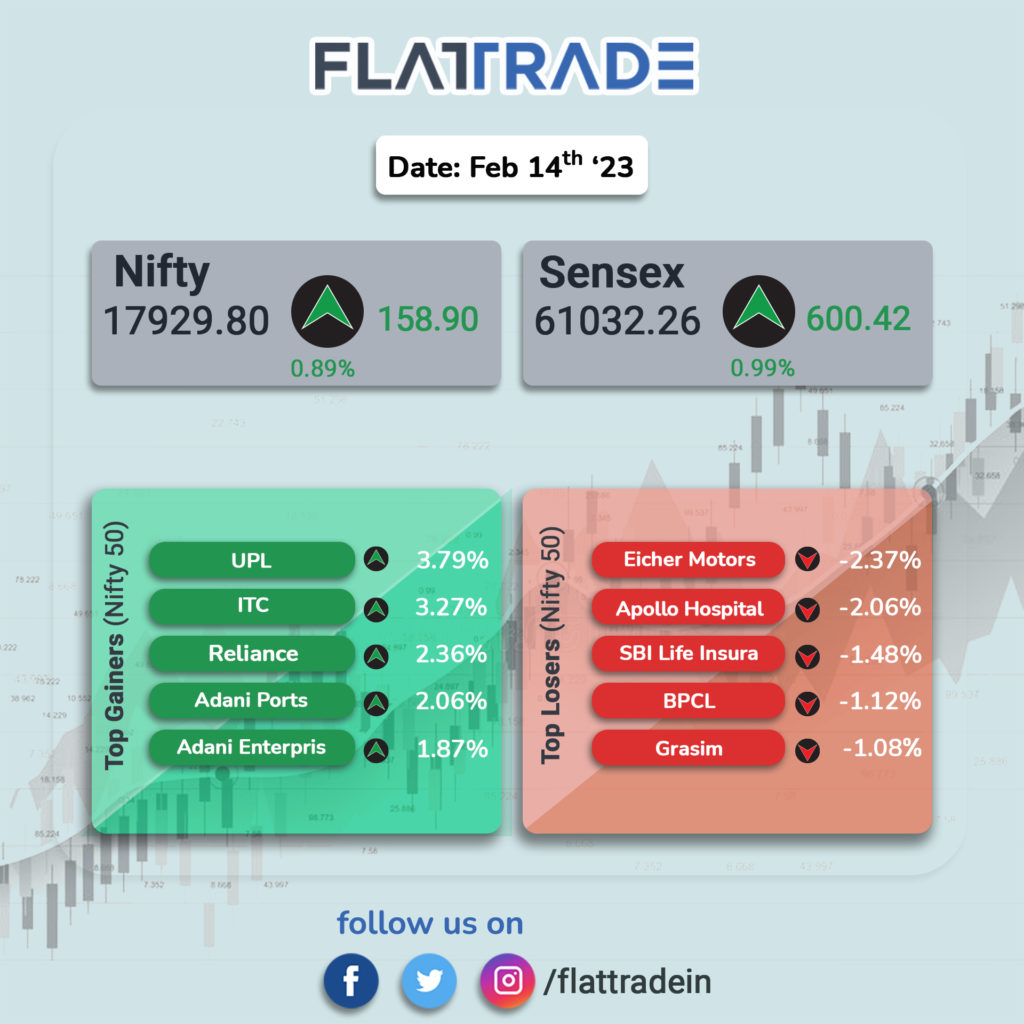

Benchmark stock indices ended higher as investor sentiments were boosted by easing WPI-based inflation and strong buying in PSU Bank, FMCG and metals stocks. The Sensex rose 0.99% and the Nifty 50 index was up 0.89%.

Broader markets underperformed Nifty Midcap 100 index dropped 0.27% and the BSE Smallcap fell 0.61%.

