Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.37% higher at 17,984.50, indicating that Dalal Street was headed for a positive start on Friday.

Chinese stocks rose on Friday as slowdown in US inflation boosted investors’ sentiments. The CSI 300 index rose 0.38% and the Hang Seng was flat. Japanese shares opened lower Friday, as a stronger yen against the dollar weighed on market sentiment. The Nikkei 225 index fell 1.11% and the Topix slipped 0.07%.

Indian rupee stood at 81.55 against the US dollar on Thursday.

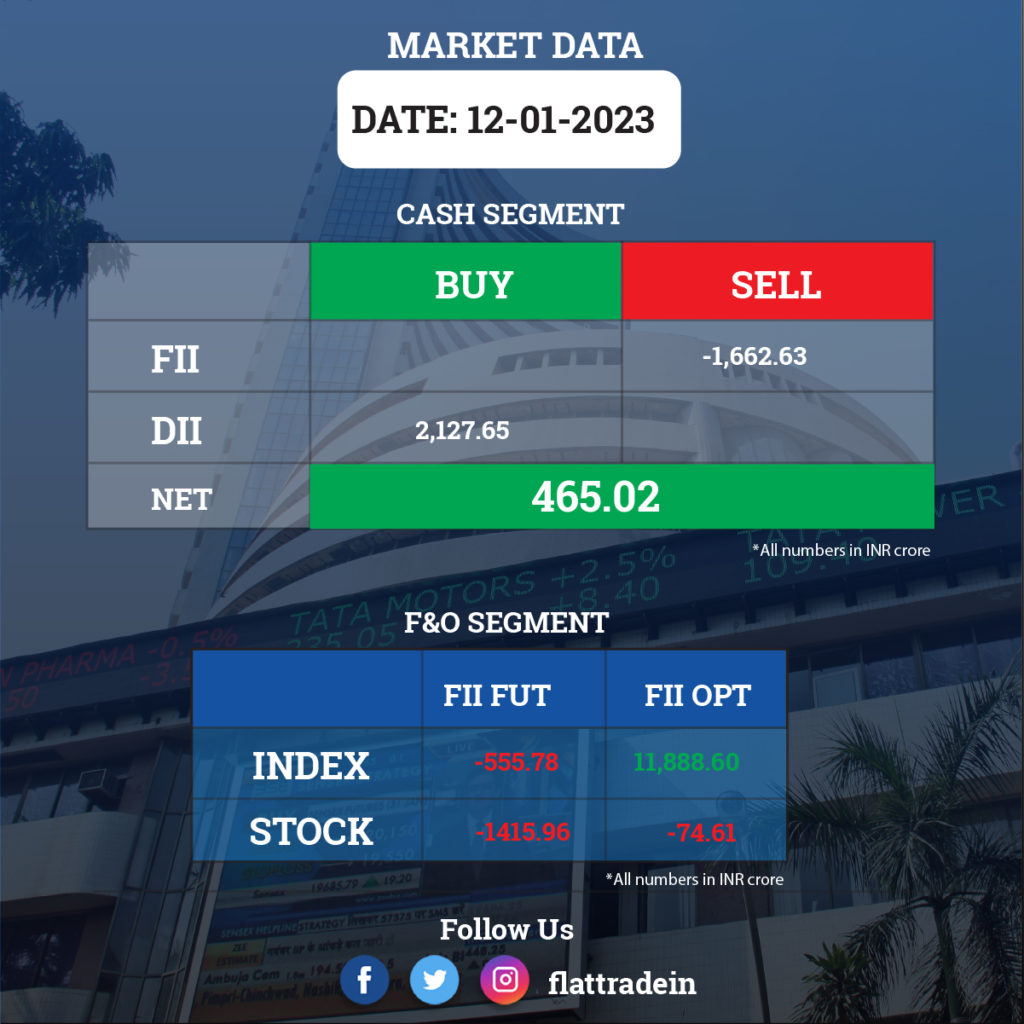

FII/DII Trading Data

Upcoming Results

Wipro, L&T Finance Holdings, Aditya Birla Money, Just Dial, The Anup Engineering, Choice International, Ganesh Housing Corporation, and Rajnish Wellness will be post their quarterly earnings on January 13.

