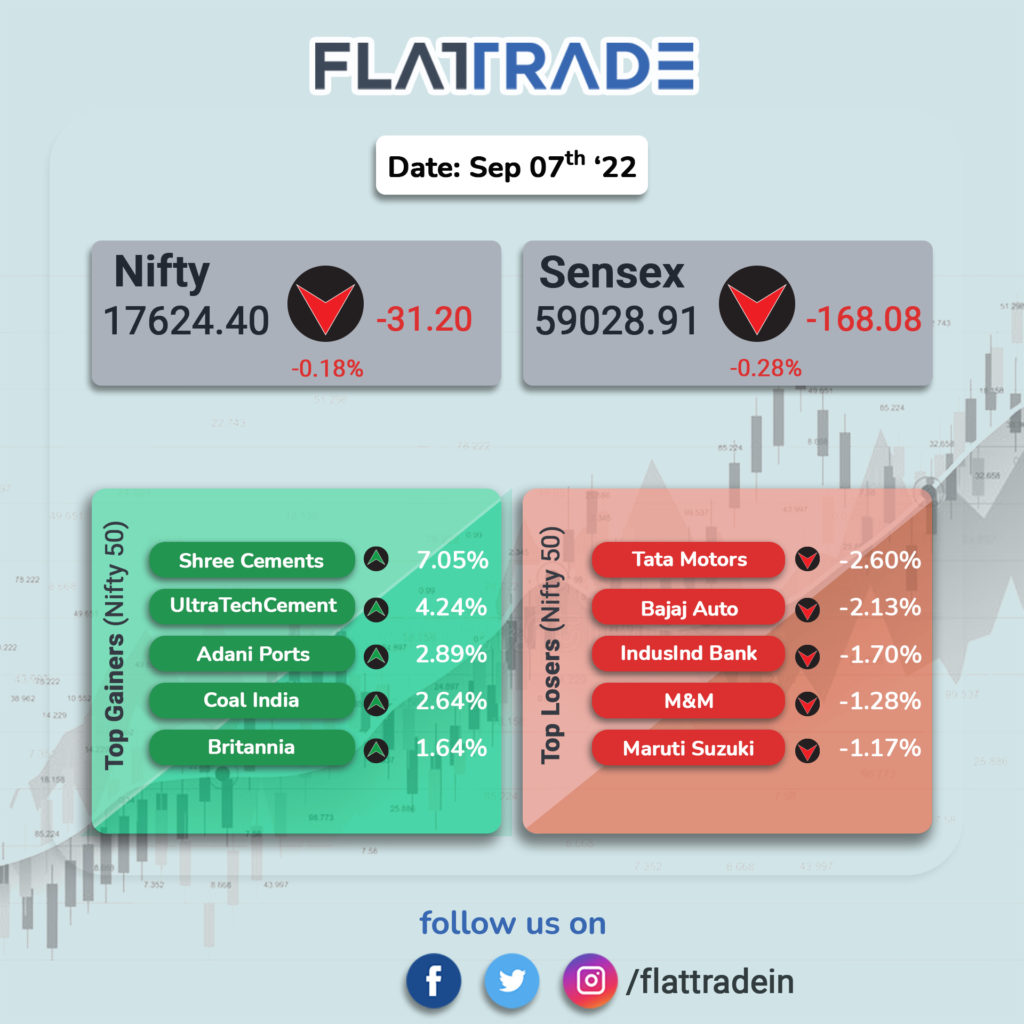

Benchmark indices rebounded from day’s lows but ended in the red as cautious investors shunned riskier assets amid rate hike concerns. The Sensex fell 0.26% and the broader index Nifty 50 lost 0.18%.

The broader indices outperformed their larger peers with the Nifty MidCap 100 index gaining 0.5% and BSE SmallCap jumping 0.73%.

Top Nifty sectoral losers were Auto [-1.15%], Private Bank [-0.62%], Energy [-0.60%], Bank [-0.53%] and Financial Services [-0.32%]. Top gainers were Media [1.46%], Pharma [0.78%], IT [0.32%] and FMCG [0.2%].

