room property in Gomti Nagar of Lucknow, Uttar Pradesh under the brand ‘Lemon Tree Hotel’. This hotel will have 72 well-appointed rooms, a banquet, meeting rooms, a restaurant, a bar, a fitness center and other public areas. The property is expected to be operational by Q3FY26. Carnation Hotels, a wholly-owned subsidiary and the hotel management arm of the company will be operating this hotel.

Mishtann Foods: The company’s consolidated net profit surged to Rs 68.91 crore in Q1FY24 as compared with Rs 11.02 crore posted in same quarter last year. Revenue from operations jumped 85.73% to Rs 293.94 crore in Q1FY24 as compared with Rs 158.26 crore in Q1FY23. EBITDA increased by 298.84% from Rs. 18.24 crore in Q1FY23 to Rs 71.26 crore in Q1FY24.

Polycab India: The company’s consolidated net profit jumped 81.69% YoY to Rs 399.27 crore and revenue from operations increased 42.13% YoY to Rs 3,889.38 crore in Q1FY24 over Q1FY23. EBITDA jumped 77% YoY to Rs 548.6 crore in Q4 FY23 and EBITDA margin improved by 280 bps YoY to 14.1%, helped by judicious price revisions, better operating leverage and favourable business mix.

Medicamen Biotech: The company has filed its first Abbreviated New Drug Application (ANDA) in eCTD format for ‘BORTEZOMIB FOR injection 3.5 MG/VIAL” with the US Food and Drug Administration (USFDA).

Ice Make Refrigeration: Shares of the company hit an upper circuit of 5% after it announced that it has secured a contract worth Rs 65.48 crore from The West Bengal Livestock Development Corporation Limited. Under the contract, the company will design, supply, installation, and commissioning of civil, mechanical, and electrical work for 1.0 LLPD (expected to expand to 1.5 LLPD) on a turnkey basis at Haringhata in West Bengal.

Century Textiles: The company reported a consolidated net loss of Rs 5.88 crore in Q1FY24 as against a net profit of Rs 46.31 crore posted in Q1FY23. Net sales declined 5.58% YoY to Rs 1,106.44 crore in the quarter ended June 2023. EBITDA in Q1FY24 stood at Rs 129 crore, down by 10% from Rs 143 crore reported in Q1FY23.

Mastek: The company’s consolidated revenue rose to Rs 725 crore in Q1FY24 from Rs 709 crore in Q1FY23. Its consolidated net profit advanced to Rs 73.5 crore in Q1FY24 from 72.5 crore in Q1FY23. EBIT stood at Rs 107 crore in Q1FY24 as against Rs 106 crore in Q1FY23.

Premier Explosives: The company’s consolidated revenues rose 19.7% YoY to Rs 61.95 crore in Q1FY24 from Rs 51.77 crore in the year-ago period. Its profit after tax jumped to Rs 8.25 crore in Q1FY24 from Rs 1.29 crore in the same period last fiscal. Ebitda soared 187.9% to Rs 16.64 crore in Q1FY24 from Rs 5.78 crore in Q1FY23.

Jubilant Pharmova: The company’s consolidated revenue rose 14% YoY to Rs 1770.5 crore in Q1FY24 from Rs 1552.5 crore in the year-ago quarter. Its consolidated profit after tax fell 87.2% YoY to Rs 60 crore in Q1FY24 from Rs 468 crore in the year-ago period. Ebitda stood at Rs 353.2 crore in the reported quarter, up 20.5% from Rs 293.2 crore in the same period last fiscal.

Ramkrishna Forgings: Shares of the company rose 1.6% after the company announced the commencement of commercial operations at their Jharkhand Plant. The company started commercial production of 13,700 TPA of RA shaft-press line and 10,100 TPA of five-inch upsetter at its plant in Kharswan from July 18, according to an exchange filing. The new plant will enhance the output of the company by 23,800 tonne per year, which will result in a total production capacity of 2,10,900 tonne per year, it added.

Federal Bank: The private sector lending is planning to issue 7.26 crore preference shares to International Finance Corporation, IFC Financial Institutions Growth Fund and IFC Emerging Asia Fund. The preference shares will be be issued at a maximum price of Rs 131.91 per share. The lender’s board has also decided on issuance of debt securities including AT-1 bonds, Tier II bonds, long term bonds, Masala bonds, ESG bonds, etc.

Schaeffler India: The company announced the appointment of Aashish Bhatia as President for the automotive OEM.