Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.13% lower at 18,150, signalling that Dalal Street was headed for a negative start on Tuesday.

Asian shares were mixed as investors were cautious after Federal Reserve officials indicated that the central bank will likely raise interest rates before pausing. Japan’s Nikkei 225 index rose 0.95% and the Topix traded 0.55% higher, while China’s CSI 300 index slipped 0.04% and Hang Seng fell 0.24%.

Indian rupee rose 36 paise to 82.36 against the US dollar on Monday.

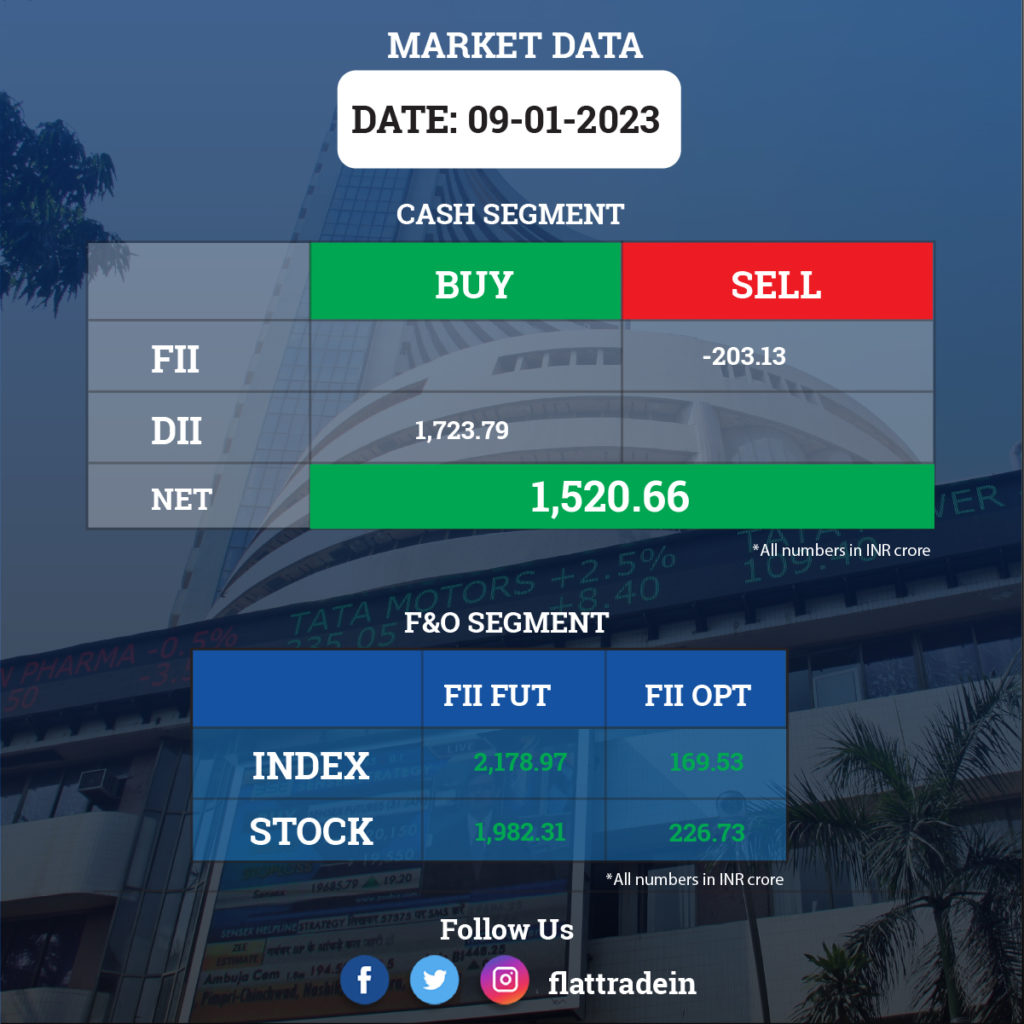

FII/DII Trading Data

Upcoming Results

Atharv Enterprises, Excel Realty N Infra, Gala Global Products, GI Engineering Solutions, Marsons, Quest Capital Markets, and Visagar Financial Services will be in focus ahead of quarterly earnings on January 10.

