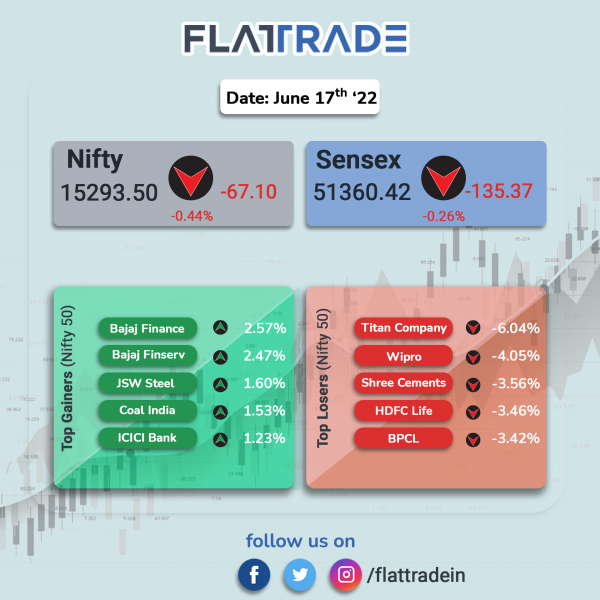

Benchmark equity indices fell in a choppy session, dragged by information technology and metal stocks as well as weak market sentiments due to a possible recession. The Sensex dropped 0.26% and the Nifty 50 lost 0.44%.

Broader markets also mirrored headline indices. The Nifty Midcap 100 slumped 1.16% and the BSE Smallcap dropped 0.88%.

Top Nifty sectoral losers were Pharma [-2.18%], IT [-1.49%], Auto [-1.15%], FMCG [-0.97%] and Energy [-0.88%]. Top gainers were Pvt Bank [0.41%], Bank [0.39%] and Financial Services [0.38%].

Indian rupee remained little changed at 78.07 against the US dollar on Friday.

Stock in News Today

HDFC Life Insurance Company: The company’s board has approved issuing non-convertible debentures (NCDs) aggregating upto Rs 350 crore on private placement basis. The coupon rate for the same has been decided at 8.20% per annum.

GAIL: Brokerage firm Jefferies said that GAIL is expected to gain due to rising Liquefied Natural Gas (LNG) prices. Over the last two days, global LNG prices have risen 60% amid gas shortage in key EU countries. The prices are likely to remain elevated through FY2022-23E, according to Jefferies. The brokerage added that consumer gas distribution companies could face pressure due to higher LNG price and lead to a reduction in industrial volumes.

Delta Corp: Shares of the company zoomed 12.6% apiece after the company’s gaming unit Deltatech Gaming filed for an IPO. Adda52 owner Deltatech Gaming, a subsidiary of casino operator Delta Corp, has filed for a Rs 550-crore IPO. The IPO will comprise of a fresh issues of shares worth Rs 300 crore and an offer for sale for up to Rs 250 crore.

Maruti Suzuki India (MSI): The carmaker said it has invested around Rs 2 crore in Sociograph Solutions Pvt Ltd (SSPL), a startup specialising in artificial intelligence. The investment is part of the company’s initiative to support startups with promising mobility solutions.

Sugar manufacturing companies: Shares of sugar producers closed lower after Reuters reported that India is mulling to impose a ceiling on sugar exports for the second straight year starting this October, citing industry and government sources. India could cap sugar exports at 6 million to 7 million tonnes in the 2022-23 season, 33% less that the total to be shipped out in the ongoing 2021-22 season, according to the Reuters report. The decision was to ensure ample domestic supplies and maintain price stability.

Sun TV Network: Shares of the company gained 6.11% after Kotak Institutional Equities upgraded the stock to ‘buy’ from ‘reduce’ and raised the company’s target price to Rs 540 from Rs 460. The brokerage firm said Sun TV has gained market share from Zee Tamil and the viewership of Sun TV has stabilised after seven years of consistent market share decline. This could result in ad-revenue growth.

Infosys: The Bengaluru-based IT services company has hiked its internal promotions by 3.5 times compared to last year and further doubled the employee stock ownership plan coverage over the last two years to keep the talent, according Economic Times news report. This comes as the Indian IT industry has been battling high attrition rates.

Grasim Industries: The Aditya Birla group firm announced the appointment of Pavan Jain as its next chief financial officer with effect from 15 August 2022. Jain has been with the group since 1991 and he is presently the Senior President of Grasim Industries. He will replace Ashish Adukia, who is currently the CFO of the company.

Coforge: Shares of the company rose after Antique Stock Broking upgraded the stock to ‘buy’, citing demand for cloud solutions and robust order book as an important key growth driver. The target price is cut to Rs 4,700 from Rs 5,200 per equity share.

Rajesh Exports: Shares of the company rose over 6% after ELest, a firm promoted by co-founders of Rajesh Exports, entered into an MoU with Telangana government to set up AMOLED Display FAB for manufacturing AMOLED Display units with an investment of Rs 24,000 crore.

Delhivery: The logistics company has launched its guaranteed same-day delivery service in 15 key cities in India. Delhivery will partner with brands and identify fast-moving SKUs, which will be stocked in warehouses within the city, close to the end consumer.

Godrej Group: The group’s flagship company Godrej & Boyce announced that its business, Godrej Construction, has partnered with Tvasta Manufacturing Solutions, a start-up founded by IIT-Madras alumni, to introduce and commercially deploy innovative 3D Construction Printing (3DCP) Technology in India.

Ratnamani Metals & Tubes: The company has secured new orders aggregating to Rs 203 crore including export orders worth Rs 187 crore, expected to be executed within the financial year 2022-23. The company provides critical tubing and piping solutions to diverse range of industries & niche markets.

Larsen & Toubro Infotech (LTI): The company has expanded its operations in Kolkata by setting up a new facility in the city. The new center marks company’s expansion in the Eastern region of the country and is designed to meet the requirements of a futuristic and modern workplace. The facility will be located in the Salt Lake Electronics Complex and house more than 300 employees.