Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.15% lower at 17,472.50, hinting that Dalal Street was headed for a negative start on Wednesday.

Asian shares were trading lower, tracking a decline on Wall Street overnight, amid expectations of an aggressive monetary tightening by central banks to tackle inflation. Japan’s Nikkei 225 index fell 0.95% and Topix was down 0.77%. China’s Hang Seng index dropped 1.15%, while CSI 300 index edged up 0.27%.

The Indian rupee was flat at 79.84 against the US dollar on Tuesday.

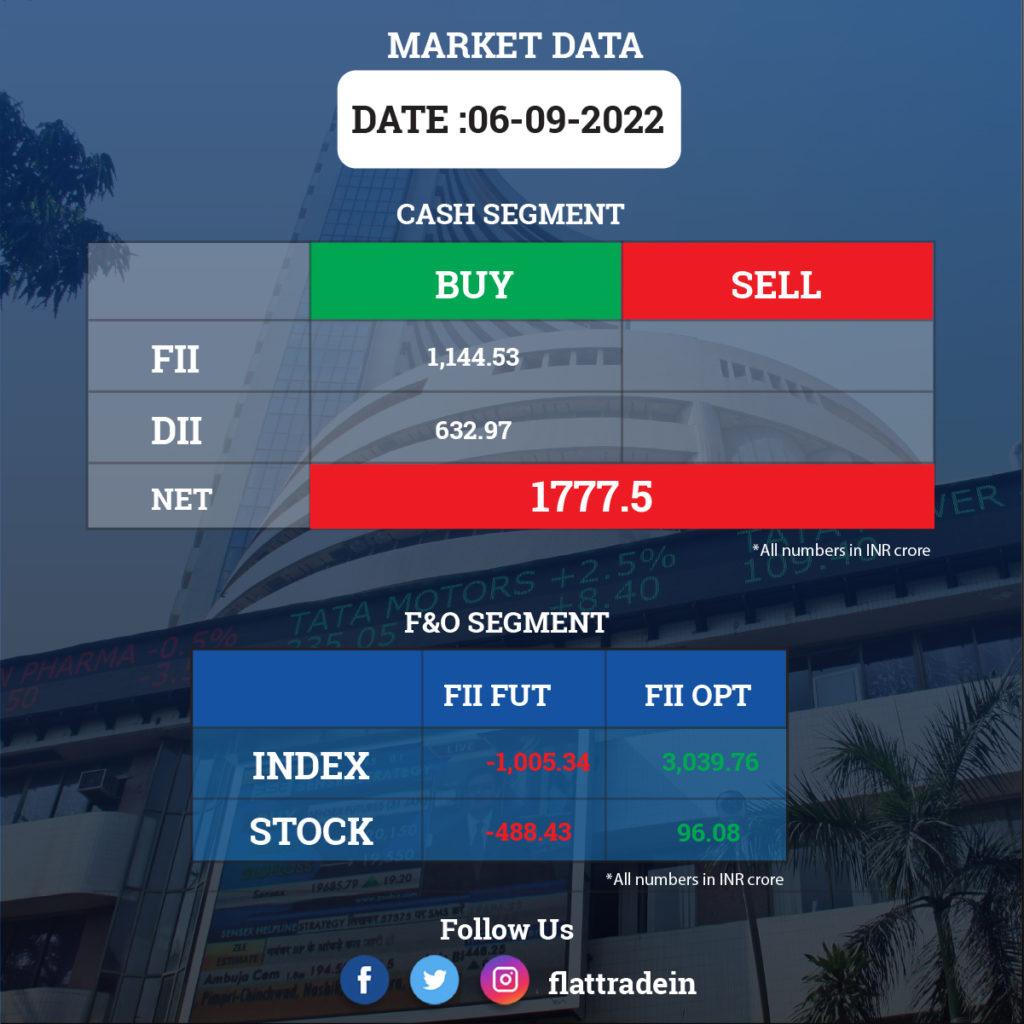

FII/DII Trading Data

Stocks in News Today

InterGlobe Aviation (IndiGo): The carrier said that Pieter Elbers has joined as the new chief executive officer (CEO) with effect from September 6. He succeeds Ronojoy Dutta, who retired last week. Elbers has served as the president and CEO of KLM Royal Dutch Airlines since 2014.

HDFC Bank: The private sector lender on Tuesday sold additional tier-1 (AT-1) bonds worth Rs 3,000 crore at a cut-off rate of 7.84%. The bond sale is the first time that a private bank has tapped the debt capital markets by issuing AT-1 bonds in the current fiscal year.

Wipro: The IT major has entered an expanded collaboration with Palo Alto Networks to deliver managed security and network transformation solutions like SASE (secure access service edge), cloud security and next-generation SOC (security operations center) solutions based on Zero Trust principles for global enterprises.

Canara Bank: The state-run bank hiked the benchmark MCLR by up to 0.15% and the benchmark one-year MCLR was raised to 7.75% as against the earlier rate of 7.65%. The rate hike will make loans costlier for borrowers.

Gail India: The company has fixed September 7, 2022, as the record date for the purpose of determining the eligibility of shareholders for the issuance of bonus shares. Bonus shares are fully paid additional shares issued by a company to its existing shareholders.

IDBI Bank: The government is expected to to invite preliminary bids for selling a stake in the lender in October, according to reports. The Cabinet Committee on Economic Affairs had given in-principle approval for strategic disinvestment and transfer of management control in IDBI Bank in May 2021. The government holds 45.48% stake in the bank and LIC, which is also the promoter of the bank, owns a 49.24% stake.

Paras Defence & Space Technologies: The company has entered into an agreement with ELDIS Pardubice, Czech Republic to provide turnkey anti-drone systems for civilian airports in India.

Salasar Techno Engineering: The company’s board has approved the allotment of three crore equity shares to QIBs at a price of Rs 27.30 per share. The company raised Rs 81.9 crore through its issue.

Zuari Industries: The company has executed Memorandum of Understanding (MOU) with Envien International, Malta and Zuari Envien Bioenergy, for building and operating a biofuel distillery. The company will explore the organic and inorganic business opportunities in the biofuel industry in India.

Astral: The company has received an order from NCLT sanctioning Scheme of Amalgamation of subsidiaries Resinova Chemie Limited and Astral Biochem Private Limited with itself. Further, the Scheme of Amalgamation is effective from September 6.