Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.19% lower at 15,286, signalling that Dalal Street was headed for a marginally lower start on Monday.

Most Asian shares were trading lower on worries over global economic growth. Japan’s Nikkei 225 index was down 1.65% and Topix fell 1.44%. China’s Hang Seng lost 0.16%, while CSI 300 rose 0.52%.

Indian rupee remained little changed at 78.07 against the US dollar on Friday.

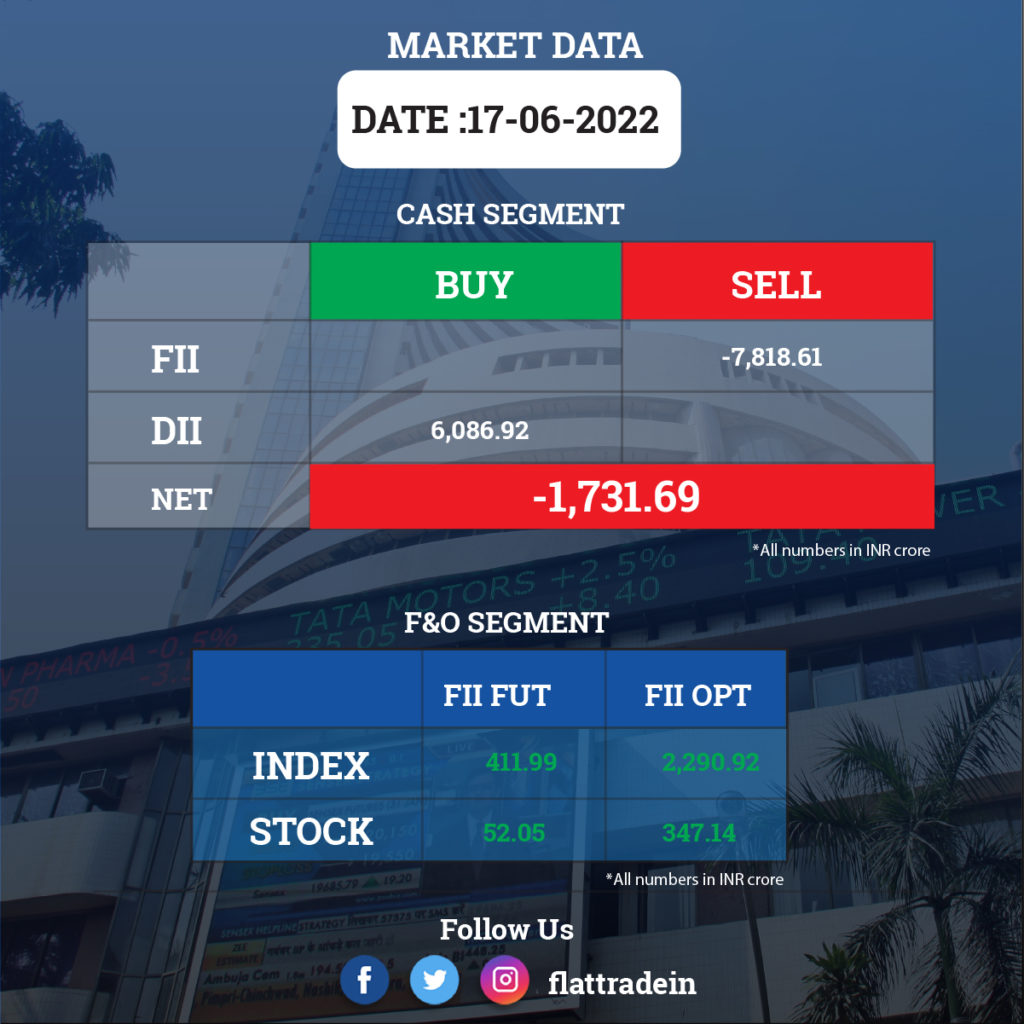

FII/DII Trading Data

Stocks in News Today

Adani Wilmar: The FMCG company slashed the prices of its edible oils by Rs 10 following the government’s move to reduce import duties on the commodity. Adani Wilmar has reduced the maximum retail price (MRP) of Fortune refined Sunflower oil’s 1-litre pack to Rs 210 from Rs 220 and the MRP of Fortune Soyabean and Fortune Kachi Ghani (mustard oil) 1-litre packs has been reduced to Rs 195 from Rs 205.

