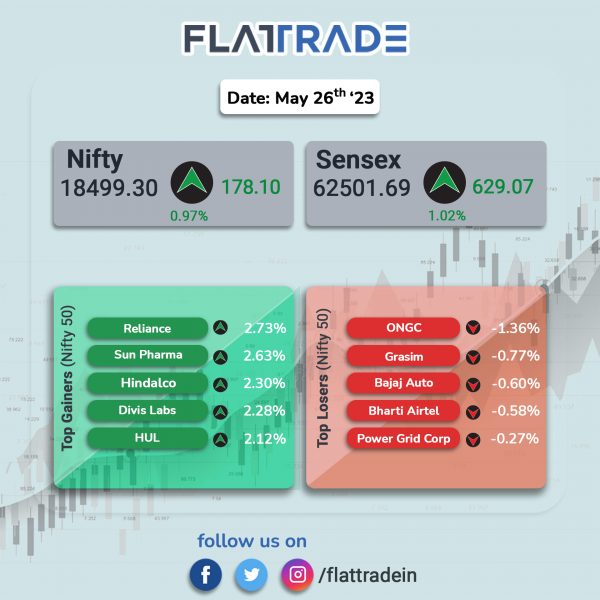

Dalal Street ended higher on improved risk appetite and strong buying across sectors. The Sensex jumped 1.02% and the Nifty 50 index rose 0.97%.

In broader markets, the Nifty Midcap 100 index gained 0.81% and the BSE Smallcap index advanced 0.49%.

Top gainers were Media [2.24%], IT [1.48%], FMCG [1.47%], Realty [1.25%], and PSU Bank [1.21%]. All other indices closed in the green.

Indian rupee appreciated by 17 paise to close at 82.57 against the US dollar on Friday.

Stock in News Today

Grasim Industries: The company’s consolidated net profit declined 4% to Rs 1,369 crore in Q4FY23 as against Rs 1,419 crore recorded in Q4FY22. Consolidated revenue from operations grew by 16% year on year to Rs 33,462 crore in the quarter ended March 2023. The rise in the revenue was mainly contributed by the strong performance of key subsidiaries. EBITDA improved by 5% to Rs 4,873 crore in Q4FY23 as against Rs 4,647 crore posted in Q4FY22. The company’s board has recommended a dividend of Rs 10 per equity share for FY23, subject to approval of shareholders at the ensuing AGM.

Mahindra & Mahindra (M&M): The company’s standalone net profit rose 22.1% to Rs 1,548.97 crore on 30.94% jump in revenue from operations to Rs 22,571.37 crore in Q4 FY23 over Q4 FY22. The passenger vehicle maker said that its operational profits improved significantly, as a result of volume growth, timely pricing actions, easing commodity inflation and stringent control over fixed costs. EBITDA grew 44% to Rs 2,797 crore in Q4FY23 from Rs 1,936 crore posted in Q4FY22. The automobile major recommended dividend of Rs 16.25 per ordinary (equity) share. The auto major reported an exceptional loss of Rs 511.83 crore, representing impairment provision for certain long-term investments, and gain on sale of certain investments.

Sun Pharmaceuticals: The company’s net profit stood at Rs 1984.5 crore in Q4FY23 as against a net loss of Rs 2277 crore in the year-ago period. Revenue rose 15.7% to Rs 10930.6 crore in Q4FY23 from Rs 9446.8 core in Q4FY22. EBITDA rose 19.7% YoY to Rs 2803 crore in Q4FY23 from RS 2340.4 crore in Q4FY22. Domestic formulation sales was up 8.7% YoY at Rs 3364 crore, while the US sales stood at $430 million, a growth of 10.5% YoY.

Info Edge: The company which operates job portal Naukri said that its net loss stood at Rs 272.8 crore in Q4FY23 as against a net loss of Rs 116.5 crore in the preceding quarter. Revenue was up 2.6% QoQ at Rs 604.7 crore in Q4FY23 as against Rs 589.5 crore in Q3FY23. EBITDA was down 1.6% QoQ at Rs 185.4 crore in Q4FY23 as against Rs 188.5 crore in the third quarter of FY23.

Zee Entertainment Enterprises (ZEE): Shares of the company surged 6.8% on Friday after NCLAT set aside NCLT’s order directing exchanges — BSE and NSE — to reconsider the ZEE-Sony merger approval, as flagged by SEBI. The division bench of Justice Rakesh Kumar and a technical member Alok Srivastava in its oral order has set aside the May 11 order of the Mumbai bench of the National Company Law Tribunal (NCLT).

Adani Wilmar: The company said it has forayed into the whole wheat category with its brand Fortune, according to its regulatory filing. The company guarantees to provide premium wheat seed varieties such as Sharbati, Poorna 1544, Lokwan, and MP Grade 1. It also said the company aims to consistently increase market share and expand into high-value metro markets such as New Delhi, Mumbai, Pune, Surat, and Ahmedabad.

GVK Power: The company reported a net loss of Rs 35.8 crore in Q4FY23 as against a net profit of Rs 52.6 crore in Q4FY22. Revenue plunged 69.1% YoY to Rs 186.2 crore in Q4FY23 as against Rs 602.1 crore in Q4FY22. EBITDA was down 49.4% YoY at Rs 106.5 crore in Q4FY23 as against Rs 210.3 crore in Q4FY22.

