Netweb Technologies India plans to raise Rs 631 crore through an initial public offering (IPO). The subscription for the IPO will be open from July 17 to July 19, 2023. The price band is fixed at Rs 475-500 per share.

The IPO comprises of fresh issue of shares worth Rs 206 crore and offer for sale of share worth Rs 425 crore.

The face value of each equity share is Rs 2 and employees of the company will get a discount of Rs 25 per share to the final issue price.

Company Summary

Netweb Technologies India is a leading high-end computing solutions (HCS) provider, with fully integrated design and manufacturing capabilities. The company’s offerings comprises of (i) high performance computing (Supercomputing / HPC) systems; (ii) private cloud and hyperconverged infrastructure (HCI); (iii) AI systems and enterprise workstations; (iv) high performance storage (HPS / Enterprise Storage System) solutions; (v) data centre servers; and (vi) software and services for our HCS offerings.

The company designs, manufactures and deploys its HCS comprising proprietary middleware solutions, end user utilities and pre-compiled application stack. The company develops homegrown storage technologies, deploy supercomputing infrastructure to meet the rising computational demands of businesses, academia, and research organisations, particularly, under India’s National Supercomputing Mission. Further, the company said in its red herring prospectus that three of the company’s supercomputers have been listed 11 times in the world’s top 500 supercomputers.

As of February 28, 2023, the company has undertaken installations of over 300 Supercomputing systems, over 50 private cloud and HCI installations, over 4,000 accelerator / GPU-based AI systems and enterprise workstations, and HPS solutions with throughput storage of up to 450 GB/ sec.

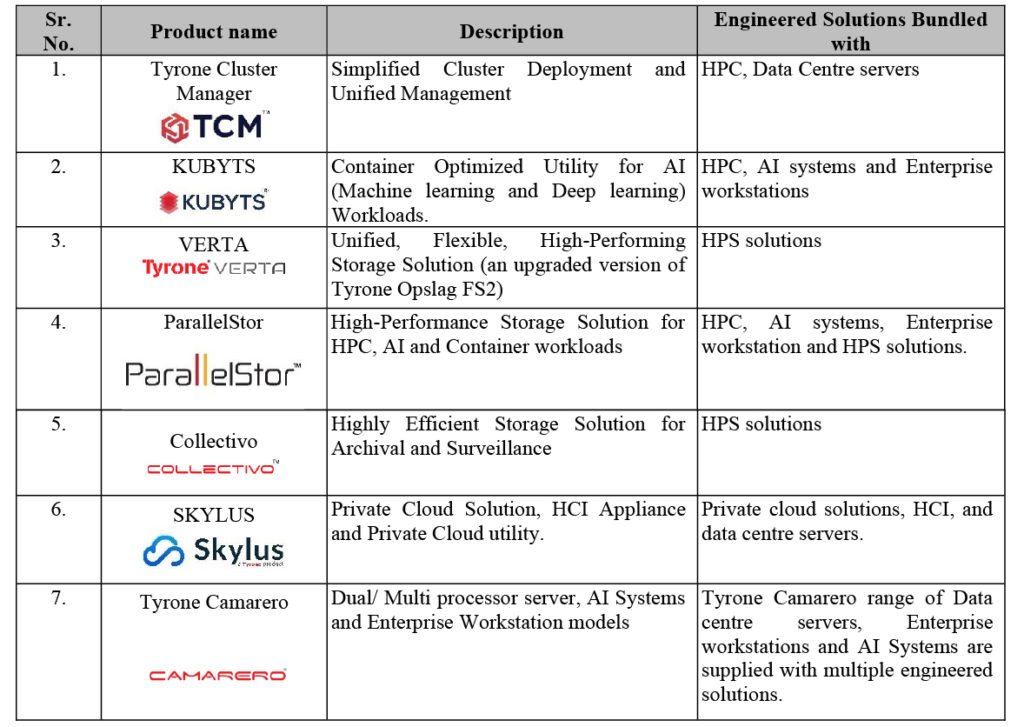

Further, the company sells their products and solutions under the following brands:

Netweb Technologies has marquee customers which include IIT Jammu, IIT Kanpur, Airamatrix, NMDC Data Centre, Graviton, INST, HL Mando, IIIT Naya Raipur, JNU, Hemvati University, Akamai, A.P.T. Portfolio, Yotta Data, CUHP University, Indian Space Research Organisation, and an R&D organisation of the Ministry of Electronics and Information Technology, Government of India, that is involved in carrying out R&D in information technology and electronics and associated areas including supercomputing.