IndiGo: The airline has started regular operation of its new flight in the Mumbai-Mangaluru-Mumbai sector on Sunday. The daily flight leaves Mumbai at 8.50 AM and reaches Mangaluru at 10.20 AM. Then, the flight leaves Mangaluru at 11 AM to reach Mumbai at 12.40 PM. IndiGo uses Airbus A320 for the new service, a release from the airline said.

ICICI Bank and Axis Bank: Global rating agency Moody’s has upgraded ICICI Bank and Axis Bank’s baseline credit assessments (BCA) to “baa3” indicating medium grade financial strength from “ba1” indicating speculative financial strength. The upgrade in BCA reflects improvements in credit fundamentals – asset quality, capital, and profitability.

TVS Motor: Norton Motorcycles, owned by TVS Motor, plans to develop and build an electric motorcycle in the UK that it claims will have “racing performance, touring range and lightweight handling” as part of a 30-month project co-funded by a government program.

Canara Bank: The public sector lender aims to improve its bottom line further with balanced focus on advances to retail, big and small businesses, coupled with greater focus on digitisation. The bank’s MD and CEO, L V Prabhakar, said in its annual report 2021-22 that there are positive signals for aggregate demand with consumer and business confidence picking up. He added bank credit growth is indicating signs of a gradual recovery and improvement is being observed in exports and imports.

HDFC Life Insurance Company: The company will raise debt capital of up to Rs 350 crore by issuing bonds on a private placement basis. The Capital Raising Committee of the company’s board approved a proposal for raising up to Rs 350 crore through issuance of 3,500 non-convertible debentures, HDFC Life said in a regulatory filing.

Dish TV and YES Bank: The Bombay High Court (HC) rejected an interim application filed by a promoter group entity of Dish TV seeking to restrain YES Bank, a shareholder of the company, from exercising its right over shares held by the bank. This development will pave the way for YES Bank to exercise its voting rights at the upcoming extraordinary general meeting (EGM) of the company that will be held on June 24.

Meanwhile, YES Bank plans to sell Rs 12,000 crore worth bad loans to ARC faces delay as the RBI wants the bank to avoid any conflict of interest with the ARC as YES Bank plans to hold a minority stake in the same ARC.

Cipla: The pharma major said that it will acquire 21.05% stake for Rs 25 crore in Achira Labs Pvt Ltd, which is engaged in development and commercialisation of point of care (PoC) medical test kits in India. The company has signed definitive agreements with Achira Labs for the purpose,

PTC India: The company has signed a pact with Greenstat Hydrogen India to jointly develop green hydrogen solutions for Indian power market beneficiaries. The areas of development shall include feasibility studies and/or project management services for green hydrogen solutions to potential beneficiaries in India.

eMudhra: The company reported a strong 62.2% rise in profit for the financial year ended March 2022 at Rs 41.14 crore when compared with Rs 25.36 crore in FY21. Total income was up 38.7 per cent at Rs 183.74 crore from Rs 132.45 crore.

Indian Hume Pipe: The company said it has bagged a Rs 110-crore pipe order from the Public Health Engineering Department (PHED), Ajmer in Rajasthan. The project is to be completed within 15 months from signing of the agreement, it said.

One97 Communications: The digital financial services firm’s Managing Director Vijay Shekhar Sharma has purchased 1.7 lakh shares of the company worth Rs 11 crore, according to a regulatory filing.

South Indian Bank: The private sector lender has raised the marginal cost of funds based lending rates (MCLR) by up to 0.2% across various tenors to be effective from Monday. The MCLR applicable for multiple tenors has been revised with effect from June 20.