Samvardhana Motherson: The company’s net profit stood at Rs 654 crore in Q4FY23 as against Rs 122 crore in Q4FY22. Revenue was up 30.4% YoY at Rs 22,476.8 crore in Q4FY23 as against Rs 17,241.4 crore in Q4FY22. EBITDA jumped 59.7% YoY at Rs 2,020.7 crore in Q4FY23 as against Rs 1,265.1 crore in Q4FY22.

PG Electroplast: The company’s net profit was up 45.6% YoY at Rs 40.2 crore in Q4FY23 as against Rs 28 crore in Q4FY22. Revenue was up 61.2% YoY at Rs 828.2 crore in Q4FY23 as against Rs 513.7 crore in Q4FY22. EBITDA was up 51.7% YoY at Rs 75.8 crore in Q4FY23 as against Rs 50 crore in Q4FY22.

Nucleus Software Exports: The company’s net profit was up 76.5% at Rs 67.6 crore in Q4FY23 as against Rs 38 crore in the preceding quarter. Revenue was up 21.8% at Rs 206.2 crore in Q4FY23 as against Rs 169.3 crore in Q3FY23. EBITDA was up 72.9% at Rs 82.8 crore in Q4FY23 as against Rs 47.9 crore in the preceding quarter of FY23.

BEML: The company’s net profit was up 18.2% YoY at Rs 157.7 crore in Q4FY23 as against Rs 133 crore in Q4FY22. Revenue was down 17.6% at Rs 1,388 crore in Q4FY23 as against Rs 1,683.5 crore in Q4FY22. EBITDA was up 25% at Rs 287 crore in Q4FY23 as against Rs 229.6 crore in Q4FY22.

Gateway Distripark: The company’s net profit fell 19.4% to Rs 68.5 crore in Q4FY23 as against Rs 85 crore in the year-ago period. Revenue rose 5% to Rs 377 crore in Q4FY23 from Rs 359 crore in Q4FY22. EBITDA was down 1.6% at Rs 93.5 crore in Q4FY23 as against Rs 95 crore in Q4FY22.

eClerx Services: The company’s consolidated net profit rose 11.6% YoY to Rs 132.55 crore on 17.1% YoY rise in revenue from operations to Rs 693.10 crore in Q4FY23 over Q4FY22. EBITDA stood at Rs 211.9 crore, while EBITDA margin was at 30.3% in Q4FY23. On full year basis, the company’s net profit jumped 17.1% to Rs 488.82 crore on 22.6% rise in revenue from operations to Rs 2,647.90 crore in FY23 over FY22. Meanwhile, the board has recommended a dividend of Rs 1 per equity share for FY23, subject to approval of shareholders.

Aster DM Healthcare: The company’s consolidated net profit declined 24.5% to Rs 170.77 crore in Q4FY23 from Rs 226.27 crore posted in Q4FY22. Revenue from operations jumped 19.6% YoY to Rs 3,262.32 crore in the quarter ended 31 March 2023. EBITDA (excluding other income) stood at Rs 506 crore in Q4FY23, registering a growth of 9% YoY. On full year basis, the company’s consolidated net profit dropped 19.2% to Rs 424.91 crore despite of 16.4% rise in revenue to Rs 11,932.88 crore in FY23 over FY22. Meanwhile, Aster DM received interest and indicative terms from potential buyers for its ‘Gulf Co-operation Council’ region business. Binding bids are likely to be received by end of Q1 of FY2024, according to its exchange filing.

Voltamp Transformers: The company’s net profit jumped 47.6% to Rs 76.57 crore in Q4FY23 as compared with Rs 51.86 crore in Q4FY22. Revenue from operations rose 13.6% YoY to Rs 439.86 crore in Q4FY23. On full year basis, the company’s net profit jumped 50.5% to Rs 199.94 crore on 22.9% increase in revenue from operations to Rs 1,385.10 crore in FY23 over FY22. Shares of the company rose over 19% in intraday trade on Friday.

Radico Khaitan: The liquor maker’s standalone net profit slipped 19.6% to Rs 37.26 crore in Q4FY23 as against Rs 46.36 crore recorded in Q4FY22. Net revenue from operations was at Rs 831.84 crore during the quarter, up 2.4% from Rs 812.52 crore reported in the corresponding quarter previous year. Total Indian Made Foreign Liquor (IMFL) volume declined 0.7% whereas Prestige & Above category volume grew 17.4%. EBITDA in Q4FY23 stood at Rs 80.1 crore, down 1.3% as against Rs 81.2 crore posted in Q4FY22. o still remains volatile, said the company.

Aurobindo Pharma: The company said that its wholly owned subsidiary Eugia Pharma Specialties has received a final approval from the US Food & Drug Administration (USFDA) to manufacture and market Carboprost Tromethamine Injection, which is indicated for the treatment of postpartum hemorrhage. The approved product has an estimated market size of around $51.4 million for the twelve months ending March 2023, according to IQVIA.