Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.56% higher at 17,729, signalling that Dalal Street was headed for a positive start on Thursday.

Japanese socks were trading higher, tracking a rally on Wall Street overnight. Japan’s Nikkei jumped 2.05% and Topix was up 1.95%. Meanwhile Chinese markets were trading lower with the Hang Seng falling 0.48% and CSI 300 inching down 0.01%.

The Indian rupee fell 6 paise to 79.90 against the US dollar on Wednesday.

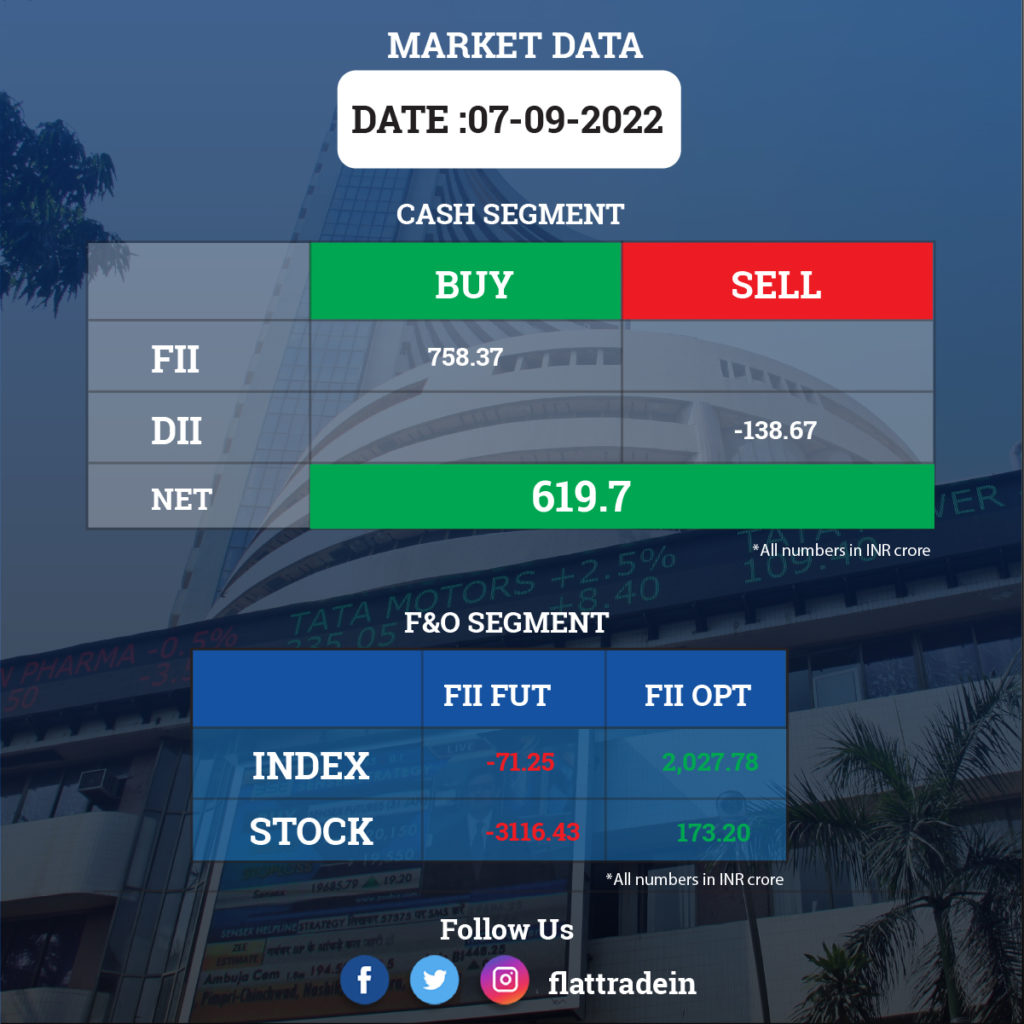

FII/DII Trading Data

Stocks in News Today

InterGlobe Aviation (IndiGo): Rakesh Gangwal, co-founder of IndiGo, and his family are looking to sell a 2.8% stake in InterGlobe Aviation, the holding company which runs IndiGo airlines, through a block deal. Morgan Stanley, one of the investment banks looking after the sale, launched a block deal, according to a notification to the stock exchanges. As part of the block deal, about 10.8 million shares have been listed for sale for Rs 19.96 billion. The shares are listed at Rs 1,850 apiece as against the company’s closing price of Rs 1,977.70 on September 7.

State Bank of India (SBI): The country’s largest lender issued additional tier-1 (AT1) bonds worth a total of Rs 6,872 crore at a cut-off of 7.75%, the lowest rate set for such debt issuances by any bank so far in the current financial year, Business Standard reported. “There was already assured demand for a large portion of the notified amount of SBI’s bonds,” the report said citing a senior treasury official.

Separately, Bank of Maharashtra on Wednesday issued AT1 bonds worth Rs 710 crore at a cut-off rate of 8.74 per cent.

NDTV: The company in an exchange filing said that the Adani Group has made an open offer to acquire additional 26 per cent stake (16.76 million shares) at Rs 294 per share. The open offer will begin on October 17 and end on November 01.

HDFC Bank: The private sector lender has increased its marginal cost of funds-based lending rate (MCLR) by 10 basis points (bps), with effect from September 7.The bank will offer overnight rates at 7.9%. The MCLR rates will be 7.90% for one month, 7.95% for three months and 8.05% for six months, according to the bank’s website.

Dr. Reddy’s Laboratories: The pharma firm has launched Lenalidomide Capsules, a therapeutic equivalent generic version of REVLIMID (lenalidomide) Capsules approved by the USFDA in the US market. With this volume-limited launch, Dr. Reddy’s is eligible for first-to-market, 180 days of generic drug exclusivity for Lenalidomide Capsules in 2.5 mg and 20 mg strengths.

Indian Railway Catering and Tourism Corporation (IRCTC): The company has emerged as the successful bidder in the e-auction for sale of commercial built up space in WTC Nauroji Nagar, New Delhi.

Zee Entertainment: The Mumbai bench of the National Company Law Tribunal (NCLT) on Wednesday directed Zee Entertainment to convene a shareholders’ meet on October 14 for approving the merger with Culver Max Entertainment (formerly known as Sony Pictures Network).

Concord Drugs: The company’s board has given approval for the acquisition of up to 100% stake in Proton Remedies Private Limited at Rs 283 per share on cash basis, and issue of up to 12,56,250 convertible warrants to the promoters on preferential basis at an issue price of Rs 33 per warrant.

Schneider Electric Infrastructure: The company has received approval from its board for enhancing the production capacity of vacuum interrupters and vacuum circuit breakers by setting up a manufacturing unit in Kolkata.

Zydus Lifesciences: The company has has achieved positive proof-of-concept in its Phase 2 clinical study of NLRP3 inhibitor, ZYIL1 in patients with cryopyrin-associated periodic syndrome (CAPS). CAPS is a rare, life-long, auto-inflammatory condition, caused by NLRP3 activating mutations and is classified as an orphan disease.

CG Power and Industrial Solutions: Standard Chartered Bank (Singapore) sold 1,38,45,000 equity shares in the company via open market transactions and the shares were sold at an average price of Rs 215 apiece.

AAVAS Financiers: CARE upgrades credit rating on the company’s long term facilities. The rating agency said that the company’s long term facilities credit rating has been upgraded to AA from AA-, while reaffirming the short term facilities rating. The outlook on the long term facilities rating is revised to Stable from Positive.