Stocks in News Today

Infosys: The IT behemoth reported a 20.2% year-on-year (YoY) rise in consolidated revenue for the quarter ended December to Rs 38,318 crore. Consolidated net profit rose 13.4% on-year to Rs 6,586 crore. The IT behemoth registered 9.4% QoQ rise in profit and revenue grew by 4.9% QoQ. Revenue in dollar terms increased 2.3% QoQ to $4,659 million and constant currency revenue growth was at 2.4% QoQ for Q3FY23. The company raised its FY23 revenue growth guidance, in constant currency terms, to 16-16.5%, from 15-16% earlier, and EBIT margin guidance remains unchanged at 21-22%.

HCL Technologies: The IT services company reported 19% year-on-year (YoY) growth in consolidated net profit to Rs 4,096 crore. The revenue grew nearly 20% on-year to Rs 26,700 crore. Revenue in dollar terms grew by 5.3% sequentially to $3,244 million with constant currency revenue growth at 5% for the quarter. Total contract value was down 1.6% sequentially to $2,347 million, while the IT attrition rate dropped to 21.7% from 23.8% during the same period. The company lowered EBIT margin guidance to 18-18.5% from 18-19% earlier and revised full year constant currency revenue growth forecast to 13.5-14% from 13.5-14.5% earlier. The company’s board has approved an interim dividend of Rs 10 per equity share for FY23. The record date is set as 20 January, 2023. The payment for the said interim dividend shall be made on 1 February, 2023

L&T Technology Services (LTTS): The company has agreed to acquire the smart world & communication (SWC) Business of L&T. This will enable company to combine synergies and take offerings in next-gen communications, sustainable spaces and cybersecurity to the global market. Smart World & Communication was founded in 2016 to cater to the demands in smart cities, address opportunities and provide smart solutions in the areas of end-to-end communications, city surveillance and intelligent traffic management system for the Government as well as enterprises.

Cyient: The company reported better-than-expected results with a 37% jump in quarterly revenue on the back of a slew of acquisitions that helped counter a weak demand in an uncertain economic environment. Consolidated revenue for the quarter ended December 2022 stood at Rs 1,618 crore, compared with Rs 1,183 crore in the corresponding period last fiscal.

Rail Vikas Nigam: The company has bagged project worth Rs 38.97 crore. It has received letter of award from Southern Railway for the said project.

V-Guard Industries: The company has completed acquisition of 100% shareholding in Sunflame Enterprises for Rs 680.33 crore. Out of the total consideration, Rs 25 crore will be paid by the company to the selling shareholders after two years from the date of closure.

Shriram Finance: Apax Partners, a private equity firm, is likely to sell its entire stake in the company through a block deal on Friday. Dynasty Acquisition, a company linked to Apax Partners, is expected to sell up to 173 lakh shares, representing 4.63% stake in the company. The deal is valued at around Rs 2,200 crore and the sale is expected to take place at a 6% discount to Thursday’s closing price of Rs 1,312.6.

Anand Rathi Wealth: The company reported a 35% year-on-year growth in consolidated profit at Rs 43.22 crore for the quarter ended Q3FY23, backed by operating performance and higher revenue. Consolidated revenue from operations grew by 30.6% YoY to Rs 138 crore in Q3FY23.

GTPL Hathway: The digital cable TV service provider reported a 31% year-on-year decline in profit at Rs 37.6 crore Q3FY23, impacted by weak operating performance. Revenue from operations grew by 15% YoY to Rs 705 crore with digital cable TV business rising 3% and broadband segment growing 18% but EBITDA fell 11% to Rs 131.4 crore and margin contracted to 18.6% from 24.1% on year-on-year basis.

PVR: The Mumbai bench of the National Company Law Tribunal (NCLT) has sanctioned the merger between cinema chains PVR and Inox Leisure. The written order is expected to come out in the next few days. Once the NCLT issues the detailed order copy, the two companies will file the same with regulatory authorities like the Registrar of Companies (RoC) and stock exchanges. The allotment of shares is expected to be completed in the next few weeks.

Reliance Capital: The division bench of the National Company Law Tribunal will hear on January 16 on the company’s proposed auction challenged by Torrent Investments, a bidder in the fray to acquire Anil Ambani promoted financial services company undergoing an insolvency process.