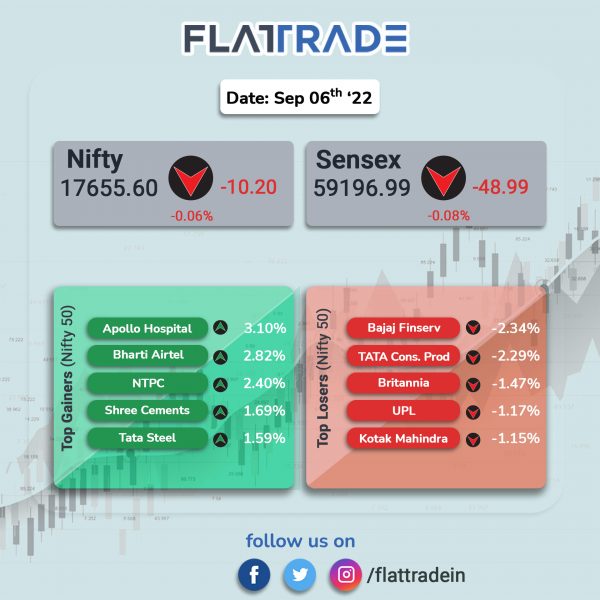

Benchmark indices oscillated in a volatile session and closed in the red as losses in FMCG and banking stocks offset gains in power, metal, energy stocks. The Sensex slipped 0.08% and the Nifty 50 index edged down 0.06%.

Broader markets performed better than headline indices to close positive. The Nifty Midcap 100 index rose 0.58% and the BSE SmallCap edged up 0.10%.

Top Nifty sectoral gainers were Metal [1.32%], Energy [1.29%], Oil & Gas [1.15%], PSU Bank [0.51%] and Realty [0.36%]. Top losers were FMCG [-0.52%], Pvt Bank [-0.47%], Media [-0.4%], Bank [-0.35%] and IT [-0.34%].

The Indian rupee was flat at 79.84 against the US dollar on Tuesday.

Stock in News Today

Bharti Airtel: Shares of the company rose nearly 3% after the brokerage firm Prabhudas Lilladher initiated a buy call on Airtel with a target price of Rs 1032. The brokerage firm said Bharti is a compelling play on multiple growth opportunities in emerging digital economy, strong brand presence, attracting high quality customers for ARPU expansion, and affordable 5G rollout using existing 4G infrastructure.

One 97 Communications (Paytm): In an exchange filing on Tuesday, the fintech firm said its lending business witnesses a 246% YoY growth during the two months ending August 2022. The number of loans disbursed stood at 6 million loans in two months ending August 2022, while the value of loans disbursed grew 484% YoY to Rs 4,517 crore. The company reiterated that it continues to see ample growth and upsell opportunities in this business and focusing on the quality of the book. The total merchant gross merchandise value (GMV) processed through the platform for the two months ended August 2022 aggregated to Rs 2.10 lakh crore ($26 billion), registering a growth of 72% YoY.

Kalpataru Power: The company has bagged orders worth Rs 1,345 crore in India and overseas markets in the transmission and distribution business. The company also won orders for pipeline laying works and received order for metro rail electrification in India. Th company’s CMD, Manish Mohnot, said that the order wins will help the firm to further consolidate order book and establish leadership in key markets.

RateGain Travel Technologies: The company has won a deal from Kuwait’s second largest airline Jazeera Airlines for providing SaaS-based solutions product for airfare pricing insights. The company’s SaaS-based airfare pricing intelligence product, AirGain, to dynamically adjust prices with real-time, accurate and high-quality airfare data. Shares of the company jumped 6.8% in intraday trading.

Blue Star: The cooling solutions provider has secured two new orders from Bangalore Metro Rail Corporation (BMRCL) for the upcoming Reach-6 of Bangalore Metro Rail Project Phase-II. The first order is valued at Rs 203 crores for a turnkey project including maintenance works for Tunnel Ventilation System (TVS) and Environmental Control System (ECS). The second order is valued at Rs 187 crores for Electrical & Mechanical (E&M) works.

Syngene International: Shares of the company fell about 2.5% after nearly 6% of the company’s equity shares changed hands via block deals on the BSE on Tuesday. Biocon had likely trimmed its holding in Syngene in a block deal in the open market, CNBC-TV18 reported citing people aware of the matter.

Veranda Learning Solutions: The company’s board will consider the proposal of raising of funds on September 14. The fund raising will be done through preferential issue on a private placement basis, rights issue or any other methods or combination, subject to approval from the shareholders in the extra ordinary general meeting to be held on 6th October 2022 and approvals from regulatory authorities.

Suzlon Energy: The company has won an new order for development of 180.6 MW wind power project for Sembcorp’s renewables subsidiary Green Infra Wind Energy. Suzlon will install 86 wind turbine generators with a Hybrid Lattice Tubular tower and a rated capacity of 2.1 MW each, in Bagalkot, Karnataka. The project is expected to be commissioned in 2024.

DreamFolks Services: The company had a strong stock market debut on Tuesday with the company shares rising to Rs 505 apiece on listing as against its issue price of Rs 326 per equity share. Shares of the company ended at 462.4 apiece.

NTPC: NTPC Renewable Energy (NTPC REL), a wholly owned subsidiary of NTPC, has incorporated Green Valley Renewable Energy, as a subsidiary of NTPC REL in 51:49 in a joint venture with DVC.