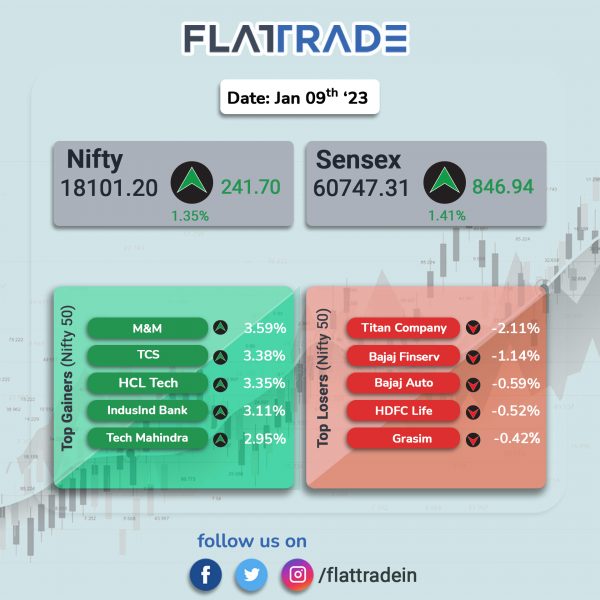

Major Indian indices snapped three days of downtrend to close higher by more than 1% on positive global cues and ahead of quarterly earnings reports from Corporate India. The Sensex rose 1.41% and the Nifty ended 1.35% higher.

In broader markets, the Nifty Midcap 100 index rose 0.94% and the BSE Smallcap index 0.50%.

Top gainers among Nifty sectoral indices were IT [2.83%], Energy [1.69%], Metal [1.43%], Oil & Gas [1.39%] and Auto [1.23%]. All indices closed in the green.

Indian rupee rose 36 paise to 82.36 against the US dollar on Monday.

Stock in News Today

Paytm: The fintech company said its loan distribution business recorded disbursals of Rs 3,665 crore in December 2022, growing 330% YoY. Total disbursements for three months ended December 2022 was Rs 9,958 crore, a growth of 357% YoY. The number of loans grew 117% YoY to 3.7 million in December, and 137% YoY to 10.5 million cumulative loans for the three months ended December 2022. The company said that its average monthly transacting users (MTU) stood at 85 million for the quarter ended December 2022, up 32% YoY. Merchant payment volumes (GMV) for the quarter ended December 2022 at Rs 3.46 lakh crore ($42 billion), YoY growth of 38%. Sahres of the company closed 2.3% higher.

PVR: The theatre operator said it has opened three new multiplexes in Jaipur, Bengaluru and Gurugram with a total count of 19 screens. With this, the company has achieved a major milestone of reaching 900 screens across 78 cities in India. The company further said that the opening of these cinemas are in accordance with the expansion strategy of the company to open over 100 screens in the current financial year.

Larsen & Toubro (L&T): The company’s heavy engineering arm has won multiple significant orders in Q3 of FY23. As per L&T’s classification, the value of the multiple order lies between Rs 1,000 to Rs 2,500 crore. In the overseas market, L&T Heavy Engineering secured orders for one of the heaviest reactors and screw plug heat exchangers for a refinery in Mexico. On the domestic front, L&T Heavy Engineering secured orders to manufacture critical residue upgrading reactors and to design & manufacture high-pressure screw plug heat exchangers with complex Cr-Mo-V steel material for Indian Oil Corporation (IOCL’s) Panipat Refinery P25 Expansion Project.

SBI Cards and Payment Services: The company said that its board approved re-appointment of Rama Mohan Rao Amara as managing director (MD) & chief executive officer (CEO) of the company for a further period of one year effective from 30 January 2023. Rama Mohan Rao Amara has been nominated by State Bank of India for the re-appointment. It is, however, subject to approval of shareholders and other necessary approvals as may be required.

Delhivery: Good Glamm Group and the logistics company have partnered to implement end-to-end supply chain solutions and increase customer satisfaction. Good Glamm Group plans to leverage Delhivey’s pan-India network to reach Tier 3 and 4 markets, where Delhivery has a strong presence, as it looks to accelerate sales from Tier 1 and 2 cities.

Laurus Labs: Akash Bhanshali of Enam Holdings becomes a 1.14% of stakeholder in Laurus Labs Ltd., according the companies shareholding pattern on BSE.

Ajmera Realty & Infra India: The company has recorded sales value of Rs 128 crore for the quarter ended December 2022 and Rs 694 crore in the nine-month period of the current financial year. The company also sold 3.01 lakh square feet of space in the same period. While, the volume sold stood at 63,595 square feet for Q3.

Ashoka Buildcon: The company has emerged as the Lowest Bidder (L-1) for a project from NHAI with a bid value of Rs 2,161 crore. The project entails building four lane elevated corridor and at-grade improvements. Separately, the company has received letters of intent from Dakshinanchal Vidyut Vitran Nigam for two projects worth Rs 807.6 crore.

National Fertilizers: The company in an exchange filing announced that it has recorded total fertilizer sales of 49.71 lakh MT in the first nine months of FY23 compared to 39.25 lakh MT in the same period last year. Its agrochemical business also registered 146% year-on-year growth during the same nine-month period.

TARC: The company said that it has clocked sales worth Rs 350 crore for its recently launched luxury residential project TARC Tripundra in Delhi. The gated community project with various luxurious amenities has sales potential of around Rs 900 crore, with approximately 5 lakh square feet of saleable area. TARC Tripundra is located at New Delhi’s Bijwasan Road and it has easy access to the lndira Gandhi lnternational Airport, Cyber City and Aerocity.

Best Agrolife: The company’s wholly-owned subsidiary, Best Crop Science, received registration for the indigenous manufacturing of Propaquizafop technical and Cyhalofop Butyl technical. The registration was granted by the Central Insecticides Board & Registration Committee at its 443rd meeting.

Hi-Tech Pipes: The company signed a memorandum of understanding (MoU) with government of Uttar Pradesh to set up a mega manufacturing facility of steel tubes & pipes and flat steel processing. Under this MoU, the company would invest Rs 510 crore in a phased manner. The favourable business environment and the special incentive packages offered by the U.P. government will help the company to strengthen its position in the steel tubes & pipes and flat steel processing industry.

Mahindra & Mahindra (M&M): The company introduced an all-new range of Thar. The all-new range includes Rear Wheel Drive (RWD) variants in two engine options (diesel and petrol) and enhanced capability in the Four Wheel Drive (4WD) variants. The new Thar range starts at a price of Rs 9.99 lakh.

JSW Steel: The group has a combined crude steel production for Q3FY23 was 6.24 million tonnes, registering a growth of 17% YoY. JSW Steel had recorded crude steel production of 5.35 million tonnes in Q3FY22. The crude steel production was sequentially higher by 10%, primarily due to improved average capacity utilisation to 91% as against 84% in Q2FY23 at JSW Steel and BPSL.

GHCL: The company has received requisite regulatory approval for increase in its soda ash production capacity from 11 lakh ton per annum (TPA) to 12 lakh TPA, as per terms and condition.