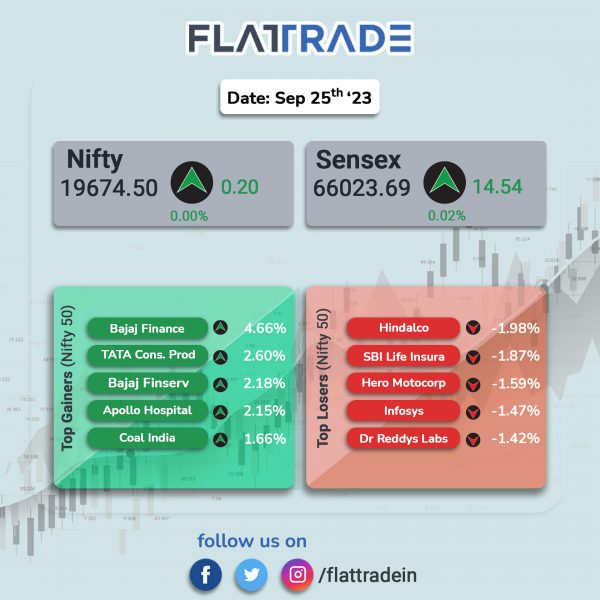

Benchmark stock indices closed flat in a volatile session as investors weighed the latest comments from the Federal Reserve and its impact on global economy. The Sensex ended marginally higher by 0.02% and the Nifty 50 index closed flat.

In broader markets, the Nifty Midcap 100 index jumped 0.66% and the BSE Smallcap rose 0.11%.

Top gainers were Realty [1.52%], Financial Services [0.56%], Private Bank [0.45%], Bank [0.35%], and PSU Bank [0.16%]. Top losers were IT [-0.78%], Media [-0.73%], Pharma [-0.34%], Oil & Gas [-0.25%], and Metal [-0.11%].

The Indian rupee fell 20 paise to 83.14 against the US dollar on Monday.

Stock in News Today

Hero MotoCorp: The two-wheeler manufacturer announced that Karizma XMR will be priced at Rs 1,79,900 onwards (ex-showroom Delhi) effective October 1st, 2023. Hero Karizma XMR will be available at current introductory price of Rs 1,72,900 till midnight of September 30, 2023. The current booking window will close at midnight on September 30, and the date for new booking window will be announced later.

Power Grid: The power transmission company announced that its board has approved raising up to Rs 2,250 crore in FY24 in second tranche on private placement basis as part of its fund raising plans. Power Grid’s bond issue will consists of a base issue size of Rs 500 crore along with a green shoe option of Rs 1,750 crore. The company said that the proceeds will be used to part finance its capex requirements, to provide inter corporate loans to its wholly-owned subsidiaries and joint ventures, and for general corporate purposes.

Religare Enterprises: The financial services company said that the Burman family, which holds a controlling stake in Dabur, announced an open offer for a 26% stake in the company for up to Rs 2,116 crore ($255.03 million), according to a regulatory filing. The family said it aims to acquire up to 90,042,541 shares at Rs 235 each. Earlier, in August, the family acquired a 7.5% stake in Religare Enterprises for Rs 534 crore through open market transactions. Shares plummeted by 6.85% on the NSE.

Shree Cement: The company’s board has approved the issuance of secured, rated, redeemable, taxable, non-convertible debentures (“NCDs”) with a base issue size of Rs 350 crore with an option to retain over-subscription up to Rs 350 crore aggregating to a total issue size of up to Rs 700 crore on private placement basis to certain eligible investors permitted to invest in the NCDs under applicable laws.

Apar Industries: The company said that CARE Ratings upgraded its long-term rating on the bank facilities of the company to “CARE A+; Stable” from “CARE A; Positive”. The rating agency cited strong improvement in operating performance with 53.9% growth in the total operating income in FY23 led by increased volumes sold and premiumisation of product mix across segments. In addition, export revenue increased by 97% YoY backed by improved mix of premium products.

Satin Creditcare Network: The company announced that it has received the first tranche of Rs 14.77 crore under the category III of the Assam Micro Finance Incentive and Relief Scheme 2021 (AMFIRS). The scheme was introduced in August 2021, wherein, the MFIs signed a MoU with the Government of Assam for the joint implementation of AMFIRS with the aim of providing financial relief from the government to the microfinance borrowers in Assam to aid them in continuing to maintain strong credit discipline.

Strides Pharma Science: The company’s step‐down wholly owned subsidiary in Singapore received the USFDA nod for Icosapent Ethyl capsules, which are used in conjunction with other medicines like statins to reduce the risk of heart attack, stroke and heart issues in those afflicted with cardiovascular disease. The product will be manufactured at the company’s facility in Bengaluru. The capsules has a market size of $1.3 billion, according to IQVIA.

Shyam Metalics and Energy: The company plans to manufacture aluminum foil for lithium-ion cell. The customized battery aluminum foil from Shyam Metalics with thickness ranging from 12-micron to 20- micron has been tested and validated by third-party laboratories. The company also has the necessary state-of-the-art German equipment that can manufacture aluminum foils as thin as 6-micron thickness.

Apollo Micro Systems: The company has entered into several transfer of technology agreements with the Defence Research and Development Organisation (DRDO). The agreement pertains to transfer of technology for Guidance and Navigation Technology, Weaponisation of Hand-Held Thermal Imager with LRF, Rotary Electro Mechanical Actuator, and Unified Avionics Computer.