Top gainers were PSU Bank [1.04%], FMCG [1.03%], Metal [1.02%], IT [0.99%] and Financial Services [0.90%]. Top losers were Realty [-1.84%], Auto [-0.36%], Media [-0.16%] and Pharma [-0.16%].

Indian rupee fell 4 paise to 82.75 against the US dollar on Tuesday.

India’s wholesale price index to 4.73% in January on an annual basis from 4.95% in December 2022, according to Commerce Ministry. The month-on-month change in WPI index for January witnessed a increase of 0.13% as against a contraction of 1.12% in the preceding month. The WPI-based inflation had eased to a 22-month low of 4.95% in December 2022.

Stock in News Today

Adani Enterprises: The company’s consolidated net profit was Rs 820 crore in Q3FY23 as against a loss of Rs 11.63 crore in the year-ago period. Revenue from operations increased 42% YoY to Rs 26,612.23 crore. EBITDA increased by 101% YoY to Rs 1,968 crore.

In other news, Adani Group has appointed accountancy firm Grant Thornton for independent audits of some of its companies in a bid to discredit claims made by short-seller Hindenburg Research, Bloomberg reported citing two people familiar with the matter. Hindenburg in its report released on January 24, 2023 had accused Adani Group companies of improper use of offshore tax havens and stock manipulation.

Grasim Industries: The company’s net profit nearly halved to Rs 237 crore in Q3FY23 from Rs 489 crore in Q3FY22. Its revenue was up 7.1% to Rs 6196 crore in the reported quarter as against Rs 5784 crore in the year-ago period. EBITDA fell 48.1% to Rs 478 crore in Q3FY23 as against Rs 921.4 crore in Q3FY22.

Hindustan Aeronautics Limited (HAL): The company has an order book position of Rs 84,000 crore and another Rs 50,000 crore worth of orders are in the pipeline, its Chairman and Managing Director C B Ananthakrishnan said on Tuesday. He also said Argentina and Egypt have shown interest in buying the HAL-built Light Combat Aircraft ‘Tejas’. While Argentina’s requirement is 15 aircraft, Egypt wanted a fleet of 20 LCAs, Ananthakrishnan told a press conference on the sidelines of Aero India 2023.

Eicher Motors: The automaker’s net profit surged by 62.4% to Rs 740.8 crore in Q3FY23 as against Rs 456.1 crore in Q3FY22. Its revenue rose 29.2% to Rs 3721 crore in Q3FY23 from Rs 2881 crore in Q3FY22. Its EBITDA rose 47.2% to Rs 857.2 crore in Q3FY23 from Rs 582 crore in Q3FY22.

ITC: The company closed 3.27% higher after the media reported that the government does not plan to sell its indirectly held stake in ITC. “The government does not plan to sell its indirectly held stake in ITC at this point,” Tuhin Kanta Pandey, secretary, Department of Investment and Public Asset Management (DIPAM), said. The government held 97.45 crore shares, or a 7.86% stake, in ITC via the Specified Undertaking of the Unit Trust of India (SUUTI).

Bharat Forge: The company’s net profit fell 14.3% to Rs 289 crore in Q3FY23 from Rs 337.3 crore in Q3FY22. Its revenue rose 22% to Rs 1952 crore Q3FY23 from Rs 1602 crore in Q3FY22. Its EBITDA jumped 31.2% to Rs 535 crore in Q3FY23 from Rs 408 crore in the year-ago period.

Spencer’s Retail: The company reported widening of consolidated loss after tax at Rs 61.75 crore for December quarter 2022-23. The company had posted a loss after tax of Rs 26.77 crore for the same quarter last fiscal year. Revenue from operations in the quarter under review stood at Rs 638.91 crore as compared to Rs 624.07 crore in the year-ago period. Total expenses were higher at Rs 703.89 crore as compared to Rs 669.49 crore in the same quarter a year ago.

