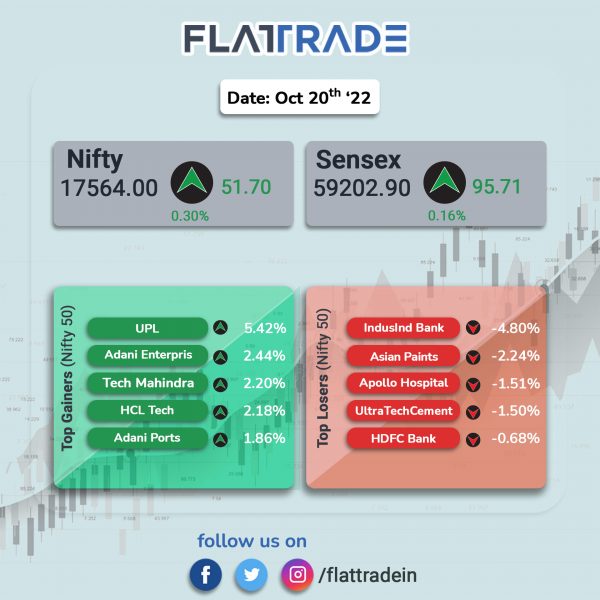

Major equity indices ended with minor gains, supported by gains in PSU bank, Oil & Gas and IT stocks. The Sensex rose 0.16% and the Nifty gained 0.30%.

In broader markets, the Nifty Midcap 100 index fell 0.27% and the BSE Smallcap [-0.01%] was almost flat.

Top gainers among Nifty sectoral indices were PSU Bank [1.88%], Oil & Gas [1.46%], Energy [1.4%], IT [1.33%] and Metal [1.14%]. Top losers were Private Bank [-1%], Bank [-0.68%] and Financial Services[-0.2%].

The Indian rupee rose 26 paise to 82.76 against the US dollar on Thursday.

Stock in News Today

Asian Paints: The company said its consolidated sales increased by 19.8 % to Rs 8,430.60 crore in Q2FY23 from Rs 7,036.51 crore in Q2F22. Profit before depreciation, interest and tax (PBDIT) increased by 35.7% to Rs 1,227.70 crore from Rs 904.45 crore in the year-ago period. The company will pay an interim dividend of Rs. 4.40 per equity share of the face value of Re 1 (Rupee One) each for FY23. The record date has been fixed as 1st November, 2022, and dividend will be paid to shareholders from 10th November.

Canara Bank: The lender said its standalone net profit surged 89.51% YoY to Rs 2,525.47 crore on 16.88% YoY rise in total income to Rs 24,932.19 crore in Q2FY23. The bank’s net interest income grew 18.51% YoY to Rs 7,434 crore in Q2FY23. Meanwhile, the non-interest income rose 13.05% YoY in Q2FY23. The ratio of net NPA ratio reduced to 2.19% in Q2FY23 as compared with 2.48% in Q1FY23 and 3.21% in Q2FY22.

Union Bank of India (UBI): The public sector lender said its net profit rose 21.1% YoY to Rs 1,847.7 crore in Q2FY23 from Rs 1,526.1 crore in the year-ago period. NII climbed 21.6% YoY to Rs 8,305 crore in the second quarter of FY23 from Rs 6,829.3 crore in the same period last year. Net NPA fell 14.3% QoQ to Rs 19,192.6 crore in the quarter under review.

Tata Consultancy Services (TCS): The IT company said that Sainsbury’s, a leading supermarket retailer in the UK, has selected the company as a transformation partner to accelerate the UK-retailer’s its business growth through a cloud-first strategy. TCS will consolidate and modernise Sainsbury’s IT infrastructure landscape into a modern hybrid cloud stack using TCS Enterprise Cloud. TCS will build a scalable foundation for a digital core, enabling greater agility, flexibility, and resilience for Sainsbury’s. Additionally, TCS will provide end-to-end managed services for modern workplace services, network connectivity, and security.

Adani Transmission: The company said that it has won the BEST Undertaking’s tender for appointment of advanced metering infrastructure (AMI) service provider. Under the contract, 10.80 lakh smart meters and related communication & cloud infrastructure will be installed over a period of 30 months and maintained for the following 90 months. The company’s distribution platform shall implement the smart metering project on design-build-finance-own-operate-transfer (DBFOOT) basis.

Colgate-Palmolive: The company’s profit rose 3.3% to Rs 278 crore in Q2FY23 from Rs 269.2 crore in Q2FY22. Its revenue stood at Rs 1387 crore in Q2FY23, up 3% from Rs 1344 crore in the year-ago period. EBITDA margin fell 40 basis points to 29.4% in Q2FY23 compared with 29.8% in the corresponding quarter last year. EBITDA was up 1.5% YoY to Rs 407 crore in the reported quarter.

