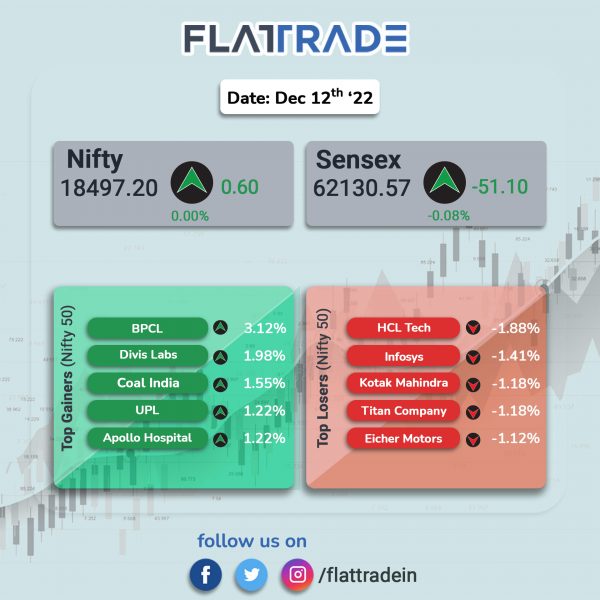

Benchmark equity indices closed flat ahead of India’s retail inflation data for November 2022 that is due later today. The Sensex fell 0.08% and the Nifty 50 index ended flat.

In broader markets, the Nifty Midcap 100 index rose 0.36% and the BSE Smallcap index gained 0.36%.

Top gainers among Nifty sectoral indices were PSU Bank [1.4%], Oil & Gas [1.05%], Realty [0.46%], Metal [0.40%] and Energy [0.30%]. Top losers were IT [-0.40%] and Pharma [-0.13%].

Indian rupee fell 26 paise to 82.53 against the US dollar on Monday.

Direct tax collection, net of refund, stood at Rs 8.77 lakh crore in November 2022. The collection was 24.26% higher than the corresponding period of the preceding year and 61.8% of budget estimates for FY23, said the Finance Ministry.

Stock in News Today

Dalmia Bharat: The company announced the acquisition of cement assets of Jaypee Group’s flagship company, Jaiprakash Associates, and its associate firms for an enterprise value of Rs 5,666 crore. In a regulatory filing, the company’s wholly-owned subsidiary Dalmia Cement Bharat Limited (DCBL) has entered into a binding framework agreement for the acquisition of clinker, cement and power plants from Jaiprakash Associates Limited and its associate company. The deal includes a total cement capacity of 9.4 Million tones (MT) per annum, along with clinker capacity of 6.7 MT and thermal power plants of 280MW for an enterprise value of Rs 5,666 crore, it added.

Oil and Natural Gas Corporation (ONGC): The company said it plans to drill 53 exploratory wells in Andhra Pradesh- 50 in Godavari on-Land PML (Petroleum Mining Lease) Block of KG Basin and three in CD-ONHP-2020/1 (OALP-Vi) Block Of Cuddapah basin with an investment outlay of Rs 2,150 crore. These wells will be converted to development wells and connected to the nearest Early Production System (EPS)/ Gas Collecting Station (GCS) if proved commercially viable, the company added.

Reliance Jio: The telecom arm of Reliance Industries collaborated with global technology brand OnePlus to bring in the evolutionary stand-alone 5G technology ecosystem in the country. Under the collaboration, all the OnePlus 5G devices will be powered by Jio ‘True 5G’ technology. Both the companies have been actively working together at the back-end to make 5G technology more accessible to the consumers and continue to expand their 5G technology services across the product portfolio.

One97 Communications (Paytm): The company said that its loan distribution business rose to 6.8 million loans during October and November, a 150% YoY growth and in terms of value loan disbursement was Rs 6,292 crore, an increase of 374%. The total merchant gross merchandise value (GMV) for the two months ended November 2022 aggregated to Rs 2.28 lakh crore ($28 billion), registering 37% YoY growth, the company said in a regulatory filing. The company is a leader in offline payments with over 5.5 million devices deployed.

Macrotech Developers (Lodha): The company said has raised Rs 3,547 crore through QIP issue. It offered offer shares at a price of Rs 1,026 apiece for the qualified institutional placement (QIP). The offer price was set at Rs 3.25 above floor price of Rs 1,022.75 per share. The company offered 3,45,70,506 equity shares of face value Rs 10 each. The qualified institutional buyers were Kuwait Investment Authority FD 222, Kuwait Investment Authority Fund No. 202, Nomura India Investment Fund Mother Fund, New World Fund Inc and Stitching Depositary APG Emerging Markets Equity Pool.

Punjab National Bank (PNB): Brokerage company JPMorgan revised the bank’s rating to overweight from underweight and raised its target price to Rs 72 from Rs 34 on the stock. The brokerage said the upgrade is due to decrease in company’s net slippages in Q2, recovery momentum outpacing new non-performing loan creation along with minimal stress in corporate loans.

VA Tech Wabag: The water technology company secured a repeat order worth Rs 260 crore from Purolite S.R.L., Romania. The contract is on engineering and procurement basis and includes design and engineering, equipment supply, installation and commissioning of the Purolite Victoria wastewater treatment plant. The project will be executed over 24 months. Shares of the company rose 12.24% in intraday trade.

KPI Green Energy: The company announced that it is developing solar power projects worth 24.90 MWp capacity under the captive power producer (CPP) segment through its subsidiaries. With this, the company’s cumulative capacity of solar power projects under all segments will stand at 63.66 MWp.

Hindustan Oil Exploration: The company resumed oil production from D1 well in its B-80 field, located in western offshore, after arresting a leak in the SCSSV control line. Currently, D1 and D2 wells at the offshore field are on production, and the flow rate of oil and gas of both D1 and D2 wells are about 1800 BOPD and about 9 MMSCFPD of gas, lesser than the capacity of the wells, the company said in an exchange filing.

Jaiprakash Power Ventures: Shares of the company surged over 9% in intraday trade after the company said it will meet on Monday to consider the proposal for divesting Jaypee Nigrie Cement Grinding unit.

Poonawalla Fincorp: The company said that it will meet on December 14 to consider proposal for raising funds or sale of controlling stake in its unit Poonawalla Housing Finance. Shares of the company rose 2.82% in intraday trade.

Escorts Kubota: The company announced that it has appointed Harish Lalchandan has been appointed as Chief Commercial officer to head the domestic tractor business for Agri Machinery with effect from December 12, 2022.

Thomas Cook (India): Shares of surged 11.3% in intraday trade after its subsidiary, Sterling Holiday Resorts, announced the launch of its property, Sterling Arunai Anantha Tiruvannamalai, in Tamil Nadu. It is their 8th resort in the state.

Honeywell Automation India: Shares of the company rose 5.44% in intraday trade after brokerage firm Nomura said it expects recovery in Honeywell’s services and exports to increase margins in the second half of the current fiscal, according to a Bloomberg report. The brokerage kept a ‘buy’ rating on the stock and raised the target price to Rs 50,642.