The Indian rupee fell 6 paise to 79.90 against the US dollar on Wednesday.

Stocks in News Today

Adani Group: Billionaire Gautam Adani said his ports-to-power conglomerate will build three giga factories in India for manufacturing solar modules, wind turbines, and hydrogen electrolyzers as part of a $70 billion investment in clean energy by 2030. He added that these new factories will generate an additional 45 GW of renewable energy to Adani group’s existing 20 GW capacity, as well as 3 million tons of hydrogen by 2030.

Separately, India and the United States should increase cooperation in climate change, semiconductor production, defence and cyber space, Adani said after receiving the USIBC Global Leadership Award.

Airtel: Shares of the company fell more than 9% in intraday trading after multiple block deals were reported on the exchanges in early trade. On the NSE, 11.56 crore shares changed hands in the morning session compared with an average trading volume of 70.66 lakh shares traded in the past three months. However, the shares recouped losses to end about 1.07% lower.

Infosys: The IT firm has announced a five-year agreement with Spirit AeroSystems. Infosys will collaborate with Spirit AeroSystems to provide aerostructure and systems engineering services for product development of commercial, business jet and emerging aircraft programs, and Maintenance, Repair and Overhaul (MRO) services.

Adani Transmission: The company has incorporated its wholly-owned subsidiary in the name of Adani Transmission Mahan (ATML) with an initial authorised and paid-up capital of Rs.1,00,000/- each. The company will be in the business of transmission, distribution and supply of power and other infrastructure services.

Tata Consultancy Services (TCS): The IT company has been selected by Nokia to reimagine the employee experience for the company’s global workforce in more than 130 countries of operation. TCS said that it consultants will work closely with Nokia to drive its human-centric, cloud-first model by redesigning HR processes and implementing a full stack of solutions powered by Oracle Fusion Cloud Human Capital Management (HCM).

Cipla: The pharma firm said that it has received final nod from the USFDA for is abbreviated new drug application for Lenalidomide capsule. The capsules are therapeutic equivalent generic version of Bristol Myers Squibb’s Revlimid capsules and it is usd for treating cancer. According to IQVIA, it had a sales of about $2.58 billion for the 12-month period ending June 2022.

Lupin: The company has signed an exclusive licensing and supply agreement with DKSH, to market five biosimilar candidates in the Philippines. The biosimilars planned under this agreement include biosimilar Prolia, Xgeva, Simponi, and Eylea as well as two undisclosed proposed biosimilars for immunology and oncology. The pharma company’s Philippines subsidiary, Multicare Pharma, will file for marketing approval and be responsible for distribution and commercialisation of the biosimilars after approval.

Shree Pushkar Chemicals & Fertilisers: The company announced that it has commenced commercial production of one of its plant with respect to Unit V after obtaining all the necessary approvals and license. The Unit V is located at MIDC, Lote Parshuram, Ratnagiri district, Maharashtra. The license was received for storage of the compressed gas, ethylene oxide in two numbers of pressure vessels.

Container Corp of India: Shares of the company closed 8.6% higher after the Union cabinet lowered the railway land license fee to 1.5% from 6% for certain usages, according to EconomicTimes report. The lease period has been increased to up to 35 years from presently 5 years. The report stated that the decision will expedite the sale process of the Centre’s stake in the company.

Arvind Smartspaces: Shares of the company rose 10.9% in intraday trading a day after Quant Mutual Fund bought stakes in the company. According to bulk deals data available on BSE website, Quant MF has bought 5 lakh shares at an average price of Rs 228.50 apiece.

Sterlite Power: The company’s Mumbai Urja Marg Transmission Ltd (MUML) has commissioned 400kV Banaskantha, Kansari and Vadavi Transmission lines in Gujarat. The high voltage transmission line will help in the evacuation of around 1000 MW of renewable power from the pooling station at Bhuj in northern Gujarat to the national grid, a company statement said. This will significantly augment the available power transmission capacity of the state, taking it from 9300 MW to 11200 MW.