Jubilant Ingrevia: The company announced that its net profit declined 23.93% to Rs 84.28 crore in the quarter ended September 2022 as against Rs 110.79 crore in the year-ago period. Sales rose 6.73% to Rs 1298.98 crore in the quarter ended September 2022 as against Rs 1217.07 crore in the same period last year.

Symphony: The company’s standalone net profit rose 40.63% to Rs 45 crore in the quarter ended September 2022 as against Rs 32 crore in the year-ago period. Sales rose 53.57% to Rs 215 crore in the quarter ended September 2022 as against Rs 140 crore in the year-ago period. The company’s board has recommended second interim dividend of Rs 2 per equity share for FY23.

Central Bank of India: The state-run lender’s net profit rose 27.26% YoY to Rs 318.17 crore on 8.24% YoY increase in total income to Rs 7,064.96 crore in Q2FY23. The ratio of net NPAs to net advances stood at 2.95% as on 30 September 2022 as against 3.93% as on 31 June 2022 and 4.51% as on 30 September 2021.

Tracxn Technologies: Shares of Tracxn rose on listing day from its issue price of Rs 80 apiece. The scrip was listed at a price of Rs 83, at a premium of 3.75% as compared to the issue price. The shares touched a high of Rs 100 apiece but pared some gains to end at Rs 93.25 per share.

Lupin: The company’s subsidiary, Lupin Inc., USA, has signed an agreement with Sunovion Pharmaceuticals, USA, for acquiring Brovana and Xopenex HFA, respiratory brands for a total purchase price of $75 million. The acquisition is expected to be completed 2-3 weeks.

Ipca Laboratories: The company has appointed Dr. Narendra Mairpady as an additional director of the company with effect from 20th October, 2022. He is also appointed as an Independent Director of the company for a period of 5 years from 20th October 2022 till 19th October 2027.

Rainbow Children’s Medicare: Shares of the company jumped 3.43% after ace investor Ashish Kacholia purchased stake in the company during July-September 2022 quarter. According to the shareholding pattern filed by the company for the September quarter, Ashish Kacholia held 10,44,211 equity shares, or 1.03% stake, in the company.

DCM Shriram: The company reported 19.2% decline in consolidated net profit to Rs 128.12 crore despite of a 27.8% increase in net revenue from operations to Rs 2,740 crore in Q2FY23 over Q2FY22. Total expense rose 36% YoY to Rs 2,679.80 crore and cost of materials consumed was up 69.72% YoY to Rs 778.25 crore in Q2FY23.

Granules India: The pharma company said that its net profit rose 79.85% to Rs 145.10 crore in the quarter ended September 2022 as against Rs 80.68 in the quarter ended September 2021. Sales increased 29.54% to Rs 1150.73 crore in the quarter ended September 2022 from Rs 888.33 crore in the year-ago period. EBITDA improved by 61% to Rs 243 crore in Q2FY23 from Rs 151 crore in Q2FY22. EBITDA margin was 21% in Q2FY23 as against 17% in Q2FY22.

Steel Strips Wheels: The company has fixed 11 November 2022 as the record date for the purpose of ascertaining eligible shareholders for stock split. The company will split equity shares of the company from the existing 1 (one) equity share of face value of Rs.5 each into 5 (Five) equity shares of face value of Re 1 each.

ICRA: the rating agency said that its net profit of rose 39.03% to Rs 16.67 crore in the quarter ended September 2022 as against Rs 11.99 crore in th eyear-ago period. Sales rose 12.15% to Rs 53.36 crore in the quarter under review as against Rs 47.58 crore in the corresponding quarter last fiscal.

AAVAS Financiers: The company said that net profit rose 16.04% to Rs 106.64 crore in the quarter ended September 2022 from Rs 91.90 crore in the same period last year. Revenue rose 21.55% to Rs 394.85 crore in the quarter ended September 2022 as against Rs 324.85 crore in the same quarterlast fiscal.

Clean Science & Technology: The company’s net profit rose 26.96% to Rs 67.95 crore in the quarter ended September 2022 as against Rs 53.52 crore during the quarter ended September 2021. Sales rose 61.60% to Rs 247.51 crore in the quarter ended September 2022 from Rs 153.16 crore reported in the quarter ended September 2021.

Meghmani Finechem: The company said its net profit was up 94.8% YoY at Rs 91.6 crore in Q2FY23 as against Rs 47 crore in the year-ago period. Revenue rose 63.6% to Rs 555.5 crore in the quarter under review compared with Rs 339.6 crore in the corresponding quarter last year. EBITDA increased 79% to Rs 180.3 crore in Q2FY23 from Rs 100.7 crore in the same period last year. Margin stood at 32.5% in the quarter ended September 2022 versus 29.7% in the year-ago period.