The company also collaborates with various technology partners, such as Intel Americas, Advanced Micro Devices, Samsung India Electronics, Nvidia Corporation, and Seagate India to design and innovate products as well as provide services tailored to specific customer requirements. The order book value stood at Rs 90.21 crore, respectively.

Netweb Technologies has recently forayed into developing new product lines, such as Network Switches and 5G ORAN appliances. Network Switches and 5G ORAN Appliances are critical to the data center industry for enterprise IT, and the telecommunication industry for enabling 5G services.

The company operates manufacturing facility in Faridabad, Haryana, and has 16 offices across India. It also has R&D facilities in Faridabad and Gurgaon, Haryana, and Hyderabad, Telangana (R&D Facilities) and R&D team comprised of 38 members as on May 31, 2023.

Company Strengths

- The company is one of the leading original equipment manufacturers (OEM) for high-end computing solutions (HCS) with integrated design and manufacturing capabilities.

- Netweb Technologies has a long standing relationship with a marquee and diverse customer base.

- Significant product development through innovation and continued investments in R&D.

- The company operates in a rapidly evolving and technologically advanced industry with high entry barriers.

- Experienced board and qualified senior management.

- Consistent track record of financial performance and steady growth.

Company Financials

Period Ended | FY23 | FY22 | FY21 |

Total Assets (Rs in crore) | 265.95 | 148.61 | 110.2 |

Total Revenue (Rs in crore) | 445.65 | 247.94 | 144.29 |

EBITDA (Rs in crore) | 70.69 | 35.51 | 15.89 |

EBITDA Margin | 15.89% | 14.37% | 11.13% |

Profit After Tax (Rs in crore) | 46.94 | 22.45 | 8.23 |

Profit Margin | 10.55% | 9.09% | 5.76% |

Return on Equity (ROE) | 68.01% | 67.85% | 46.41% |

Return on Capital Employed (ROCE) | 64.42% | 51.63% | 35.54% |

Net Debt – Equity Ratio | 0.3 | 0.73 | 1.31 |

Purpose of the IPO

- The net proceeds from fresh issue of shares will be utilised for the following purposes: Funding of the company’s capital expenditure requirements totalling Rs 32.29 crore; Funding of long-term working capital requirements aggregating up to 128.02 crore; and repayment or pre-payment, in full or in part, of certain of the company’s outstanding borrowings totalling Rs 22.50 crore.

- The proceeds from offer for sale (OFS) of 85 lakh shares worth Rs 425 crore shall be received by the selling shareholder and it will not form part of the company’s net proceeds. In addition, the company expects to achieve the benefits of listing on the Indian stock exchanges.

Company Promoters

Sanjay Lodha, Navin Lodha, Vivek Lodha, and Niraj Lodha are the promoters of the company.

IPO Details

|

IPO Subscription Date |

July 17 to July 19, 2023 |

|

Face Value |

Rs 2 per share |

|

Price |

Rs 475 to Rs 500 per share |

|

Lot Size |

30 Shares |

|

Total Issue Size |

1,26,20,000 shares aggregating up to Rs 631 crore |

|

Fresh Issue |

41,20,000 shares aggregating up to Rs 206 crore |

|

Offer for Sale |

85,00,000 shares of Rs 2 aggregating up to Rs 425 crore |

|

Issue Type |

Book Built Issue IPO |

|

Listing At |

BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 30 | Rs 15,000 |

Retail (Maximum) | 13 | 390 | Rs 1,95,000 |

Small HNI (Minimum) | 14 | 420 | Rs 2,10,000 |

Small HNI (Maximum) | 66 | 1,980 | Rs 9,90,000 |

Large HNI (Minimum) | 67 | 2,010 | Rs 10,05,000 |

Allotment Details

Event | Tentative Date |

Allotment of Shares | July 24, 2023 |

Initiation of Refunds | July 25, 2023 |

Credit of Shares to Demat | July 26, 2023 |

Listing Date | July 27, 2023 |

To check allotment, click here