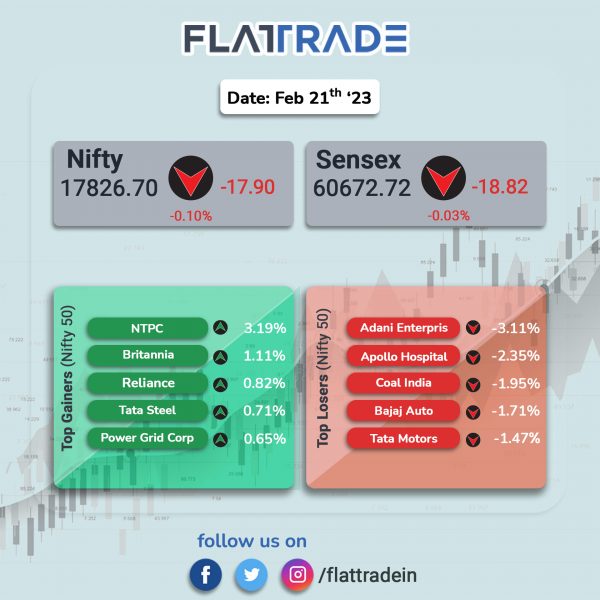

Benchmark indices pared gains and closed marginally lower in a volatile session, weighed by losses in state-owned banks, IT and realty stocks. The Sensex closed 0.03% lower and the Nifty fell 0.1%.

In broader markets, Nifty Midcap 100 fell 0.36% and BSE Smallcap was down 0.31%.

Top losers were PSU Bank [-1.79%], Realty [-1.2%], IT [-0.88%], Media [-0.86%] and Oil & Gas [0.34%]. Top gainers were Energy [0.4%] and FMCG [0.11%].

Indian rupee fell 7 paise to 82.79 against the US dollar on Tuesday.

Stock in News Today

Tata Steel: The company’s board has approved the issue of non-convertible debentures (NCDs) aggregating to Rs 2,150 crore on private placement basis. The NCDs will have a face value of Rs 1 lakh each aggregating to Rs 2,150 crore, will be allotted on 27 February 2023 and will mature on 25 February 2028. The NCDs are proposed to be listed on Wholesale Debt Market Segment of Bombay Stock Exchange (BSE). The NCDs received credit rating of ‘AA+’ by India Ratings and Research (India Ratings) and ‘AA+’ by CARE Ratings.

Cyient: The company announced a partnership with Thingtrax to enable manufacturers to increase efficiency and reduce costs. The partnership will enable global manufacturers to drive higher performance across their entire manufacturing operation through AI-powered data. Cyient’s end-to-end manufacturing services suite and the Thingtrax solution allow manufacturing leaders to improve operational performance by engaging people at every level to embrace a high-performance culture.

Indian Energy Exchange (IEX): Shares of the company jumped 4.2% after the Power Ministry invoked section 11 of the Electricity Act, an Emergency law to push power plants to operate at full capacity, Economic Times reported. The power ministry asked imported coal-based power plants to run at full capacity for three months starting March 16. Power demand is expected to peak around 229 GW in April, the ministry said in a notification.

NTPC: The company’s subsidiary, NTPC Green Energy Ltd (NGEL), has invited bids for rupee denominated term loan of up to Rs 9,000 crore, PTI news reported. The bid document showed that NGEL intends to raise fresh debt and repay outstanding liability of Rs 8,200 crore towards NTPC by March 31, 2023 along with applicable interest cost, the report added. Also, additional funds to the tune of Rs 800 crore would be required for additional debt liability and for balance capex payments of projects which are yet to achieve full commercial operations.

Lupin: The company announced that it has launched Lurasidone Hydrochloride tablets in the US. Lurasidone Hydrochloride tablet is a generic equivalent of Latuda tablets of Sunovion Pharmaceuticals, Inc. Lurasidone is used to treat the symptoms of schizophrenia in adults and children 13 years of age and older. Accroding to IQVIA MAT December 2022, Lurasidone Hydrochloride tablets had estimated annual sales of $4.2 billion in the US.

Central Bank of India: The company has entered into a strategic co-lending partnership with Moneywise Financial Services to offer MSME Loans at competitive rates, subject to regulatory compliance. Under the partnership, Moneywise will originate and process MSME Loan proposals under MSME sector as per jointly formulated credit parameters and eligibility criteria and Central Bank of India will take into its books 80% of the MSME loans under mutually agreed terms. Moneywise Financial Services will service the loan account throughout the life cycle of the loan.

SpiceJet: The low-cost carrier said that its board will meet on 24 February 2023 to consider issuance of equity shares on preferential basis consequent upon conversion of outstanding liabilities into equity shares of the company, subject to applicable regulatory approvals. Further, the board will also consider options for raising fresh capital through issue of eligible securities to qualified institutional buyers, subject to applicable regulatory approvals.

Gujarat Ambuja Exports: The company signed a memorandum of understanding (MoU) with the Government of Gujarat to setup a 900 tonne per day (TPD) Greenfield corn wet-milling plant at Himmatnagar, Gujarat, at a cost of Rs 333 crore. The manufacturing facility would have a capacity of 550 TPD of Maize Starch Powder, 50 TPD of Malto-Dextrin Powder and 300 TPD of Feed Ingredients. The Greenfield expansion is expected to be completed by 2025. With this, the company’s total maize processing capacity will reach 6000 TPD by 2025.

PTC Industries: The company said that its wholly-owned subsidiary, Aerolloy Technologies, has signed a memorandum of understanding (MOU) with Dassault Aviation for supply of titanium cast parts and material to Dassault. Under the MoU, both the companies will evaluate the possibility of Dassault Aviation purchasing Titanium and Super Alloy material, components, and castings for Aerospace applications from Aerolloy Technologies. These titanium castings and components shall be used for Rafale multirole fighters and other Dassault manufactured aircraft, said the company.

Best Agrolife: The company said that its wholly owned subsidiary Seedlings India has received a patent for an invention entitled ‘Synergistic Herbicidal composition of Triazine and Sulfonylurea Herbicides with Phenoxyacetic Herbicide’ for the term of 20 years. The company further informed that the new patent is a combination of Ametryn+2, and 4D+Halosulfuron methyl used for the control of weeds in sugarcane as pre, early post, and post-emergent herbicide.

NIBE: The company’s board has approved allotment of 14,40,779 equity shares aggregating to Rs 52.58 crore on preferential basis. The company will issue up to 14,40,779 preferential shares of face value of Rs 10 per share at an issue price of Rs 365 per share, to non-promoters.

Gayatri Projects: The company reported a net loss of Rs 291.56 crore in the quarter ended December 2022 as against a net loss of Rs 288.13 crore during the quarter ended December 2021. Sales declined 70.97% to Rs 232.89 crore in the quarter ended December 2022 as against Rs 802.37 crore during the quarter ended December 2021.