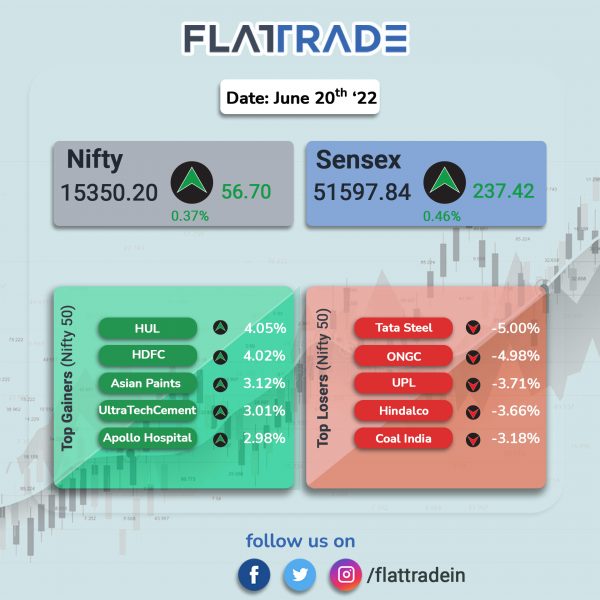

Benchmark equity indices whipsawed to close higher, helped by gains in HDFC twins, FMCG and information technology stocks amid decline in crude oil prices. The Sensex rose 0.46% and the Nifty 50 index gained 0.37%.

Broader markets tumbled amid high volatility. The Nifty Midcap 100 index tanked 2.26% and the BSE Smallcap plunged 2.95%.

Top Nifty sectoral losers were Metal [-3.9%], PSU Bank [-2.49%], Energy [-1.88%], Realty [-1.83%] and Auto [-0.7%]. Top gainers were FMCG [1.8%], Financial Services [0.96%] and IT [0.87%].

Indian rupee rose 9 paise to 77.98 against the US dollar on Monday.

Stock in News Today

Vedanta: Shares of the company tumbled 12.69%, after The Economic Times newspaper carried an advertisement that the Sterlite copper smelter in Tuticorin, Tamil Nadu, is now up for sale. The company had issued an advertisements about the sale and invited Expressions of Interest. The copper smelter plant and sulphuric acid as well as copper refinery are on sale, according to the advertisement. The sale process will be executed in collaboration with Axis Capital.

Vodafone Idea Ltd (VIL): The telco will consider raising up to Rs 500 crores by issuance of equity shares and/or convertible warrants on a preferential basis to one or more entities belonging to Vodafone Group. The company’s board will meet on June 22 to consider the fund raising proposal.

Life Insurance Corporation of India (LIC): Investment bank JPMorgan initiated coverage of the stock with an ‘overweight’ rating and target price of Rs 840 apiece, citing that the market is mispricing the stock

Sun Pharmaceutical Industries: Shares of the company rose 1.5% after brokerage firm Jefferies upgraded the company to ‘buy’ from ‘underperform’ and gave a target price of Rs 910 apiece, up from Rs 775 apiece. Jefferies expects the growth over the next two years to be driven by specialty products such as Ilumya, Cequa, Winlevi. It also cited that the company’s plans to increase its sales force in India by 10% should drive above-industry-level growth for the company.

National Aluminium Co (NALCO): Shares of the company fell 6.8% after the stock was downgraded to ‘sell’ from ‘reduce’ by ICICI Securities citing demand-supply surplus over FY2023-24E. The brokerage also identified price correction in aluminium and alumina as a key downside risk.

NIIT: The company announced that its life sciences division, NIIT Life Sciences, has entered into a multi-year learning services agreement with a Swiss multinational leader in healthcare. NIIT will provide a full range of learning services to streamline their regulatory operations using Veeva Vault RIM suite of applications.

Apollo Tyres: Shares of the company fell more than 3% during intraday trading after the stock was reduced to ‘add’ from ‘buy’ by brokerage firm Axis Capital. The target price was Rs 170 apiece. However, the shares rebounded from losses to close half a percentage point higher.

Delta Corp: Shares of the cruise operator fell 5% after billionaire investor Rakesh Jhunjhunwala sold 5.7 million equity shares of the company through open market.

Greenlam Industries: The company’s board have approved an issue of shares to Smiti Holding and Trading Company worth Rs 195 crore. The company will issue shares up to 63,10,680 at a price of Rs 309 each.