Stocks in News Today

Tata Consultancy Services (TCS): The IT services and consultancy company reported 19% YoY growth in consolidated revenue in Q3FY23 at Rs 58,229 crore, which above consensus. The net profit rose 11% YoY to Rs 10,846 crore and the software company announced a special dividend of Rs 67 per share and an interim dividend of Rs 8 per share. The IT company reported an operating margin at 24.5% during the reported quarter. Its attrition stood at 21.3% in Q3FY23 as against 21.5% in Q2FY23. The company has an order book of $7.8 billion.

Tata Motors: The automaker’s global wholesales increased 13% YoY in the December 2022 quarter to 3.23 lakh units. Passenger vehicles sales were up 23% during the period at 2.25 lakh units. Its subsidiary Jaguar Land Rover saw a 15% YoY rise in wholesale sales volumes to 79,591 units in the December 2022 quarter due to increase in production amid improvement in chip supplies. The luxury carmaker’s retail sales grew by 5.9% to 84,827 units. JLR expects free cash flow to be positive by over 400 million pounds in Q3.

Reliance Jio Infocomm: The telecom arm of Reliance Industries Limited has launched 5G wireless services in 10 cities across 4 states — Uttar Pradesh, Andhra Pradesh, Kerala, and Maharashtra. The 5G services have been launched in following cities: Agra, Kanpur, Meerut, Prayagraj, Tirupati, Nellore, Kozhikode, Thrissur, Nagpur, and Ahmednagar.

IDBI Bank: Department of Investment and Public Asset Management (DIPAM) Secretary Tuhin Kanta Pandey said that the government will soon notify the exemption period for meeting the public-shareholding norm for the prospective owner of IDBI Bank. The government has so far received interests from both global and domestic investors to acquire a majority stake in IDBI Bank. Teh government expects to close the deal by September-October.

JSW Steel: The steelmaker’s crude steel output rose 17% on year to 6.24 million tonne in the December quarter, aided by an improved average capacity utilisation.

Star Health Life Insurance: The insurance major’s gross direct premium as of end of December 2022 stood at Rs 8,752 crore, up 13% from the year-ago period. Gross direct premium in personal accident segment increased 23% to Rs 133.5 crore, health-retail segment witnessed 19% growth at Rs 8,045.50 crore. Gross direct premium in health-group segment declined 38% to Rs 571.70 crore.

IRB Infrastructure Developers: The company and its subsidiary IRB Infrastructure Pvt Ltd reported a 32% YoY growth in gross toll collection to Rs 388 crore in December 2022. The toll collection by the 5 special purpose vehicles (SPVs) of IRB InvIT Fund surged 18% YoY to Rs 77.7 crore.

Lupin: The company has got approval from Spain’s health ministry for part reimbursement of retail price to patients for its NaMuscla drug, used to treat non-dystrophic myotonic related disorders.

Indian Overseas Bank: The bank has increased its marginal cost of funds-based lending rates or MCLR by 5 bps across tenures, from Tuesday. Following the hike, rates on loans will be in the range of 7.70-8.45%.

Indian Energy Exchange: The shares buyback worth Rs 98 crore will open on January 11. The maximum price for the buyback has been set at Rs 200 a share.

Sona BLW Precision: The auto component maker will acquire 54% stake in Serbia-based Novelic for 40.5 mln euros. Novelic manufactures radar sensors, and through this acquisition, Sona BLW plans to expand its business in autonomous and connected vehicle technologies.

Rajnish Wellness: Shares of the company will trade ex-split from the face value of Rs 2 to Re 1 per share i.e. in the ratio of 1:2. Ahead of the stock split date, the stock hit a 5% upper circuit on Monday.