Updater Services Limited plans to go public to raise up to Rs 640 crore. The subscription for the IPO will be open from September 25 to September 27, 2023. The price band is set at Rs 280 – Rs 300 per share.

The IPO consists of fresh issue of shares worth Rs 400 crore and offer for sale of shares worth Rs 240 crore. The face value is set at Rs 10 per share and size one lot is 50 shares.

Company Summary

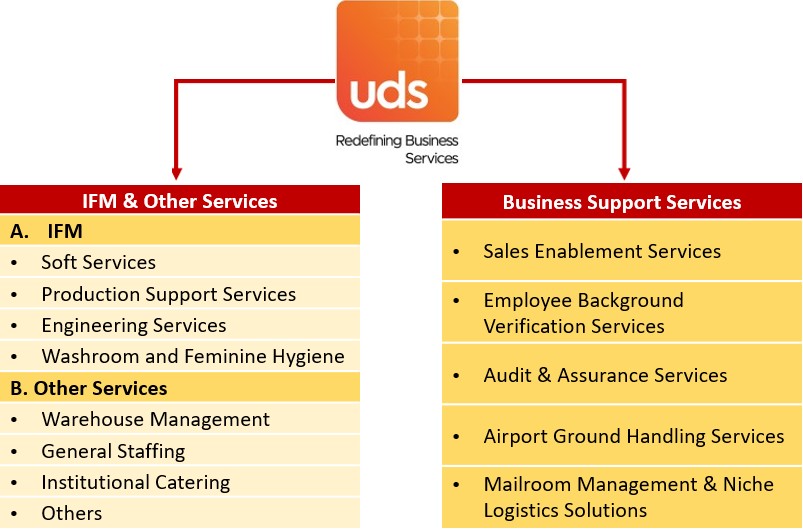

Updater Services Limited is a leading integrated business services platform in India offering integrated facilities management (“IFM”) services and business support services (“BSS”) to customers present across India. The company is the second largest player in the IFM market in India and has the widest service offering in the industry, making it a unique and differentiated player in the market.

Within the BSS segment, the company offers Audit and Assurance services through its subsidiary, Matrix. According to F&S Report, Matrix is a leading Audit and Assurance company for dealer / distributor audits, and retail audits and its strong branch reach and field associate reach has driven the company to reach the top spot in India, with a market share of 19.2% in the fiscal 2023. In FY23, the company said it has 1,427 customers under the IFM segment and 1,669 customers under BSS segment.

The company’s portfolio of services offered across these two business segments is shown below in the image,

Updater Services also offers employee background verification check services through Matrix and in this segment, Matrix is the third largest company in India with a share of 5.4% in the financial year 2023. Further, the company provides sales enablement services through its subsidiaries Denave and Athena. According to F&S Report, Denave is the largest player in this segment with a market share of 20.1% in India in FY2023. In addition, the company offers mailroom management services through our subsidiary, Avon which is a market leader in India with a share of 11.1% in the mailroom management services market in FY2023.

The company said has grown to become a pan India player over the years since its commencement of operations in 1990, with a widespread network consisting of 4,331 locations (excluding staffing locations) managed from 129 points of presence with 116 offices situated in India and 13 offices situated overseas, as of June 30, 2023.

Updater Services said its portfolio of services has evolved over the years to cater to the needs of diverse customer segments across a range of sectors including FMCG, manufacturing and engineering, BFSI, healthcare, IT/ITeS, automobiles, logistics and warehousing, airports, ports, infrastructure and retail, among others.

As on June 30, 2023, the company has served 2,797 customers across various sectors, including marquee global and Indian customers such as Procter & Gamble Home Products, Aditya Birla Fashion and Retail, Microsoft, Hyundai Motor India, Saint-Gobain India, Tata Consultancy Services, LTIMindtree, Honda Motorcycle and Scooter India, IIFL Finance, SBI Life Insurance Company, Sony India, and Shriram Transport Finance Company.

Some of the listed peers of Updater Services operating in the same industry and may have similar offerings are Quess Corp, SIS Limited, and TeamLease Services, according to its red herring prospectus.

Company Strengths

- Integrated business services platform, operating across diverse segments.

- Long-standing relationship with customers across various sectors leading to recurring business.

- Well-established track record of successful acquisition and integration of high margin business segments.

- Strong presence across India with large and efficient workforce coupled with strong recruitment capabilities.

- Leveraging appropriate technology to driveaccuracy, efficiency, customer satisfaction, and better service delivery.

- Highly experienced management team with support from private equity investors.

Company Financials

Period Ended | FY23 | FY22 | FY21 |

Total Assets (Rs in crore) | 1,216.95 | 874.57 | 579.49 |

Total Revenue (Rs in crore) | 2,112.09 | 1,497.89 | 1,216.35 |

Revenue from contracts with customers (Rs in crore) | 2,098.89 | 1,483.55 | 1,210.03 |

EBITDA (Rs in crore) | 99.77 | 86.54 | 70.22 |

EBITDA Margin | 4.74% | 5.80% | 5.78% |

Profit After Tax (Rs in crore) | 34.61 | 57.37 | 47.56 |

PAT Margin | 1.64% | 3.85% | 3.92% |

ROE | 9.40% | 16.24% | 15.79% |

ROCE | 14.17% | 20.23% | 22.59% |

Debt to Equity | 0.46 | 0.17 | 0.04 |

Purpose of the IPO

- The net proceeds from fresh issue of shares will be utilised for repayment and /or prepayment of certain borrowings availed by the company totalling Rs 133 crore; funding the company’s working capital requirements aggregating up to Rs 115 crore; pursuing inorganic initiatives worth Rs 80 crore; and general corporate purposes.

- The proceeds from offer for sale shall be received by the selling shareholders after deducting the offer related expenses as well as taxes, and the company will not receive any proceeds from the offer for sale.

Company Promoters

Raghunandana Tangirala, Shanthi Tangirala, and Tangi Facility Solutions Private Limited are promoters of the company.

IPO Details

IPO Subscription Date | September 25 to September 27, 2023 |

Face Value | Rs 10 per share |

Price Band | Rs 280 to Rs 300 per share |

Lot Size | 50 Shares |

Total Issue Size | Rs 640 crore |

Fresh Issue | Shares aggregating up to Rs 400 crore |

Offer for Sale | 80,00,000 shares aggregating up to Rs 240 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 50 | Rs 15,000 |

Retail (Maximum) | 13 | 650 | Rs 1,95,000 |

Small HNI (Minimum) | 14 | 700 | Rs 2,10,000 |

Small HNI (Maximum) | 66 | 3,300 | Rs 9,90,000 |

Large HNI (Minimum) | 67 | 3,350 | Rs 10,05,000 |

Allotment Details

Event | Date |

Allotment of Shares | October 4, 2023 |

Initiation of Refunds | October 5, 2023 |

Credit of Shares to Demat Account | October 6, 2023 |

Listing Date | October 9, 2023 |

To check allotment, click here