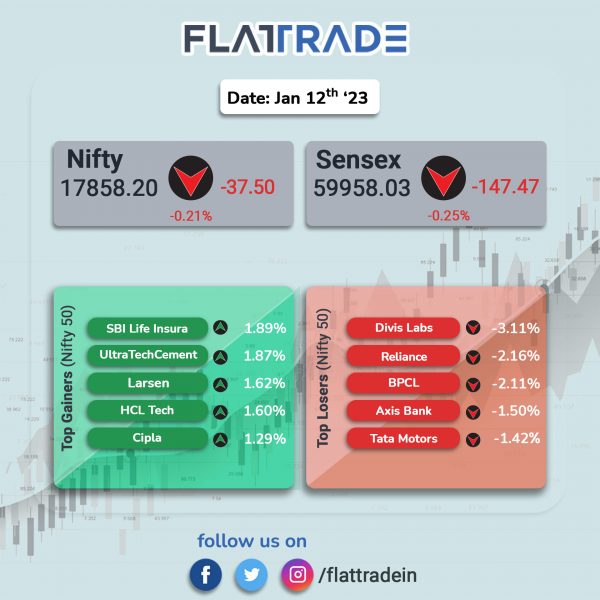

Benchmark equity indices fell as investors were cautious ahead of US inflation data and waited for more signals from the Fed along with fall in energy share prices. The Sensex fell 0.25% and the Nifty 50 index dropped 0.21%.

In broader markets, Nifty Midcap 100 index was down 0.13% and the BSE Smallcap slipped 0.02%.

Top losers among Nifty sectoral indices were Oil & Gas [-1.02%], Energy [-0.68%], Private Bank [-0.47%], FMCG [-0.36%] and Bank [-0.36%]. Top gainers were Media [0.80%], IT [0.43%], Auto [0.13%].

Indian rupee was unchanged at 81.55 against the US dollar on Thursday.

Sah Polymers witnessed a strong stock market debut on Thursday. Shares of the company opened at Rs 85 apiece against its issue price of Rs 65 per equity share. The shares rose to a high of Rs 89.25 and closed at the same price.

Stock in News Today

Maruti Suzuki India: The automaker unveiled two new products — Jimny and Fronx — in India as the carmaker seeks to regain 50% market share in the domestic passenger vehicle segment by bolstering its presence in the sports utility vehicle (SUV) space. Fronx has two engine options available — 1.2-litre naturally aspirated K-series engine and 1-litre turbo-petrol engine. Customers can pre-book the vehicles through the official website or at their nearest Nexa showroom.

Paytm: China’s Alibaba Group sold a 3.1% stake in Paytm worth $125 million through a block deal, Reuters reported citing a source with direct knowledge of the matter. Alibaba, which held a 6.26% stake in Paytm as of end of September 2022, sold the stake at Rs 536.95 rupee apiece, the source said. Paytm’s stock fell 8.8% in intraday trade on Thursday.

TVS Motor Company: The two-wheeler manufacturer said it plans to invest in Madhya Pradesh (MP) for its potential future two-wheeler and three-wheeler expansion in electric and internal combustion engine vehicles. This expansion plan entails an investment of over Rs 1,000 crore and could create direct and indirect employment in Madhya Pradesh of over 2,000 jobs. The announcement was made at the Global Investors Summit 2023 held at Indore.

RailTel Corporation of India: The company said it has received work order from Government of Puducherry, Department of Revenue and Disaster Management for designing, development, SITC, O&M for five years of Integrated Command Control Centre and other associated activities for Puducherry Smart City.

Zydus Lifesciences: The company’s subsidiary, Zydus Worldwide DMCC, has received final approval from the United States Food and Drug Administration (USFDA) to market Brexpiprazole tablets, which is used as an adjunctive therapy to antidepressants for the treatment of major depressive disorder (MDD) in adults. It is also indicated for the treatment of schizophrenia in adults and pediatric patients ages 13 years and older . The drug will be manufactured at the group’s manufacturing facility at Ahmedabad SEZ, India. Brexpiprazole tablets had annual sales of $1,548 million in the US, according to latest IQVIA data.

Berger Paints India: The company’s board has appointment of Kaushik Ghosh as the vice president & chief financial officer and key managerial personnel of the company with immediate effect. Meanwhile, the board has noted the resignation of Vikash Sarda as the chief financial officer (key managerial personnel) of the company. Kaushik Ghosh has a track record of over two decades, implementing high-impact growth strategies, robust internal controls, and efficient reporting systems.