Torrent Pharmaceuticals: The company announced on Tuesday that it has forayed into the over-the-counter segment in the country with Shelcal 500, a calcium supplement brand. With its composition of 500mg Calcium and 250 IU of Vitamin D3, Shelcal 500 helps optimise calcium absorption, increases bone density, improves muscle strength and helps boost immunity.

PTC India: Power trading solution provider has posted 66% rise in consolidated net profit at Rs 104.48 crore for December quarter 2022-23. In the year-ago period, the profit was Rs 62.91 crore, the company said. Total income declined to Rs 3,146.91 crore in the reported quarter from Rs 3,338.40 crore in the same period a year ago.

DCM Shriram: The company’s net profit fell 53.3% to Rs 11.3 crore in Q3FY23 as against Rs 24.2 crore in Q3FY22. Revenue rose 10.6% to Rs 574.3 crore in Q3FY23 as against Rs 519.4 crore in Q3FY22. EBITDA fell 31.7% to Rs 27.4 crore in Q3FY23 as against Rs 40.1 crore in Q3FY22.

Allcargo Logistics: The company’s net profit was down 53.3% to Rs 155.9 crore in Q3FY23 as against Rs 333.7 crore in Q3FY22. Revenue fell 26.8% at Rs 4,099 crore in Q3FY23 as against Rs 5,599.4 crore in Q3FY22. EBITDA fell 47.3% to Rs 228.9 crore in Q3FY23 as against Rs 434 crore in Q3FY22.

Mawana Sugars: The company’s net profit dropped 64.9% to Rs 5.3 crore in Q3FY23 as against Rs 15.1 crore in Q3FY22. Revenue fell 1.2% to Rs 81.8 crore in Q3FY23 as against Rs 487.5 crore in Q3FY22. EBITDA slumped 41.3% to Rs 19.5 crore in Q3FY23 as against Rs 33.2 crore in Q3FY22.

Rane Holdings: The auto ancillary company’s net profit rose to Rs 41 crore in Q3FY23 as against Rs 9.6 crore in Q3FY22. Revenue was up 28.3% to Rs 874.3 crore in Q3FY23 as against Rs 681.4 crore in Q3FY22. EBITDA was at Rs 77.8 crore in Q3FY23 as against Rs 36.7 crore in Q3FY22.

Nucleus Software Exports: The company said its net profit rose to Rs 38.3 crore in Q3FY23 as against Rs 11 crore in Q2FY23. Revenue climbed 30.1% to Rs 169.3 crore in Q3FY23 as against Rs 130.1 crore in Q2FY23. EBITDA stood at Rs 47.8 crore in Q3FY23 as against Rs 11.5 crore in Q2FY23.

Kamat Hotels: The company’s net profit rose to Rs 27.8 crore in Q3FY23 as against Rs 1.3 crore in Q3FY22. Revenue jumped 63% to Rs 83.8 crore in Q3FY23 as against Rs 51.4 crore in Q3FY22. EBITDA surged 90.8% to Rs 33.2 crore in Q3FY23 as against Rs 17.4 crore in Q3FY22.

La Opala Glass: The company’s net profit was up 6.7% to Rs 34.6 crore in Q3FY23 as against Rs 32.5 crore in Q3FY22. Revenue was up 16.4% to Rs 126.4 crore in Q3FY23 as against Rs 108.6 crore in Q3FY22. EBITDA was up 2.7% to Rs 46.1 crore in Q3FY23 as against Rs 44.8 crore in Q3FY22.

Panacea Biotec: The company’s net profit stood at Rs 19.4 crore in Q3FY23 as against a net loss of Rs 49.2 crore in Q3FY22. Revenue fell 26.1% to Rs 115.2 crore in Q3FY23 as against Rs 155.9 crore in Q3FY22. EBITDA loss stood at Rs 8.7 crore in Q3FY23 as against EBITDA profit of Rs 11.9 crore in the year-ago period.

