Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.20% lower at 17,892.50, signaling that Dalal Street was headed for a negative start on Wednesday.

Japanese shares were trading lower, tracking Wall Street overnight, as investor expecting January’s hotter-than-expected inflation report. The Nikkei 225 index was down 0.09% and the Topix flat at 0.06%. Chinese markets were lower with the CSI 300 falling 0.22% and the Hang Seng down 0.15%.

Indian rupee fell 48 paise to 82.37 against the US dollar on Tuesday.

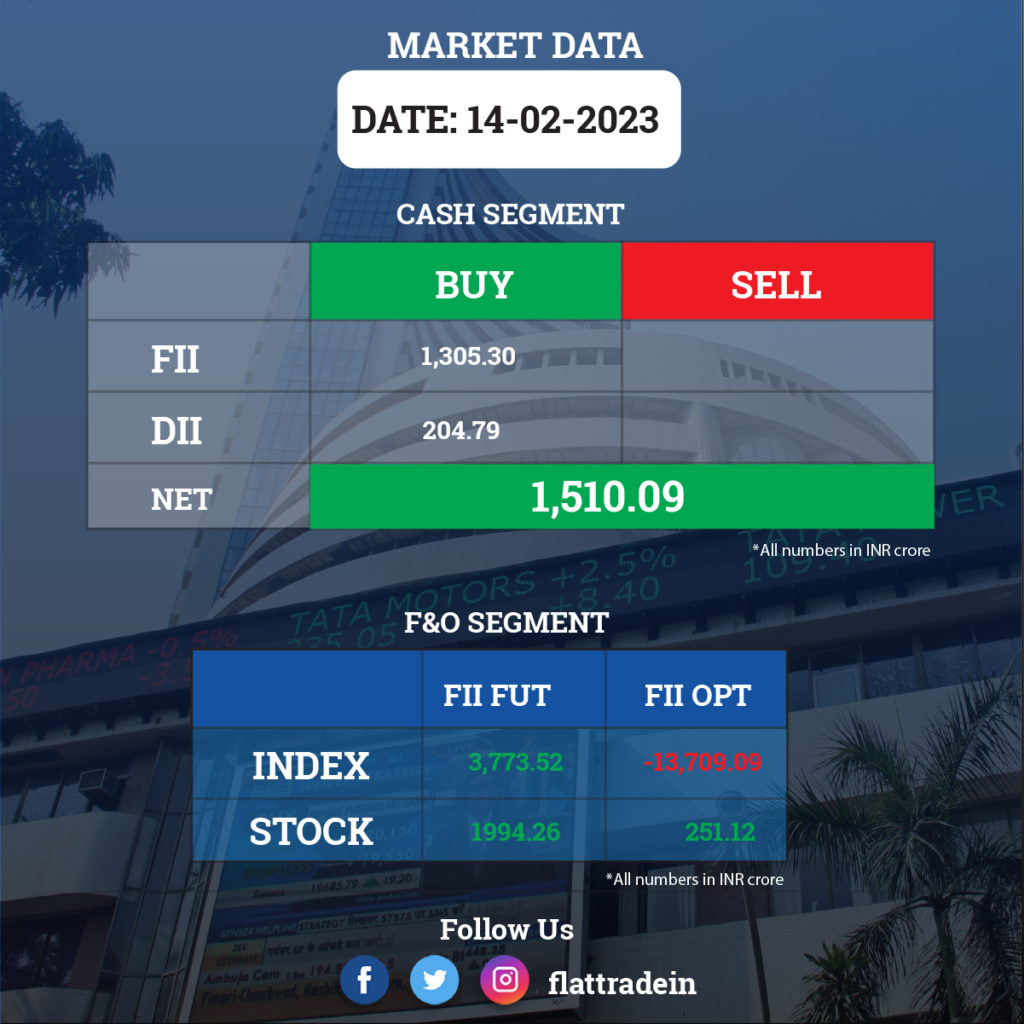

FII/DII Trading Data

Stocks in News Today

ONGC: The state-owned oil & exploration company has recorded a 26% year-on-year growth in standalone profit at Rs 11,045 crore for the quarter that ended December FY23. Revenue for the quarter at Rs 38,583.3 crore increased by 35.5% over a year-ago period, with crude oil price realization growing 26%. The board members have declared a second interim dividend of Rs 4 per share.

Prestige Estates Projects: The real estate developer has recorded a massive 47.6% year-on-year growth in consolidated profit at Rs 127.8 crore for the quarter that ended December FY23, supported by healthy topline and operating income. Revenue from operations grew significantly by 74.5% YoY to Rs 2,317 crore for the quarter. On the operating front, EBITDA jumped 57.5% YoY to Rs 574.2 crore in Q3FY23, but the margin fell by 268 bps YoY to 24.78%.

Bata India: The footwear company has reported a 15% year-on-year growth in profit at Rs 83.1 crore for quarter ended December FY23, supported by operating performance. Revenue for the quarter at Rs 900.2 crore grew by 7% over a year-ago period. At the operating level, EBITDA jumped 22.2 YoY to Rs 206 crore with a margin expansion of 284 bps in Q3FY23.

Apollo Hospitals Enterprise: The healthcare services provider has registered a 33.3% year-on-year decline in consolidated profit at Rs 162.3 crore for the third quarter of FY23, impacted by weak operating performance. Revenue for the quarter at Rs 4,264 crore increased by 17.2% over a year-ago period. On the operating front, EBITDA fell 14% YoY to Rs 505.35 crore with a margin down by 428 bps for the quarter. The board declared an interim dividend of Rs 6 per share.

Torrent Power: The power utility company has recorded a whopping 86% year-on-year growth in consolidated profit at Rs 685 crore for the three-month period ended December FY23 as revenue grew by 71% YoY to Rs 6,443 crore during the quarter. On the operating front, EBITDA for the quarter at Rs 1,444 crore increased by 54.6% over a year-ago period, but the margin declined 239 bps in the same period. The company declared an interim dividend of Rs 22 per share including Rs 13 per share as a special dividend for FY23.

Biocon: The biopharmaceutical company has posted a consolidated loss of Rs 41.8 crore for the December FY23 quarter as against a profit of Rs 187.1 crore in the corresponding period of last fiscal as there was the one-time loss of Rs 271.4 crore during the quarter. Consolidated revenue grew by 35.3% YoY to Rs 2,941 crore driven by growth across key segments (generics, biosimilars, and research services). At the operating level, EBITDA surged 32% YoY to Rs 644.3 crore but the margin declined 55 bps on higher input costs for the quarter.

GMR Airports Infrastructure: The company has reported a profit of Rs 191.4 crore for the quarter ended December FY23, against a loss of Rs 626.3 crore in the same period last year, supported by an exceptional gain of Rs 292.52 crore, higher other income, and forex gains. Revenue grew by 29.5% YoY to Rs 1,766.4 crore for the quarter. On the operating front, EBITDA fell by 26% YoY to Rs 530 crore with a margin contraction of 2,245 bps compared to the year-ago period.

EID Parry (India): The sugar manufacturer has reported consolidated profit at Rs 250.89 crore for the quarter that ended December FY23, rising 10.1% YoY impacted by a lower operating margin. Consolidated revenue grew by 52% YoY to Rs 9,917 crore for the quarter. At the operating level, EBITDA jumped 49% YoY to Rs 914.4 crore but the margin fell by 17 bps YoY to 9.22% for the quarter on higher input costs.