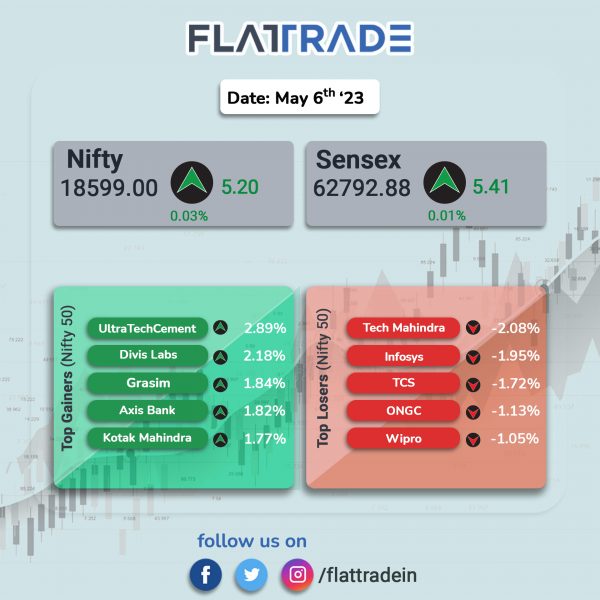

Sensex, Nifty ended flat as gains in auto and pharma stocks were offset by significant losses in IT stocks. The Sensex inched up 0.01% and the Nifty 50 index rose 0.03%.

In broader markets, the Nifty Midcap 100 edged up 0.06% and the BSE Smallcap advanced 0.42%.

Top losers among Nifty sectoral indices were IT [-1.88%], PSU Bank [-0.2%], Media [-0.14%], Metal [-0.14%], and Energy [-0.14%]. Top gainers were Realty [1.19%], Auto [1.09%], Pharma[0.61%], Private Bank [0.22%], and Financial Services [0.21%].

Indian rupee rose 9 paise to 82.6 against the US dollar on Tuesday.

Meanwhile, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) began its three-day meeting on Tuesday. The second bi-monthly monetary policy meeting of FY24 is being held from June 6 to 8 and the committee’s monetary policy decision will be announced on June 8.

Stock in News Today

Bajaj Finserv: The company shares rose 1.37% in intraday trade after the company launched its new mutual fund business under Bajaj Finserv Mutual Fund. Bajaj Finserv Mutual Fund will launch a comprehensive set of products across fixed income, hybrid and equity categories to meet the needs of diverse investor profiles ranging from retail and high net worth individual (HNIs) to institutions. To begin, the company will launch a set of fixed income, liquid, overnight and money market products to cater to the institutional segment and company treasuries.

Larsen & Toubro (L&T): The infrastructure behemoth said that the Buildings and Factories (B&F) Business of L&T Construction has secured ‘significant’ EPC orders in India. According to L&T’s classification, the value of the said contract lies between Rs 1,000 crore to 2,500 crore. The company has secured orders from a developer to construct commercial towers at two locations in Mumbai.

The contract includes construction of tallest commercial building in India of 300.05 meter in height which includes four-level basements and 2 towers of 70 floors & 50 floors respectively with combined BUA of 3.4 million square feet (sq ft). The towers are to be done in 40 months. Further, the contract also entails construction of large commercial building of 5.1 million sq ft which includes four-level basements and 2 towers of 19 floors each with combined BUA of 5.1 million sqf.t. The construction of towers is expected to be completed within 35 months.

Tata Consultancy Services (TCS): The IT behemoth launched data exchange and marketplace platform — Dexam — on Google Cloud. Dexam is a software-as-a-service product that enables data exchange across enterprises and ecosystems.

Axis Bank: Shares of the lender rose over 2% in intraday trade after brokerage firm Jefferies maintained a ‘Buy’ rating with price target of Rs 1,150 apiece on the back of the integration with Citibank. The brokerage firm cited that there is a scope of re-rating with a 16% CAGR over FY23-26 led by topline and some cost synergies. The brokerage also said that after the integration costs are absorbed in FY24, the bank must be ROEs accretive.

NHPC: The state-owned company said that it has entered into a memorandum of understanding (MoU) with Department of Energy, Government of Maharashtra, for establishment of energy storage systems. The agreement entails setting up of pumped energy storage systems along with other renewable energy source like solar/ wind/hybrid, etc. with a total capacity of 7,350 megawatt.

