Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.36% lower at 18,524.50, signalling that Dalal Street was headed for a negative start on Monday.

Asian shares were trading lower as markets awaited rate decisions from the US Federal Reserve and the European Central Bank. The Nikkei 225 index was down 0.29%, the Topix fell 0.14%, the Hang Seng lost 1.495 and the CSI 300 index was 0.56% lower.

Indian rupee settled 15 paise lower at 82.27 against the US dollar on Friday.

Uniparts India will make its stock market debut on Monday. It raised Rs 835.6 crore via the IPO and the price band was in the range of Rs 548-577 apiece.

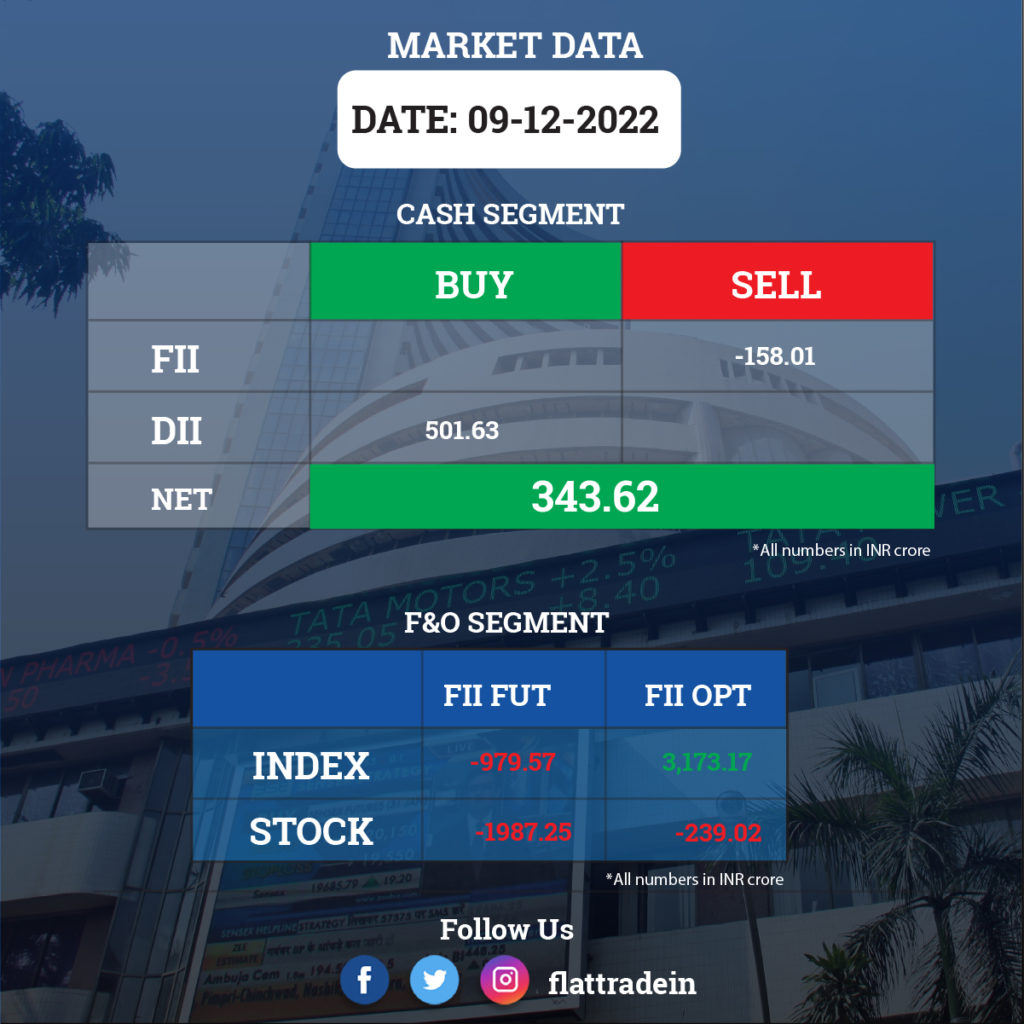

FII/DII Trading Data

Stocks in News Today

Bharti Airtel : The telecom company said it has approved the allotment of 11.88 lakh equity worth $8.6 million (about Rs 71 crore) to those holding its foreign debt bonds issued in January 2020. The company had issued $1-billion foreign currency convertible bonds (FCCBs) that are due for 2025.

NTPC: The state-run power giant said it has commissioned 162.27 MW of solar power capacity at Ettayapuram in Tamil Nadu. With this, standalone installed and commercial capacity of NTPC has reached 57,801.27 MW and the group installed and commercial capacity stood at 70,416.27 MW.

Glenmark Pharmaceuticals: The company has received a warning letter from the US drug regulator for manufacturing lapses, including failure to establish required laboratory control mechanisms, at its Goa-based manufacturing plant. In a letter addressed to Glenmark’s MD Glenn Saldanha, the USFDA pointed out various lapses at the company’s Bardez-based facility in Goa. The USFDA inspected the manufacturing facility from May 12, 2022, to May 20, 2022.

Vodafone Idea: The telecom company and its vendor ATC Telecom Infrastructure have agreed to extend the last date for subscription of Rs 1,600 crore optionally convertible debentures to February 28.

PTC India Financial Services: The company said the board of directors has sanctioned additional loans of Rs 800 crore to various borrowers. The company is committed to perform better in coming quarters to achieve sustainable growth.

PSP Projects: The company has received a letter of intent from Nila Spaces for civil constriction of residential project “VIDA” at GIFT City Gandhinagar, Gujarat. The construction order is worth Rs 121.51 crore. With this, the total order inflow for the financial year 2022-23 till date amounts to Rs 1,833.09 crore.

Kalpataru Power Transmission: The company has raised Rs 99 crore by allotment of 990 NCDs of the face value of Rs 10 lakh each on private placement basis. The said NCDs will be listed on wholesale debt market segment of BSE.

V-Guard Industries: The electricals and home appliances player will acquire Sunflame Enterprises for Rs 660 crore in an all-cash deal. The acquisition will help the company to scale up its kitchen appliances business.

Zydus Lifesciences: The drug maker has received approval from the US health regulator to market Silodosin capsules, which is used in treating prostatic hyperplasia in America. It has also received final approval from the USFDA to market Pregabalin capsules in multiple strengths.

Mahindra Holidays & Resorts India: The hospitality plans to invest up to Rs 1,500 crore in the next three years for expansion purposes, including room additions and resort acquisitions. The company is also considering launching a new upscale brand for managing resorts, through which it would also look to further grow its Club Mahindra memberships.

Apar Industries: HDFC Mutual Fund sold 1 lakh shares in the company via open market transactions on December 7. With this, the fund house shareholding in the company reduced to 6.78%, from 7.04% earlier.

Himatsingka Seide: The board of directors of the company will meet on December 15 to consider fund raising up to Rs 108 crore. They will also consider an issue of non-convertible debentures up to Rs 500 crore, to identified investors.