PNC Infratech: The company said that its subsidiary, Hardoi Highways Private (SPV / Concessionaire), received ‘Appointed Date’ of 7 January 2023 for the following HAM Project of National Highways Authority of India. The project entails iand upgradation of existing road to 4-lane with paved on Hybrid Annuity Mode under NH(O) in Uttar Pradesh.

Stove Kraft: The company fell 4.36% after its chief executive officer (CEO) and whole time director, Rajiv Nitin Mehta informed that he plans to resign from the company to pursue opportunities outside the group. The company said that the formal resignation of Rajiv Mehta will be placed before the board of directors at the forthcoming meeting.

P B Fintech: The company in an exchange filing said that its wholly-owned subsidiary, PB Financial Account Aggregators, has received certificate of registration as NBFC-Account Aggregator from the Reserve Bank of India.

D B Realty: The company’s wholly owned subsidiary, Goregaon Hotel and Realty, has executed a settlement agreement with Reliance Commercial Finance for loans given by the latter earlier. D B Realty and Goregaon Hotel will now pay Rs 185.6 crore and Rs 214.4 crore, respectively, to the lender by March 31, 2025 as full and final settlement.

EKI Energy Services: The company announced that it has collaborated with DNV Supply Chain & Product Assurance, a Norway-based independent assurance and risk management provider, to foster climate transition ecosystem with innovation and digitalisation by numerous measures agreed upon by both organizations as part of Charter of Collaboration.

Under the collaboration, EKI will extend advisory services to DNV’s assurance customers on their journey towards carbon neutrality and net-zero in addition to GHG inventorization/ESG and sustainability assurance services. The collaboration also seeks to bridge the gap between capital market sustainable finance and carbon finance by innovative debt financial instrument assurance with DNV’s broad experience, deep expertise and global reach.

G M Breweries: The company reported a 30.98% YoY jump in net profit to Rs 25.92 crore and 17.41% YoY increase in revenue to Rs 153.66 crore in Q3FY23. Total expenses advanced 18.21% YoY to Rs 577.49 crore in Q3 FY23. Cost of material consumed was Rs 109.50 crore, up 14.84% YoY.

Bombay Burmah Trading Corp: The company said in an exchange filing that its wholly owned foreign subsidiary, Baymanco Investments, has acquired 1,08,000 (1.88%) shares of National Peroxide by way of a block deal from the existing promoters by way of inter-se transfer of shares. With this acquisition, the total holding of the corporation and its subsidiary has increased from 22.40% to 24.28%.

IIFL Wealth Management: The company said that its board will consider a proposal to split the shares and issue of bonus shares in its meeting to be held on 19 January 2022. The company said that the board will consider sub-division of equity shares of the company of face value of Rs 2 each and the record date is fixed as January 30, 2023.

Container Corporation of India: The company’s total throughput in quarter ended December 2022 was 10,85,154 twenty foot equivalent units (TEUs), up by 5.18% from 10,31,701 TEUs recorded in the same period last year. While the company’s export-import (EXIM) volumes rose by 0.62% to 8,33,796 TEUs, domestic (DOM) volumes jumped by 23.80% to 2,51,358 TEUs in Q3FY23 over Q3FY22. CONCOR’s total throughput rose by 7.92% in the period ended December 2022 to 32,42,097 TEUs from 30,04,204 TEUs recorded in the period ended December 2021.

Emami Realty: The company’s board has approved conversion of existing unsecured loan of Rs 700 crore of Suraj Finvest and Diwakar Finvest into optionally convertible debentures. The two entities are promoter companies, and as a result, about 8.53 lakh optionally convertible debentures of Rs 82 each will be assigned to the two entities.

TruCap Finance: The company said that it has entered into a partnership with Shivalik Small Finance Bank for gold loan origination under business correspondent model. With a loan book of over Rs 500 crore, TruCap aims to build social capital by providing small ticket gold loans and business loans to its MSME borrowers.

DRC Systems India: The company’s net profit rose to Rs 1.62 crore in the quarter ended December 2022 as against Rs 0.07 crore during the previous quarter ended December 2021. Sales rose 40.56% to Rs 6.03 crore in the quarter ended December 2022 as against Rs 4.29 crore during the previous quarter ended December 2021.