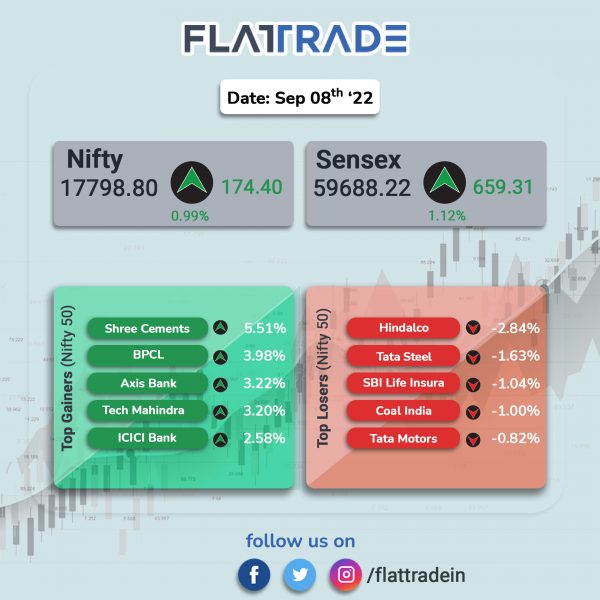

Benchmark stock indices zoomed as banking and IT stocks gained as well as crude prices dropped. The Sensex jumped 1.12% and the Nifty 50 index rose 0.99%.

In broader markets, the Nifty MidCap 100 index gained 0.18% and BSE SmallCap rose 0.6%.

Top Nifty sectoral index gainers were PSU Bank [2.51%], Bank [1.91%], Private Bank [1.88%], Financial Services [1.48%], IT [0.97%] and Auto [0.6%]. Top losers were Metal [-0.9%], Media [-0.45%], Realty [-0.29%] and Pharma [-0.05%].

The Indian rupee rose 19 paise to 79.71 against the US dollar on Thursday.

Stock in News Today

Adani Group: Fitch Group’s research arm, CreditSights, has admitted to calculation errors in its recent debt report with respect to two Adani Group companies. CreditSights corrected Adani Transmission’s EBITDA estimate to 52 billion rupees from 42 billion rupees earlier. The research firm also corrected Adani Power’s gross debt estimate to 489 billion rupees from 582 billion rupees in the earlier report.

Vodafone Idea (VIL): The Finance Ministry has cleared a proposal to convert the accrued interest on dues related to deferred adjusted gross revenue (AGR) worth Rs 16,130 crore of Vodafone Idea into equity, according to Economic Times report. The telecom department will now have to finalise the transaction according to the package announced earlier.

Bharti Airtel: Singtel entities have offloaded a 1.76% stake in the telcom company for about Rs 7,128 crore, PTI news agency reported citing sources. According to the bulk deal data available with the exchange, Bharti Telecom, Airtel’s promoter, have purchased 9,62,34,427 shares (1.63% stake) at an average price of Rs 686 apiece. Another entity, Viridian, has offloaded about 1 crore shares.

Tata Power: The company’s subsidiary, Tata Power Renewable Energy, has partnered with stainless steel maker Viraj Profile to set up a 100 MW captive solar plant. The plant will be developed by the Tata-Group company at its Nasik site and the power generated will be used for captive consumption by Viraj Profile’s Tarapur Plant. Tata Power will own 74% of the generation while Viraj Profile will hold the remaining 26%.

Hindustan Zinc: The company has incorporated a new wholly owned subsidiary Hindustan Zinc Fertilisers. The new entity will have an authorized share capital of Rs 10 lakh divided by 1 lakh equity shares of Rs 10 each. The new entity will be involved in the business of manufacture, sale and dealing of multiple grades of nitrogenous, phosphatic, potassic fertilisers, specialty chemicals and other allied items essential to crop industry and various other industries.

Sona BLW Precision Forgings: The company has achieved 100,000 EV traction motor production milestone, it said in an exchange filing. The company said its R&D team designed and developed the EV traction motors in-house and launched them for production in 2020. The company added that it took 17 months to reach a cumulative production of 50,000, but doubled the count in four months.

Pennar Industries: The engineering company in an exchange filing said that it has bagged orders worth Rs 511 crore across various business verticals during July and August 2022. The company added that the orders are expected to be executed in the next two quarters.

Sonata Software: Shares of the IT service provider jumped 6.21% after the company traded ex-bonus. The company has fixed September 10, 2022, as the record date to determine the eligibility for the issuance of bonus shares. The company had announced the issue of bonus shares in 1:3 ratio for all shareholders holding the stock on the record date.

Panacea Biotech: Shares of the company gained 2.21% after the company informed the exchanges that it has received communication from the US drug regulator indicating the inspection classification as ‘Official Action Indicated’. The company added that it is working closely with USFDA to close these observations. The USFDA had issued Form 483 with eight observations after inspecting the company’s facility at Baddi in Himachal Pradesh between May 30 and June 8.

Websol Energy: The company has signed an agreement with AMP Energy India to form a joint venture for manufacturing and producing up to 1.2 GW monocrystalline PERC (Passivated Emitter and Rear Cell) solar cells and modules. Websol will hold 51% and AMP the balance 49%. The solar cells and modules will be manufactured in two phases of 600 MW each at AMP Energy’s existing unit at Falta, West Bengal.