NTPC: The state-run power company said that it has declared commercial operation of second part capacity of 10 megawatt (MW) out of 20 MW Gandhar Solar PV Project at Gandhar, Gujarat. With this, standalone installed and commercial capacity of NTPC will become 56,378 MW, while group installed and commercial capacity of NTPC will become 72,364 MW.

RateGain: The company said that Cem Air, a South African regional airline, has selected RateGain Travel Technologies’ AirGain airline pricing solution to gain real-time pricing insights from over 200+ sources. Cem Air aims to get crucial pricing insights and competitive intelligence data to accelerate growth in an ever-evolving market. AirGain’s user-friendly interface makes it easy to drive swift decision-making and take note of market changes. Cem Air will be able to track and respond to market changes by monitoring dynamic price fluctuations.

Thermax: The company announced that in a arbitration between the company and its customer, the arbitral tribunal has passed an award in favor of the customer, resulting in a cost of Rs 250 crore to the company. In an exchange filing, the company said that the matter of arbitration between Thermax and the customer (claimant) regarding recovery of damages, losses, etc. for breakdown of two gas turbo generator (GTGs), an award has been passed by the arbitral tribunal consisting of sole arbitrator on 5 June 2023. “The company has been advised that the order is not based on proper appreciation of facts and is in the process of challenging the award before the appropriate appellate authority,” Thermax said in a statement.

Sonata Software: The IT services company said that it has announced a strategic partnership with SAP Commerce to drive digital innovation and help businesses to accelerate their digital transformation journey. As part of the partnership, Sonata Software will provide implementation and customization services, integration with third-party systems, and ongoing support and maintenance. The company will also leverage its domain expertise and innovative solutions to enhance the SAP Commerce platform’s functionality and value proposition.

Kirloskar Ferrous Industries: The company announced that the operations of the ‘Mini Blast Furnace – I’ at Koppal plant, Karnataka, have been suspended temporarily with effect from 6 June 2023 for around ninety days. The suspension is for the purpose of replacement of top equipment with bell less top as well as other allied maintenance activities.

Force Motors: Shares of the company surged 13.62% in intraday trade after the company registered 26.04% jump in domestic sales to 2,154 units in May 2023 from 1,709 units sold in May 2022. Export sales stood at 491 units in May 2023, up 54.89% YoY and up 195.78% MoM. The company’s production in May 2023 was at 2,828 units, up by 38.15% from 2,047 units produced in May 2022. The production grew by 21.84% last month from 2,321 units produced in April 2023.

Man Infraconstruction: The company said that its subsidiary, MICL Creators LLP, has acquired development rights from Ghatkopar-based ten adjoining Societies, for a cluster development project with a revenue potential of Rs 1,200 crore. The ten adjoining societies are all located at Ratilal B. Mehta Road (60 Feet Road), Ghatkopar (East), Mumbai, Maharashtra. MICL will develop a luxurious residential project, which will have a saleable carpet area of approximately 4 lakh sq. ft.

Nelco: The Tata Group company surged 19.41% after the company entered into an agreement to acquire 9.09% stake in Piscis Networks for total consideration of Rs 99.99 lakh. Piscis Networks is an OEM engaged in the business of providing SD-WAN solutions (Software Defined Wide Area Network) to organizations to improve their network performance, reliability and security.

Indoco Remedies: The company will acquire 85% stake US-based FPP Holding Company and the company expects the acquisition would help them in solidifying its position as a key player in the US market. FPP Holding is the holding company of Florida Pharmaceutical Products, LLC (FPP) which is based in Florida and engaged in marketing and distribution of generic pharmaceutical products in the USA.

Piramal Pharma: The company said that its Piramal Critical Care (PCC) business has appointed Jeffrey Hampton as president & chief operating officer (COO). He has worked with several leading pharmaceutical companies, including Osmotica Pharmaceuticals, Dabur Pharma and IVAX Pharmaceuticals. Hampton joins PCC from Accord Healthcare, where he was the president and responsible for accelerating the firm’s growth strategy. His career, so far, spans over three decades across sales and marketing, regulatory, commercial operations, sales strategy, distribution, and business development. Hampton holds Bachelor of Science degree in marketing from University of Florida.