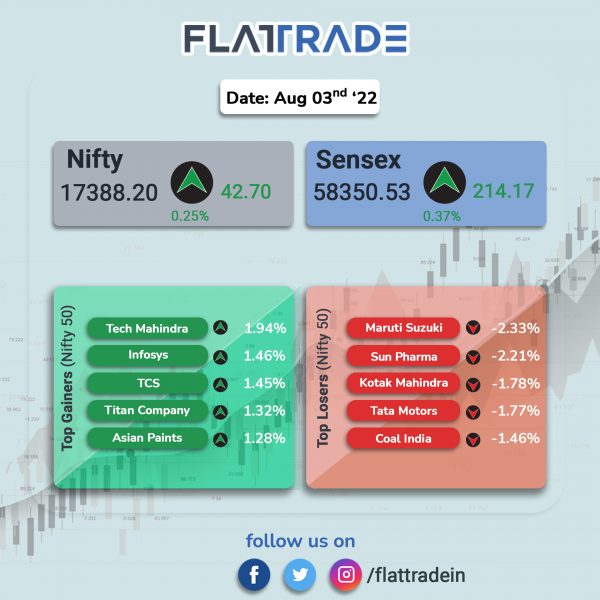

Benchmark indices swung between losses and gains to end higher, boosted by gains in IT stocks. The Sensex rose 0.37% and the Nifty gained 0.25%.

Broader markets underperformed headline indices. The Nifty Midcap 100 fell 0.70% and BSE Smallcap lost 0.28%.

Top Nifty sectoral gainers was IT [1.35%]. Top losers were Auto [-0.8%], Pharma [-0.77%], Realty [-0.76%], PSU Bank [-0.53%] and FMCG [-0.41%].

The Indian rupee fell by 45 paise to 79.16 against the US dollar on Wednesday.

The S&P Global India Services PMI decreased to 55.5 in July 2022 from 59.2 in June 2022, pointing to the weakest expansion in the sector since March this year. The decline was due to weaker sales growth and inflationary pressures that restricted the latest upturn in business activity.

Stock in News Today

Adani Power: The company’s net profit jumped multi-fold to Rs 4,779.86 crore in Q1FY23 from Rs 278.22 crore in the year-ago period. The company’s revenue doubled to Rs 13,723.06 crore in the quarter under review from Rs 6,568.86 crore in the same period last year.

SpiceJet: The budget carrier is expected to be in deal talks with a Middle Eastern carrier for a possible stake sale. The airline’s promoter, Ajay Singh, holds a stake of about 60% in the budget carrier. According to various news reports, a big Middle Eastern airline has expressed interest to pick a 24%stake and a board seat in SpiceJet. A big Indian business conglomerate has also approached Singh for a stake in the airline.

Devyani International: The company reported a consolidated revenue from operations of Rs 704.72 crore in Q1FY23 as against Rs 352.75 crore in the year-ago period. The net income came in at Rs 74.765 crore in Q1FY23 compared with a loss of Rs 33.415 crore in the year-ago period.

Vedanta: The company has joined hands with Detect Technologies for deployment of T-Pulse, a workplace safety software based on AI. Vedanta Group CEO, Sunil Duggal said, “This partnership will further augment Vedanta’s capabilities on technology led safety enablement. Detect Technologies’ AI and computer vision solutions will help us enhance our digital safety monitoring across all business units.”

Siemens: The industrials company said that consolidated revenue was up 12% to Rs 4,258.3 crore in Q1FY23 from Rs 3,801.1 crore in Q1FY22. The company’s net profit fell 12% to Rs 300.7 crore in Q1FY23 from Rs 340 crore Q1FY22. EBITDA stood at at Rs 412.20 crore in the quarter ended June 2022 compared with Rs 469.4 crore in the year-go period.

ICICIDirect: The company has acquired investment networking platform Multipie, which is a web and app based networking platform for the investor community. The deal involves acquisition of Multipie app, technology, brand, domain name, user base and other related matters.

Deepak Nitrite: The company’s revenue came in at Rs 2,057.99 crore in Q1FY23, up 34.84% from Rs 1,526.22 crore in Q1FY22. The company net Profit stood at Rs. 234.62 crore in Q1FY23, down 22.47% from Rs 302.63 crore in June 2021.

Jubilant Pharmova: Shares of the company reacted negatively after the US health regulator concluded audit of the solid dosage formulations facility at Roorkee plant and issued six observations. The company said it will submit an action plan on the observation and engage with the US drug regulator for next steps.

Brigade Enterprises: The company’s total income surged 135%to Rs 920.28 crore in Q1FY23 compared with Rs 391.52 crore in Q1FY22. Net profit stood at Rs 64.65 crore in Q1FY23 as against a loss of Rs 85.89 crore in the year-ago period. “Demand continued to be robust, driven by strong sales in the residential sector during the quarter leasing business picking up and hotels have also started performing well,” said M R Jaishankar, CMD of the company.

Lemon Tree Hotels: The hospitality company reported a consolidated revenue rise of 61% QoQ to Rs 192.03 crore in Q1FY23 from Rs 119.53 crore in the previous quarter. The company posted a net profit of Rs 13.85 crore in the quarter under review as against a net loss of Rs 24.62 crore in the previous quarter. EBITDA jumped four-fold to Rs 87.58 crore in Q1FY23 from Rs 21.58 crore Q4FY22.

Godrej Consumer: The company’s consolidated net profit fell 5% to Rs 345.12 crore in Q1FY23 from Rs 363.24 crore in Q1FY22. Revenue rose 7% to Rs 3124.97 crore in the reported quarter as against Rs 2915.82 crore in the year-ago period. Its EBITDA increased 12% to Rs 520.79 crore in the quarter under review from Rs 463.07 crore in the same period last year.

Chambal Fertilisers: Shares of the company fell over 4% in intraday trading after it posted lower-than-expected results. The company’s consolidated net profit fell to Rs 341.82 crore in Q1FY23 from Rs 381.43 crore in the year-ago period. Revenue doubled to Rs 7,291.18 crore in the reporte quarter as against Rs 3,539.52 crore in the same period last fiscal. The company’s EBITDA rose to 593 crore in Q1FY23 from Rs 581 crore in Q1FY22.

Birlasoft: The company said that its revenue from operations rose to Rs 1154.41 crore in Q1FY23 from Rs 945.31 in the year-ago period. The company’s profit came in at Rs 120.72 crore in Q1FY23 compared with Rs 113.64 in Q1FY22.