Bosch: The company’s net profit was up 35.8% at Rs 318.9 crore in Q3FY23 as against Rs 234.8 crore in Q3FY22. Revenue was up 17.7% to Rs 3,660 crore in Q3FY23 as against Rs 3,109.1 crore in Q3FY22. EBITDA was up 13% at Rs 403.8 crore in Q3FY23 as against Rs 357.4 crore in Q3FY22.

HT Media: The company has made a net loss of Rs 21.9 crore in Q3FY23 as against a net profit of Rs 45 crore in Q3FY22. Revenue was down 5.5% to Rs 440.4 crore in Q3FY23 as against Rs 466.1 crore in Q3FY22. EBITDA loss stood at Rs 19.7 crore in Q3FY23 as against EBITDA profit of Rs 72.9 crore in Q3FY22.

IPCA Labs: The company’s net profit fell 45.3% to Rs 107.8 crore in Q3FY23 as against Rs 197 crore in Q3FY22. Revenue was up 8.1% to Rs 1,546 crore in Q3FY23 as against Rs 1,430.5 crore in Q3FY22. EBITDA was down 29.9% to Rs 215.8 crore in Q3FY23 as against Rs 307.9 crore in Q3FY22.

Lupin: The company announced the launch of a world-class Neuro-rehabilitation center, Atharv Ability in Bandra Kurla Complex (BKC), Mumbai. Atharv Ability offers a range of rehabilitation programs for post-stroke patients, patients with traumatic brain injury, spinal cord injury, and pediatric neurological conditions as well as for other neurological conditions including Parkinsons, cerebral palsy and multiple sclerosis.

Mirza International: The footwear manufacturer said its consolidated net profit jumped 31.1% YoY to Rs 57.58 crore and its revenue from operations rose marginally by 0.9% YoY to Rs 594.88 crore in Q3FY23. Total expenditure fell 2.8% YoY to Rs 495.33 crore in Q3FY23. Cost of raw material consumed rose 25% to Rs 80.98 crore while employee expenses jumped 27.67% to Rs 31.52 crore.

RHI Magnesita India: The company’s shares slumped 7.89% in intraday trade after the company reported 23% fall in consolidated net profit to Rs 59 crore in Q3FY23 from Rs 76 crore in Q3FY22. Its income income stood at Rs 649 crore in Q3FY23, up 19% YoY from Rs 547 crore in the year-ago period. EBITDA declined by 11% to Rs 97 crore during the period under review as against Rs 109 crore recorded in the same period last year, due to higher cost of trading goods and foreign exchange fluctuations.

Emami Realty: The company’s net loss stood at Rs 10.71 crore in the quarter ended December 2022 as against a net profit of Rs 1.38 crore during the quarter ended December 2021. Sales declined 63.75% to Rs 12.97 crore in the quarter ended December 2022 as against Rs 35.78 crore during the quarter ended December 2021.

Hinduja Global Solutions: The company announced the appointment of Patrick Elliott as the Chief Executive Officer for its UK operations. Patrick, who was last with Capita, will be based out of London in the UK, and he will focus on expanding the business in the region. He will also be a key member of HGS’ Global Advisory Board and participate in corporate strategy.

Aurobindo Pharma: The company announced that as per the information available on the USFDA website, the company’s Unit – IX, an API intermediate facility situated at Gundlamachnoor Village, Sangareddy District, Telangana, which was inspected by the USFDA from 10 November to 18 November 2022, has now been classified as Voluntary Action Indicated (VAI).

Campus Activewear: The company’s consolidated net profit declined 11.7% to Rs 48.31 crore in Q3FY23 from Rs 54.72 crore in Q3FY22. Revenue from operations rose 7.4% to Rs 465.62 crore in the quarter ended December 2022 as against Rs 433.55 crore in the quarter ended December 2021. Total expenses increased 11.78% YoY to Rs 401.5 crore in the quarter ended December 2022.