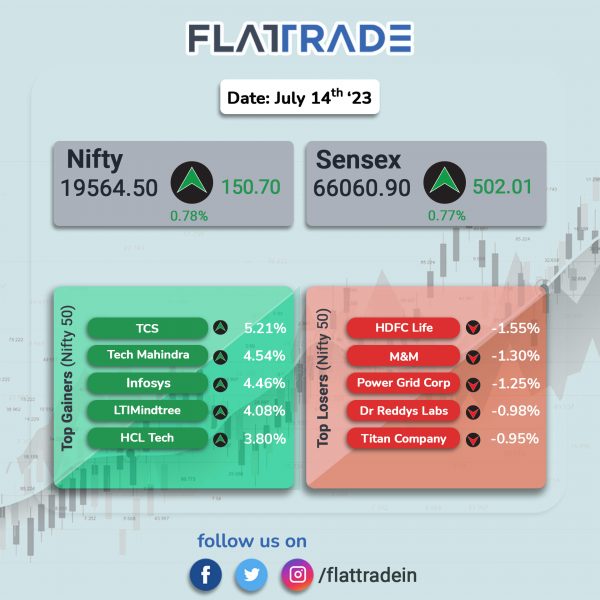

Benchmark stock indices closed at lifetime high as IT stocks soared and overall positive global cues. The Sensex jumped 0.77% and the Nifty gained 0.78%.

In broader markets, the Nifty Midcap 100 rose 1.15% and the BSE Smallcap surged by 1.14%.

Top gainers among Nifty sectoral indices were IT [4.45%], Media [3.94%], Metal [1.41%], Realty [1.16%], and PSU Bank [0.80%]. All Nifty sectoral indices closed with gains, except Energy [-0.01%].

Indian rupee fell by 8 paise to 82.16 against the US dollar on Friday.

The wholesale price-based inflation rate declined to (-) 4.12% in June on easing prices of food, fuel and manufactured items. The wholesale price index (WPI) based inflation in May was (-) 3.48%. In June last year, it was 16.23%. Inflation in food articles declined to (-) 1.24% in June as against (-) 1.59% in May, the Commerce and Industry Ministry said. Fuel and power basket inflation eased to (-) 12.63% in June from (-) 9.17% in May.

India’s merchandise trade deficit in June fell to $20.13 billion from $22.1 billion in May, the government data showed. Merchandise exports stood at $32.97 billion, while imports were $53.10 billion in June. In the previous month, merchandise exports were $34.98 billion, while imports stood at $57.10 billion. Meanwhile, Services exports in June stood at $27.12 billion, while imports were at $15.88 billion. In May, services exports were $25.30 billion and imports were $13.53 billion.

Stock in News Today

State Bank of India (SBI): The lender has raised Rs 3,101 crore capital via additional tier I bonds (AT1) at a coupon of 8.1%, which is 15 basis points lower than the pricing for its previous AT1 bond issued at 8.25% in March 2023. The base issue size for AT1 bonds was Rs 3,000 crore, with green shoe of Rs 7,000 crore. Rating agency CRISIL has assigned an “AA+” rating to AT1 bonds (Under Basel III regulations).

Oil & Natural Gas Corporation (ONGC): The company has signed three agreements with Indradhanush Gas Grid that will help connect ONGC natural gas fields with the North East Gas Grid for transportation of natural gas. ONGC will deliver 1.85 lakh standard cubic meters of gas per day from Jorhat Asset, 82,500 SCMD from Silchar Asset and seven lakh SCMD from Tripura asset to its customers.

Saregama India: Saregama India and Digidrive Distributors have agreed to a scheme of arrangement, where Digidrive Distributors will be demerged and transferred to a resulting company. Further, Digidrive Distributors will issue equity shares to the shareholders of Saregama India, where they will receive 1 fully paid-up equity share of Rs 10 each in Digidrive Distributors for every 5 equity shares of Re 1 each held in Saregama India. Following the allotment, Digidrive Distributors will no longer be a subsidiary of Saregama India.

Orient Electric: The company said that Rajan Gupta has resigned from the position of managing director & chief executive officer (MD & CEO) with effect from the close of business hours on July 14 due to personal reasons. Meanwhile, the board of directors of the company has appointed Desh Deepak Khetrapal as the managing director for a period of one year, effective from July 15, designated as vice chairman and managing director of the company.

Gland Pharma: The company announced the conclusion of USFDA’s GMP inspection at its Hyderabad-based Dundigal facility. In a regulatory filing, the company said that the inspection was done between July 3-14, 2023. The inspection was concluded with ONE (1) 483 Observation. The corrective and preventive actions for this observation will be submitted to the US FDA within the stipulated period, the company said.

Jubilant Foodworks: The company plans to invest Rs 750 crore towards capital expenditure this fiscal to be spent for opening around 220 outlets and others. Sameer Khetarpal, MD and CEO of Jubilant FoodWorks, said the company plans to open 30 to 35 Popeyes restaurants in the current financial year to take the store count to 50 from the present 18 restaurants.

Tata Metaliks: The company reported a net profit of Rs 4.55 crore in Q1FY24 as against a net profit of Rs 1.22 crore in Q1FY23, recording a growth of 273% YoY. Net sales fell by 2.4% YoY to Rs 650.46 crore during the reported quarter. Total expenditure in the first quarter aggregated to Rs 615.31 crore (down 4.2% YoY) and raw material costs for the period under review declined by 25.5% YoY.

Dilip Buildcon: The company announced that it has received the completion certificate for a Maharashtra project. The scope of the project involved construction of access controlled Nagpur-Mumbai super communication expressway (Maharashtra Samruddhi Mahamarg) in Maharashtra on EPC mode. The cost of the project stood at Rs 1,698 crore.

PG Electroplast: The company entered into joint Venture (JV) Agreement with Jaina Group for manufacturing of LED Televisions. The JV’s purpose is to leverage both parties’ expertise and resources to create a strong and competitive business that can meet the growing demand for high-quality televisions. The equity shareholding of the JV company will be 50%-50% between PGEL and JMA.

Ahluwalia Contracts: The company has bagged institutional and residential projects worth Rs 199.6 crore from the Indian Financial Technology and Allied Services. The project will involve work for civil structural, facade, and related external development for the Enterprise Computing and Cybersecurity Training Institute at Bhubaneshwar, Orrisa, and it is expected to be completed within 20 months.

GMR Power and Urban Infra: The company secured an order from Purvanchal Vidyut Vitran Nigam and Dakshinanchal Vidyut Vitran Nigam to install and maintain 75.69 lakh smart metres in the Purvanchal and Dakshinanchal areas of Uttar Pradesh, according to its exchange filing.

Aptech: The company’s board has approved issue of bonus shares in the 2:5 ratio; i.e. two free shares for every shareholder holding five equity shares as of the record date.